Albertsons 2013 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

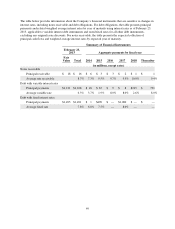

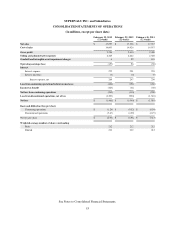

SUPERVALU INC. and Subsidiaries

CONSOLIDATED SEGMENT FINANCIAL INFORMATION

(In millions)

February 23, 2013

(52 weeks)

February 25, 2012

(52 weeks)

February 26, 2011

(52 weeks)

Net sales

Retail Food $ 4,736 $ 4,921 $ 5,054

% of total 27.7% 28.4% 29.1%

Save-A-Lot 4,195 4,221 3,890

% of total 24.5% 24.3% 22.4%

Independent Business 8,166 8,194 8,413

% of total 47.8% 47.3% 48.5%

Total net sales $ 17,097 $ 17,336 $ 17,357

100.0% 100.0% 100.0%

Operating earnings (loss)

Retail Food (1) $ (420) $ (328) $ (415)

% of sales (8.9)% (6.7)% (8.2)%

Save-A-Lot (1) 146 232 197

% of sales 3.5% 5.5% 5.1%

Independent Business (1) 189 243 257

% of sales 2.3% 3.0% 3.1%

Corporate (1) (72) (51) (69)

Total operating earnings (loss) (157) 96 (30)

% of sales (0.9)% 0.6% (0.2%)

Interest expense, net 269 247 230

Loss from continuing operations before income taxes (426) (151) (260)

Income tax benefit (163) (41) (60)

Net loss from continuing operations (263) (110) (200)

Net loss from discontinued operations, net of tax (1,203) (930) (1,310)

Net loss $ (1,466) $ (1,040) $ (1,510)

Depreciation and amortization

Retail Food $ 233 $ 226 $ 217

Save-A-Lot 68 62 56

Independent Business 64 67 81

Total $ 365 $ 355 $ 354

Capital expenditures

Retail Food $ 107 $ 214 $ 146

Save-A-Lot 101 130 132

Independent Business 33 59 45

Total $ 241 $ 403 $ 323

Identifiable assets

Retail Food $ 1,695 $ 2,229 $ 2,161

Save-A-Lot 936 867 784

Independent Business 1,857 1,955 2,050

Corporate 75 84 119

Discontinued operations 6,471 6,966 8,644

Total $ 11,034 $ 12,101 $ 13,758

(1) Operating segment earnings (loss), primarily Retail Food, includes pension expense of $83, $88, $69 in fiscal 2013, 2012 and 2011 for

inactive participants in the SUPERVALU Retirement Plan. This pension expense is anticipated to be reclassified primarily to Corporate

Operating earnings (loss) for future periods to reflect the structure of the organization under which the business will be managed. Upon

the change in structure all corresponding balances for earlier periods will be recast for comparability.

During fiscal 2013, the Company disaggregated its previous reportable segment, Retail Food, into two separate reportable segments:

Retail Food and Save-A-Lot (formerly referred to the Hard Discount operating segment within the Retail Food reportable segment)

and previously reported segment information has been revised to conform to current presentation. These changes do not revise or

restate information previously reported in the Consolidated Statements of Operations, Consolidated Statements of Comprehensive

Loss, Consolidated Balance Sheets, Consolidated Statements of Stockholders’ Equity or Consolidated Statements of Cash Flows for

the Company for any period. Refer to Note 14—Segment Information in the accompanying Notes to Consolidated Financial

Statements for additional information concerning the Company’s reportable segments.

See Notes to Consolidated Financial Statements.

52