Albertsons 2013 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company’s ability to comply with the covenants or to refinance the Company’s obligations with respect to

the Company’s indebtedness will depend on the Company’s operating and financial performance, which in turn

is subject to prevailing economic conditions and to financial, business and other factors beyond the Company’s

control. In particular, the uncertainties of the global economy and capital markets may impact the Company’s

ability to obtain debt financing. These conditions and factors may also negatively impact the Company’s debt

ratings, which may increase the cost of borrowing, adversely affect the Company’s ability to access one or more

financial markets or result in a default under the Company’s debt instruments.

Any of these outcomes may adversely affect the Company’s financial condition and results of operations.

Current economic conditions

All of the Company’s store locations are located in the United States making its results highly dependent on U.S.

consumer confidence and spending habits. The U.S. economy has experienced economic volatility in recent years

due to uncertainties related to higher unemployment rates, energy costs, a decline in the housing market, and

limited availability of credit, all of which have contributed to suppressed consumer confidence. Consumer

spending has declined as consumers trade down to a less expensive mix of products and seek out discounters for

grocery items. In addition, inflation continues to be unpredictable; food deflation could reduce sales growth and

earnings, while food inflation, combined with reduced consumer spending, could reduce gross profit margins. If

these consumer spending patterns continue or worsen, along with an ongoing soft economy, the Company’s

financial condition and results of operations may be adversely affected.

Labor relations

As of February 23, 2013, the Company is a party to 52 collective bargaining agreements covering approximately

15,000 of its employees, of which 22 collective bargaining agreements covering approximately 5,600 employees

are scheduled to expire in fiscal 2014. In addition, during fiscal 2013, four collective bargaining agreements

covering approximately 135 employees expired without their terms being renegotiated. Negotiations are expected

to continue with the bargaining units representing the employees subject to those agreements. In future

negotiations with labor unions, the Company expects that, among other issues, rising healthcare, pension and

employee benefit costs will be important topics for negotiation. There can be no assurance that the Company will

be able to negotiate the terms of expiring or expired agreements in a manner acceptable to the Company.

Therefore, potential work disruptions from labor disputes could disrupt the Company’s businesses and adversely

affect the Company’s financial condition and results of operations.

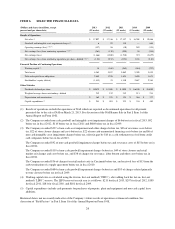

Costs of employee benefits

The Company provides health benefits and sponsors defined pension, defined contribution pension, and other

postretirement plans for substantially all employees not participating in multiemployer health and pension plans.

The Company’s costs to provide such benefits continue to increase annually. The Company uses actuarial

valuations to determine the Company’s benefit obligations for certain benefit plans, which require the use of

significant estimates, including the discount rate, expected long-term rate of return on plan assets, mortality rates,

and the rates of increase in compensation and health care costs. Changes to these significant estimates could

increase the cost of these plans, which could also have a material adverse effect on the Company’s financial

condition and results of operations.

In connection with the NAI Banner Sale, the Company divested its defined benefit pension plan associated with

its Shaw’s banner and retained its largest defined pension benefit plan. The defined benefit pension plan retained

by the Company is for pension obligations to current and former employees of the Company as well as some of

its divested businesses. The Company and AB Acquisition also entered into a binding term sheet with the

Pension Benefit Guaranty Corporation (the “PBGC”) relating to issues regarding the effect of the NAI Banner

Sale on certain SUPERVALU retirement plans. The binding term sheet provides, among other things, that the

15