Albertsons 2013 Annual Report Download - page 31

Download and view the complete annual report

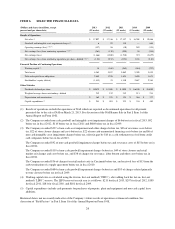

Please find page 31 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Excluding these items the remaining decrease in operating loss for Retail Food in fiscal 2013 is primarily due to

lower employee-related costs.

Save-A-Lot operating earnings for fiscal 2013 were $146, or 3.5 compared with $232, or 5.5 percent of Save-A-

Lot net sales, last year. The $86 decrease in Save-A-Lot operating earnings reflect $22 of net charges related to

the closure of 22 non-strategic stores and $13 of non-cash property, plant and equipment impairment charges.

Excluding these charges, the remaining decrease is primarily due to negative gross profit impacts from

competitive price investment, higher advertising and shrink costs.

Independent Business operating earnings for fiscal 2013 were $189, or 2.3 percent of Independent Business net

sales, compared with $243, or 3.0 percent of Independent Business net sales, last year. The $54 decrease in

Independent Business operating earnings includes $11 of non-cash property, plant and equipment and intangible

asset impairment charges and net $7 of higher severance costs. Excluding these items the $36 decrease is due

primarily to gross margin investment and change in business mix partially offset by a lower LIFO charge and

lower employee related costs.

Interest Expense, Net

Net interest expense was $269 in fiscal 2013, compared with $247 last year, primarily reflecting the write-off of

unamortized financing costs of $22, in connection with the debt refinancing transaction completed during fiscal

2013.

Income Tax Benefit

The Income tax benefit for fiscal 2013 was $163 compared with an Income tax benefit of $41 last year. Income

tax benefit for fiscal 2013 and 2012 reflect the operating losses arising during the respective years.

Net Loss from Continuing Operations

Net loss from continuing operations was $263, or $1.24 per basic and diluted share, for fiscal 2013 compared

with a Net loss from continuing operations of $110, or $0.52 per basic and diluted share last year. Net loss from

continuing operations for fiscal 2013 includes non-cash property, plant and equipment impairment charges of

$227 before tax ($140 after tax, or $0.66 per diluted share), employee-related expenses, primarily severance and

labor buyout costs of $36 before tax ($23 after tax, or $0.10 per diluted share), store closure costs of $22 before

tax ($13 after tax, or $0.06 per diluted share), write-off of unamortized financing costs of $22 before tax ($14

after tax, or $0.07 per diluted share) and intangible asset impairment charges of $6 before tax ($3 after tax, or

$0.02 per diluted share) which were partially offset by a cash settlement received from credit card companies of

$10 before tax ($6 after tax, or $0.03 per diluted share). Fiscal 2012 Net loss from continuing operations includes

goodwill impairment charges of $92 before tax ($90 after tax, or $0.43 per basic and diluted share) and employee

related severance charges of $15 before tax ($10 after tax, or $0.05 per basic and diluted share). Excluding the

above items, the $66 increase in Net loss from continuing operations is primarily the result of unfavorable Gross

profit in the Save-A-Lot and Independent Business segments and lower sales volume in Retail Food and Save-A-

Lot segments.

Loss from Discontinued Operations, net of income taxes

As a result of the NAI Banner Sale, the financial results for those operations are now presented as discontinued

operations.

Net sales for discontinued operations were $17,230 for fiscal 2013 compared with $18,764 for fiscal 2012, a

decrease of $1,534 or 8.2 percent. Sales decreased primarily due to negative identical store sales of 5.0 percent or

29