Albertsons 2013 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

a private market that is not active. However, the NAV is based on the fair value of the underlying securities

within the fund, which are traded on an active market, and valued at the closing price reported on the active

market on which those individual securities are traded.

Corporate bonds—Valued based on yields currently available on comparable securities of issuers with similar

credit ratings. When quoted prices are not available for identical or similar bonds, the fair value is based upon an

industry valuation model, which maximizes observable inputs.

Government securities—Certain government securities are valued at the closing price reported in the active

market in which the security is traded. Other government securities are valued based on yields currently available

on comparable securities of issuers with similar credit ratings.

Mortgage backed securities—Valued based on yields currently available on comparable securities of issuers with

similar credit ratings. When quoted prices are not available for identical or similar bonds, the fair value is based

upon an industry valuation model, which maximizes observable inputs.

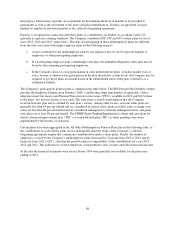

Private equity and Real estate partnerships—Valued using the most recent general partner statement of fair

value, updated for any subsequent partnership interests’ cash flows or expected changes in fair value.

Mutual funds—Mutual funds are valued at the closing price reported in the active market in which the individual

securities are traded.

Synthetic guaranteed investment contract—Valued by discounting the related cash flows based on current yields

of similar instruments with comparable durations considering the credit-worthiness of the issuer.

Other—Valued under an approach that maximizes observable inputs, such as gathering consensus data from the

market participant’s best estimate of mid-market for actual trades or positions held.

The valuation methods described above may produce a fair value calculation that may not be indicative of net

realizable value or reflective of future fair values. Furthermore, while the Company believes its valuations

methods are appropriate and consistent with other market participants, the use of different methodologies or

assumptions to determine the fair value of certain financial instruments could result in a different fair value

measurement.

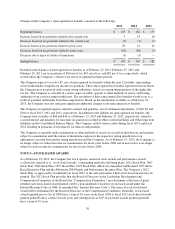

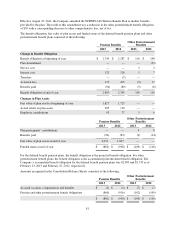

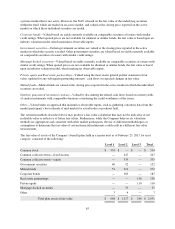

The fair value of assets of the Company’s benefit plans held in a master trust as of February 23, 2013, by asset

category, consisted of the following:

Level 1 Level 2 Level 3 Total

Common stock $ 554 $ — $ — $ 554

Common collective trusts—fixed income — 247 — 247

Common collective trusts—equity — 335 — 335

Government securities 60 92 — 152

Mutual funds 51 221 — 272

Corporate bonds — 183 — 183

Real estate partnerships — — 136 136

Private equity — — 110 110

Mortgage-backed securities — 35 — 35

Other 3 4 — 7

Total plan assets at fair value $ 668 $ 1,117 $ 246 $ 2,031

85