Albertsons 2013 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

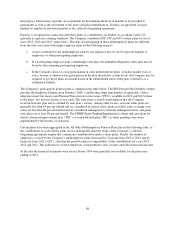

In connection with the Stock Purchase Agreement, the Company has entered into various agreements with AB

Acquisition related to on-going operations, including a Transition Services Agreement (“TSA”) with each of NAI

and Albertson’s LLC and operating and supply agreements. The initial terms of these arrangements vary from

12 months to 5 years, are generally subject to renewal upon mutual agreement by the parties thereto and also

includes termination provisions that can be exercised by each party. The Company has determined that the

continuing cash flows generated by these arrangements are not significant in proportion to the cash flows of the

Company had the stock sale not occurred and that the arrangements do not provide the Company the ability to

influence the operating or financial policies of the NAI Banners. Accordingly the above arrangements do not

constitute significant continuing involvement in the operations of the NAI Banners. Therefore, the operations of

the NAI Banners are presented as discontinued operations in the Consolidated Financial Statements for fiscal

2013, 2012 and 2011.

As the net assets of the NAI Banners met the held for sale criteria, the Company assessed the long-lived assets

for impairment and then compared the carrying value of the total net assets to be sold (the disposal group) to their

estimated fair value based on the proceeds expected to be received and debt assumed by AB Acquisition pursuant

to the Stock Purchase Agreement less the estimated costs to sell. In the fourth quarter of fiscal 2013 the Company

recorded an intangible asset impairment charge of $84 in addition to an intangible asset impairment charge of

$74 recorded in the second quarter of fiscal 2013, to write-down the intangible assets of the NAI Banners to their

estimated fair value. The Company recorded a preliminary estimated pre-tax loss on contract for the disposal of

NAI of approximately $1,150 and recorded a pre-tax Property, plant and equipment related impairment of $203

which are included in Loss from discontinued operations, net of tax on the Consolidated Statement of Operations.

This estimated loss on contract will be subject to finalization based on the balances as of the sale closing date of

March 21, 2013, which is in the Company’s first fiscal quarter of 2014, and may differ materially to this

preliminary estimate. The Company determined the pre-tax Property, plant and equipment related impairment

using level 3 inputs.

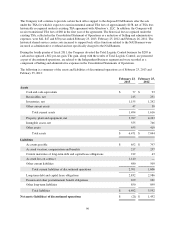

The net assets, operating results, and cash flows of the NAI Banners have been presented separately as

discontinued operations in the Consolidated Financial Statements for fiscal 2013, 2012 and 2011. The net assets,

operating results, and cash flows of the Total Logistic Control have been presented separately as discontinued

operations in the Consolidated Financial Statements for fiscal 2011. The Company has allocated interest related

to debt that will be assumed by AB Acquisition to discontinued operations. Interest expense related to such debt

and included in discontinued operations was $281, $263, and $319 for the years ended February 23,

2013, February 25, 2012 and February 26, 2011, respectively.

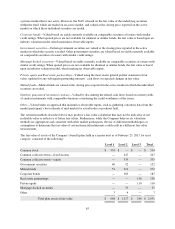

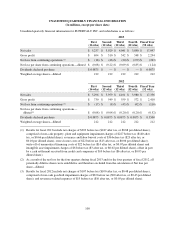

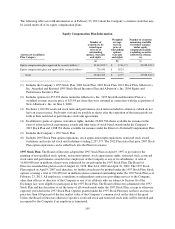

The following is a summary of the Company’s operating results and certain other directly attributable expenses

that are included in discontinued operations for the years ended February 23, 2013, February 25, 2012 and

February 26, 2011:

February 23, 2013

(52 weeks)

February 25, 2012

(52 weeks)

February 26, 2011

(52 weeks)

Net sales $ 17,230 $ 18,764 $ 20,177

Loss before income taxes from discontinued operations (1,238) (876) (1,263)

Income tax provision (benefit) (35) 54 47

Loss from discontinued operations, net of tax $ (1,203) $ (930) $ (1,310)

The Company will continue to sell certain products to the NAI Banners subsequent to the stock sale. The

amounts of the intercompany sales, which approximate related costs, were $236, $240 and $245 years ended

February 23, 2013, February 25, 2012 and February 26, 2011.

95