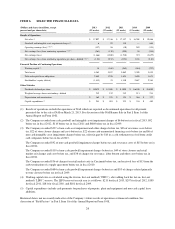

Albertsons 2013 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

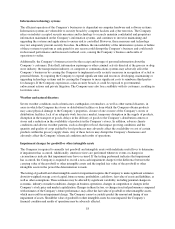

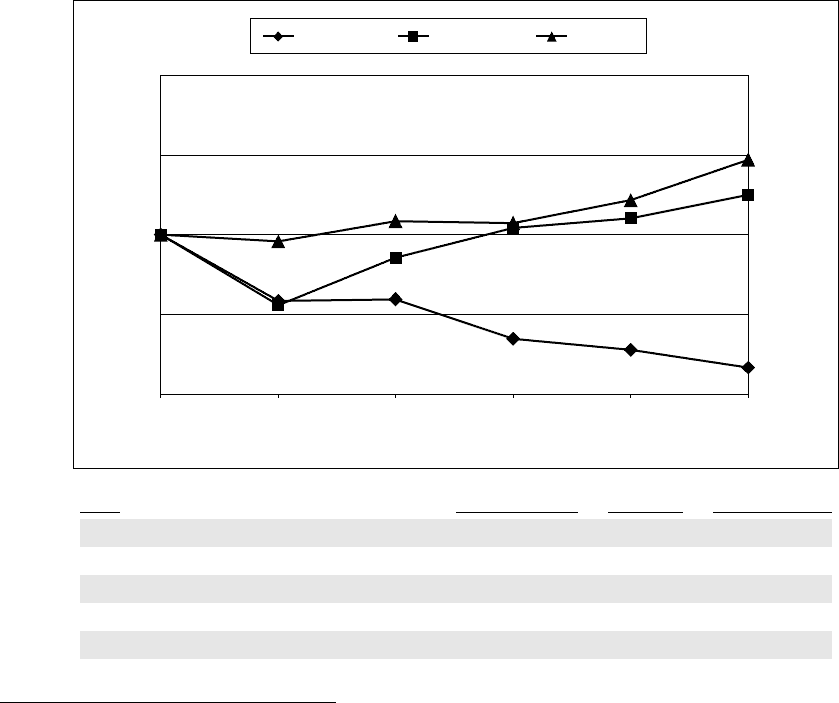

Stock Performance Graph

The following graph compares the yearly change in the Company’s cumulative shareholder return on its common

stock for the period from the end of fiscal 2008 to the end of fiscal 2013 to that of the Standard & Poor’s

(“S&P”) 500 and a group of peer companies in the retail grocery industry. The stock price performance shown

below is not necessarily indicative of future performance.

COMPARISON OF CUMULATIVE TOTAL SHAREHOLDER RETURN AMONG

SUPERVALU, S&P 500 AND PEER GROUP (1)

February 22, 2008 through February 22, 2013 (2)

Feb-08 Feb-09 Feb-10 Feb-11 Feb-12 Feb-13

$0

$50

$100

$150

$200

SUPERVALU S&P 500 Index Peer Group

Date SUPERVALU S&P 500 Peer Group (3)

February 22, 2008 $100.00 $100.00 $100.00

February 27, 2009 $ 58.44 $ 55.74 $ 95.81

February 26, 2010 $ 59.53 $ 85.62 $108.67

February 25, 2011 $ 34.53 $104.37 $107.48

February 24, 2012 $ 27.72 $110.32 $121.70

February 22, 2013 $ 16.57 $125.24 $147.28

(1) Total return assuming $100 invested on February 22, 2008 and reinvestment of dividends on the day they

were paid.

(2) The Company’s fiscal year ends on the last Saturday in February.

(3) The Company’s peer group consists of Delhaize Group SA, Koninklijke Ahold NV, The Kroger Co.,

Safeway Inc. and Wal-Mart Stores, Inc. The Company occasionally adjusts the companies included in its

peer group due to bankruptcy filings, merger and acquisition activity, and deregistrations.

The performance graph above is being furnished solely to accompany this Annual Report on Form 10-K pursuant

to Item 201(e) of Regulation S-K, is not being filed for purposes of Section 18 of the Exchange Act, and is not to

be incorporated by reference into any filing of the Company, whether made before or after the date hereof,

regardless of any general incorporation language in such filing.

23