Albertsons 2013 Annual Report Download - page 95

Download and view the complete annual report

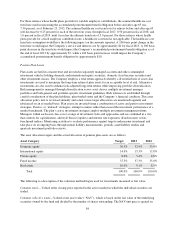

Please find page 95 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DIR pursuant to a review of the self-insured California workers’ compensation claims with respect to the

applicable businesses, and a decline in the Company’s net worth. A security deposit of $271 was demanded in

addition to security of $427 provided through the Company’s participation in California’s Self-Insurer’s Security

Fund. The Company has appealed this demand. The California Self-Insurers’ Security Fund (the “Fund”) has

attempted to create a secured interest in certain assets of New Albertsons for the total amount of the additional

security deposit. The dispute with the Fund and the DIR has been resolved through a settlement agreement as part

of the NAI Banner Sale and the primary obligation to the Fund and the DIR has been retained by NAI following

the NAI Banner Sale.

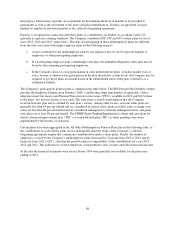

Predicting the outcomes of claims and litigation and estimating related costs and exposures involves substantial

uncertainties that could cause actual outcomes, costs and exposures to vary materially from current expectations.

The Company regularly monitors its exposure to the loss contingencies associated with these matters and may

from time to time change its predictions with respect to outcomes and its estimates with respect to related costs

and exposures. With respect to the two pending matters discussed above, the Company believes the chance of a

negative outcome is remote. It is possible, although management believes it is remote, that material differences in

actual outcomes, costs and exposures relative to current predictions and estimates, or material changes in such

predictions or estimates, could have a material adverse effect on the Company’s financial condition, results of

operations or cash flows.

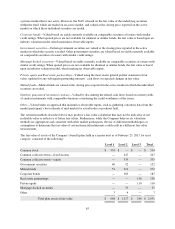

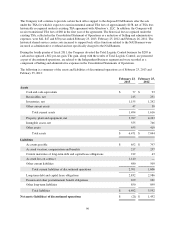

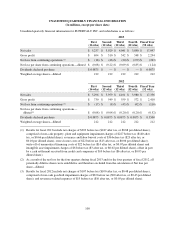

NOTE 14—SEGMENT INFORMATION

Refer to the Consolidated Segment Financial Information for financial information concerning the Company’s

operations and financial position by reportable segment.

The Company’s operating segments reflect the manner in which the business is managed and how the Company

allocates resources and assesses performance internally. The Company’s chief operating decision maker is the

Chief Executive Officer.

The Company offers a wide variety of grocery products, general merchandise and health and beauty care,

pharmacy, fuel and other items and services. The Company’s business is classified by management into three

reportable segments: Retail Food, Save-A-Lot and Independent Business. These reportable segments are three

distinct businesses, each with a different customer base, marketing strategy and management structure. The

Company reviews its reportable segments on an annual basis, or more frequently if events or circumstances

indicate a change in reportable segments has occurred.

The Retail Food segment derives revenues from the sale of groceries at retail locations operated by the Company.

The Save-A-Lot segment derives revenues from the sale of groceries at retail locations operated and licensed by

the Company (both the Company’s own stores and stores licensed by the Company to which the Company

distributes wholesale products). The Independent Business reportable segment derives revenues from wholesale

distribution to independently owned retail food stores, mass merchants and other customers (collectively referred

to as “independent retail customers”). Substantially all of the Company’s operations are domestic.

93