Albertsons 2013 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.future purchase obligations. The Company is a party to a variety of contractual agreements under which the

Company may be obligated to indemnify the other party for certain matters, which indemnities may be secured

by operation of law or otherwise, in the ordinary course of business. These contracts primarily relate to the

Company’s commercial contracts, operating leases and other real estate contracts, financial agreements,

agreements to provide services to the Company and agreements to indemnify officers, directors and employees in

the performance of their work. While the Company’s aggregate indemnification obligation could result in a

material liability, the Company is not aware of any matters that are expected to result in a material liability.

Refer to Note 16—Subsequent Events in the accompanying Notes to Consolidated Financial Statements for

information regarding the Company’s guarantees of certain debt obligations of American Stores Company, a

subsidiary NAI, subsequent to February 23, 2013.

Legal Proceedings

The Company is subject to various lawsuits, claims and other legal matters that arise in the ordinary course of

conducting business. In the opinion of management, based upon currently-available facts, it is remote that the

ultimate outcome of any lawsuits, claims and other proceedings will have a material adverse effect on the overall

results of the Company’s operations, its cash flows or its financial position.

In September 2008, a class action complaint was filed against the Company, as well as International Outsourcing

Services, LLC (“IOS”), Inmar, Inc., Carolina Manufacturer’s Services, Inc., Carolina Coupon Clearing, Inc. and

Carolina Services, in the United States District Court in the Eastern District of Wisconsin. The plaintiffs in the

case are a consumer goods manufacturer, a grocery co-operative and a retailer marketing services company who

allege on behalf of a purported class that the Company and the other defendants (i) conspired to restrict the

markets for coupon processing services under the Sherman Act and (ii) were part of an illegal enterprise to

defraud the plaintiffs under the Federal Racketeer Influenced and Corrupt Organizations Act. The plaintiffs seek

monetary damages, attorneys’ fees and injunctive relief. The Company intends to vigorously defend this lawsuit,

however all proceedings have been stayed in the case pending the result of the criminal prosecution of certain

former officers of IOS.

In December 2008, a class action complaint was filed in the United States District Court for the Western District

of Wisconsin against the Company alleging that a 2003 transaction between the Company and C&S Wholesale

Grocers, Inc. (“C&S”) was a conspiracy to restrain trade and allocate markets. In the 2003 transaction, the

Company purchased certain assets of the Fleming Corporation as part of Fleming Corporation’s bankruptcy

proceedings and sold certain assets of the Company to C&S which were located in New England. Since

December 2008, three other retailers have filed similar complaints in other jurisdictions. The cases have been

consolidated and are proceeding in the United States District Court for the District of Minnesota. The complaints

allege that the conspiracy was concealed and continued through the use of non-compete and non-solicitation

agreements and the closing down of the distribution facilities that the Company and C&S purchased from each

other. Plaintiffs are seeking monetary damages, injunctive relief and attorneys’ fees. On July 5, 2011, the District

Court granted the Company’s Motion to Compel Arbitration for those plaintiffs with arbitration agreements and

plaintiffs appealed. On July 16, 2012, the District Court denied plaintiffs’ Motion for Class Certification and on

January 11, 2013, the District Court granted the Company’s Motion for Summary Judgment and dismissed the

case regarding the non-arbitration plaintiffs. Plaintiffs have appealed these decisions. On February 12, 2013, the

8th Circuit reversed the District Court decision requiring plaintiffs with arbitration agreements to arbitrate and

the Company filed a Petition with the 8th Circuit for an En Banc Rehearing.

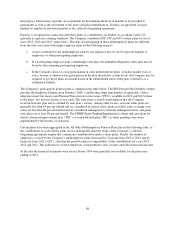

On October 24, 2012, the Office of Self-Insurance Plans, a program within the director’s office of the California

Department of Industrial Relations (the “DIR”), notified the Company that additional security was required to be

posted in connection with the Company’s California self-insured workers’ compensation obligations of New

Albertsons and certain other subsidiaries pursuant to applicable regulations. The notice from the DIR stated that

the additional security was required as a result of an increase in estimated future liabilities, as determined by the

92