Albertsons 2013 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

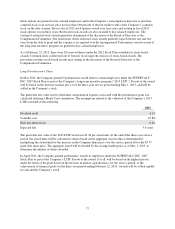

Financial Instruments

For certain of the Company’s financial instruments, including cash and cash equivalents, receivables, accounts

payable, accrued salaries and other current assets and liabilities, the fair values approximate carrying values due

to their short maturities.

The estimated fair value of notes receivable was greater than the carrying value by $2 as of February 23, 2013.

The estimated fair value of notes receivable approximated the carrying value as of February 25, 2012. The

estimated fair value of notes receivable are calculated using a discounted cash flow approach applying a market

rate for similar instruments using Level 3 inputs.

The estimated fair value of the Company’s long-term debt (including current maturities) was greater than the

book value by approximately $57 and $62 as of February 23, 2013 and February 25, 2012, respectively. The

estimated fair value was based on market quotes, where available, or market values for similar instruments, using

Level 2 and 3 inputs.

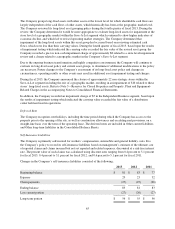

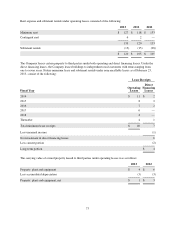

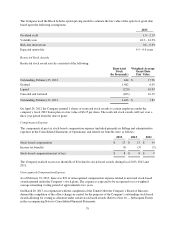

NOTE 6—LONG-TERM DEBT

The Company’s long-term debt and capital lease obligations consisted of the following:

February 23,

2013

February 25,

2012

8.00% Notes due May 2016 $ 1,000 $ 1,000

8.00% Secured Term Loan Facility due August 2018 834 —

7.50% Notes due November 2014 490 490

2.21% to 4.25% Revolving ABL Credit Facility due August 2017 207 —

Accounts Receivable Securitization Facility 40 55

1.65% to 4.75% Revolving Credit Facility and Variable Rate Notes due April

2015—April 2018 — 1,074

7.50% Notes due May 2012 — 282

Other 28 30

Net discount on debt, using an effective interest rate of 8.39% to 8.58% (40) (20)

Capital lease obligations 330 315

Total debt and capital lease obligations 2,889 3,226

Less current maturities of long-term debt and capital lease obligations (74) (345)

Long-term debt and capital lease obligations $ 2,815 $ 2,881

Future maturities of long-term debt, excluding the net discount on the debt and capital lease obligations, as of

February 23, 2013 consist of the following:

Fiscal Year

2014 $19

2015 556

2016 9

2017 1,008

2018 216

Thereafter 791

70