Albertsons 2013 Annual Report Download - page 35

Download and view the complete annual report

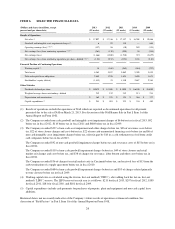

Please find page 35 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Loss from discontinued operations, net of tax for fiscal 2012 was $930 compared to $1,310 in fiscal 2011. Fiscal

2012 included goodwill and intangible asset impairment charges of $1,202 net of tax and severance of $3 net of

tax. Fiscal 2011 also included goodwill and intangible asset impairment charges of $1,635 net of tax as well as

store closure, labor strike and labor buyout costs of $68 net of tax, partially offset by gain on the sale of Total

Logistic Control of $65 net of tax. Excluding these items, the decrease of net income of $53 was primarily due to

lower sales volume in identical stores.

Refer to Note 15—Discontinued Operations and Divestitures in the Notes to Consolidated Financial Statements

included in Part II, Item 8 of this Annual Report on Form 10-K for further discussion.

CRITICAL ACCOUNTING POLICIES

The preparation of consolidated financial statements in conformity with accounting standards requires

management to make estimates and assumptions that affect the reported amounts of assets and liabilities and

disclosure of contingent assets and liabilities as of the date of the financial statements and the reported amounts

of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Significant accounting policies are discussed in Note 1—Summary of Significant Accounting Policies in the

Notes to Consolidated Financial Statements included in Part II, Item 8 of this Annual Report on Form 10-K.

Management believes the following critical accounting policies reflect its more subjective or complex judgments

and estimates used in the preparation of the Company’s consolidated financial statements.

Vendor Funds

The Company receives funds from many of the vendors whose products the Company buys for resale in its

stores. These vendor funds are provided to increase the sell-through of the related products. The Company

receives vendor funds for a variety of merchandising activities: placement of the vendors’ products in the

Company’s advertising; display of the vendors’ products in prominent locations in the Company’s stores;

supporting the introduction of new products into the Company’s retail stores and distribution system; exclusivity

rights in certain categories; and to compensate for temporary price reductions offered to customers on products

held for sale at retail stores. The Company also receives vendor funds for buying activities such as volume

commitment rebates, credits for purchasing products in advance of their need and cash discounts for the early

payment of merchandise purchases. The majority of the vendor fund contracts have terms of less than a year,

with a small proportion of the contracts longer than one year.

The Company recognizes vendor funds for merchandising activities as a reduction of Cost of sales when the

related products are sold. Vendor funds that have been earned as a result of completing the required performance

under the terms of the underlying agreements but for which the product has not yet been sold are recognized as

reductions of inventory. The amount and timing of recognition of vendor funds as well as the amount of vendor

funds to be recognized as a reduction to ending inventory requires management judgment and estimates.

Management determines these amounts based on estimates of current year purchase volume using forecast and

historical data and review of average inventory turnover data. These judgments and estimates impact the

Company’s reported gross profit, operating earnings (loss) and inventory amounts. The historical estimates of the

Company have been reliable in the past, and the Company believes the methodology will continue to be reliable

in the future. Based on previous experience, the Company does not expect significant changes in the level of

vendor support. However, if such changes were to occur, cost of sales and advertising expense could change,

depending on the specific vendors involved. If vendor advertising allowances were substantially reduced or

eliminated, the Company would consider changing the volume, type and frequency of the advertising, which

could increase or decrease its advertising expense. Similarly, the Company is not able to assess the impact of

vendor advertising allowances on increasing revenues as such allowances do not directly generate revenue for the

Company’s stores. For fiscal 2013, a 1 percent change in total vendor funds earned, including advertising

33