Albertsons 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the statement that reports comprehensive income (loss), items reclassified out of Accumulated other comprehensive

income (loss) and into net earnings in their entirety and the effect of the reclassification on each affected Statement of

Operations line item. In addition, for Accumulated other comprehensive income (loss) reclassification items that are

not reclassified in their entirety into net earnings, a cross reference to other required accounting standard disclosures is

required. This guidance is effective for the Company in the first quarter of fiscal 2014. The Company believes that the

adoption of this guidance will not have a material impact on its financial condition or results of operations.

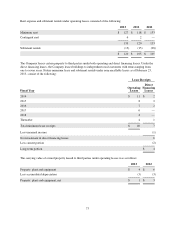

NOTE 2—GOODWILL AND INTANGIBLE ASSETS

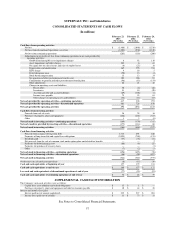

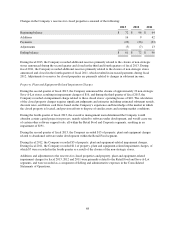

Changes in the Company’s Goodwill and Intangible assets consisted of the following:

February 26,

2011 Additions Impairments

Other net

adjustments

February 25,

2012 Additions Impairments

Other net

adjustments

February 23,

2013

Goodwill:

Retail Food goodwill $ 887 $ — $ — $ (1) $ 886 $ — $ — $ — $ 886

Accumulated impairment

losses (794) — (92) — (886) — — — (886)

Total Retail Food

goodwill, net 93 — (92) (1) — — — — —

Save-A-Lot goodwill 137 — — — 137 — — — 137

Independent Business goodwill 710 — — — 710 — — — 710

Total goodwill $ 940 $ — $ (92) $ (1) $ 847 $ — $ — $ — $ 847

February 26,

2011 Additions Impairments

Other net

adjustments

February 25,

2012 Additions Impairments

Other net

adjustments

February 23,

2013

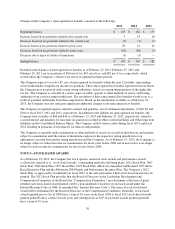

Intangible assets:

Trademarks and tradenames—

indefinite useful lives $ 14 $ — $ — $ — $ 14 $ — $ (6) $ 1 $ 9

Favorable operating leases,

customer lists, customer

relationships and other

(accumulated amortization

of $65 and $56 as of

February 23, 2013 and

February 25, 2012,

respectively) 103 2 — — 105 1 — — 106

Non-compete agreements

(accumulated amortization

of $2 and $2 as of

February 23, 2013 and

February 25, 2012,

respectively) 3 — — — 3 — — — 3

Total intangible assets 120 2 — — 122 1 (6) 1 118

Accumulated amortization (50) (8) — — (58) (8) — (1) (67)

Total intangible assets, net $ 70 $ 64 $ 51

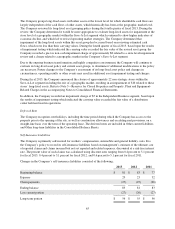

The Company applies a fair value based impairment test to the net book value of goodwill and intangible assets with

indefinite useful lives on an annual basis and on an interim basis if events or circumstances indicate that an impairment

loss may have occurred.

The Company conducted an annual impairment test of the net book value of goodwill and intangible assets with

indefinite useful lives during the fourth quarter of fiscal 2013. The fair value of goodwill for the Company’s Save-A-

Lot reporting was in excess of 100 percent of the $137 carrying value. The fair value of the Company’s Independent

Business reporting unit exceeded its $710 carrying value by approximately 60 percent. The Company recorded a pre-

tax non-cash impairment charge of $6 in the Independent Business segment for tradenames with indefinite useful lives

during the fourth quarter of fiscal 2013.

66