Albertsons 2013 Annual Report Download - page 73

Download and view the complete annual report

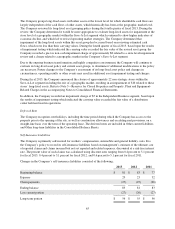

Please find page 73 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On August 30, 2012, the Company entered into two new credit agreements: (i) a five-year $1,650 (subject to

borrowing base availability) asset-based revolving credit facility (the “Revolving ABL Credit Facility”), secured

by the Company’s inventory, credit card receivables and certain other assets, which bore interest at the rate of

London Interbank Offered Rate (“LIBOR”) plus 1.75 percent to 2.25 percent or prime plus 0.75 percent to

1.25 percent, with facility fees ranging from 0.25 percent to 0.375 percent, depending on utilization and (ii) a

new six-year $850 term loan (the “Secured Term Loan Facility”), secured by a portion of the Company’s real

estate and equipment, which bore interest at the rate of LIBOR plus 6.75 percent and included a floor on LIBOR

set at 1.25 percent. These agreements replaced the Company’s senior secured credit facilities, which were

composed of a $1,500 revolving credit facility under which $280 was outstanding, scheduled to mature in April

2015, a $574 term loan B-2 scheduled to mature in October 2015 and a $446 term loan B-3 scheduled to mature

in April 2018. On August 30, 2012, the Company paid and capitalized $59 in loan origination and financing costs

which is included in Other Assets in the Consolidated Balance Sheets. As discussed below, the Revolving ABL

Credit Facility and the Secured Term Loan Facility were refinanced with two new credit agreements on

March 21, 2013 in connection with the NAI Banner Sale.

Certain of the Company’s material subsidiaries were co-borrowers with the Company under the Revolving ABL

Credit Facility, and the Revolving ABL Credit Facility was guaranteed by the rest of the Company’s material

subsidiaries. To secure the obligations under the Revolving ABL Credit Facility, the Company granted a

perfected first-priority security interest for the benefit of the Revolving ABL Credit Facility lenders in its present

and future inventory, credit card and certain other receivables, prescription files and related assets. In addition,

the obligations under the Revolving ABL Credit Facility were secured by second-priority liens on and security

interests in the collateral securing the Secured Term Loan Facility, subject to certain limitations to ensure

compliance with the Company’s outstanding debt instruments and leases.

The Secured Term Loan Facility was also guaranteed by the Company’s material subsidiaries. To secure their

obligations under the Secured Term Loan Facility, the Company and the guarantors granted a perfected first-

priority mortgage lien and security interest for the benefit of the Secured Term Loan Facility lenders in certain of

their owned or ground-leased real estate and the equipment located on such real estate. As of February 23, 2013,

there was $1,069 of owned or ground-leased real estate and associated equipment pledged as collateral, classified

as Property, plant and equipment, net in the Consolidated Balance Sheets. In addition, the obligations under the

Secured Term Loan Facility were secured by second-priority secured interests in the collateral securing the

Revolving ABL Credit Facility, subject to certain limitations to ensure compliance with the Company’s

outstanding debt instruments and leases.

The loans under the Secured Term Loan Facility could be voluntarily prepaid at any time, subject to a

prepayment fee in certain circumstances. The Secured Term Loan Facility had required repayments, equal to

1.00 percent of the initial drawn balance each year, payable quarterly, with the entire remaining balance due at

the six year anniversary of the inception date. In addition, the Company was required to apply net cash proceeds

(as defined in the Secured Term Loan Facility) from certain types of asset sales in amounts ranging from 50

percent to 100 percent (excluding proceeds of the collateral security of the Revolving ABL Credit Facility and

other secured indebtedness) to prepay the loans outstanding under the Secured Term Loan Facility. The

Company was also required to prepay the loans outstanding by up to 50 percent of its annual excess cash flow (as

defined in the Secured Term Loan Facility). As of February 23, 2013, the loans outstanding under the Secured

Term Loan Facility had a remaining principal balance of $834 at LIBOR plus 6.75 percent and included a

LIBOR floor of 1.25 percent, of which $9 was classified as current.

As of February 23, 2013, there was $207 of outstanding borrowings under the Revolving ABL Credit Facility at

rates ranging from LIBOR plus 2.00 percent to prime plus 1.00 percent. Facility fees under this facility were

0.250 percent. Letters of credit outstanding under the Revolving ABL Credit Facility were $360 at fees up to

2.125 percent and the unused available credit under the Revolving ABL Credit Facility was $857. As of

February 23, 2013, the Revolving ABL Credit Facility was secured on a first priority basis by $2,092 of assets

included in Inventories, all of the Company’s pharmacy scripts, included in Intangible assets, net and all credit

card receivables of wholly-owned stores, included in Cash and cash equivalents in the Consolidated Balance

Sheets.

71