Albertsons 2013 Annual Report Download - page 32

Download and view the complete annual report

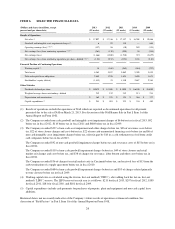

Please find page 32 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$887 and the impact of the fuel divestiture of $458. In addition, closed stores net of new stores resulted in

decreased sales of $189.

Loss from discontinued operations, net of tax for fiscal 2013 was $1,203 compared to $930 in fiscal 2012. Fiscal

2013 included the loss on sale of the NAI banners of $1,273 net of tax, asset impairment and store closure costs

of $97 net of tax and professional services costs of $5 net of tax, partially offset by cash settlement received from

credit card companies of $20 net of tax. Fiscal 2012 included goodwill and intangible asset impairment charges

of $1,202 net of tax and severance charges of $3 net of tax. Excluding these items the decrease of net income of

$123 was primarily due to lower sales volume in identical stores and investments in price.

Refer to Note 15—Discontinued Operations and Divestitures in the Notes to Consolidated Financial Statements

included in Part II, Item 8 of this Annual Report on Form 10-K for further discussion.

Comparison of fiscal 2012 ended February 25, 2012 and fiscal 2011 ended February 26, 2011:

Net sales for fiscal 2012 were $17,336, compared with $17,357 for fiscal 2011. Net loss from continuing

operations for fiscal 2012 was $110, or $0.52 per basic and diluted share, compared with net loss of $200, or

$0.94 per basic and diluted share for fiscal 2011.

Results for fiscal 2012 include net charges of $107 before tax ($100 after tax, or $0.48 per diluted share)

comprised of non-cash goodwill impairment charges of $92 before tax ($90 after tax, or $0.43 per diluted share),

and severance-related expenses of $15 before tax ($10 after tax, or $0.05 per diluted share).

During fiscal 2012, the Company added one new store through new store development for Retail Food and sold

or closed 3 Retail Food stores, including planned dispositions. During fiscal 2012, the Company added 82 new

Save-A-Lot stores through new store development and sold or closed 30 stores, including planned dispositions.

Total retail square footage as of the end of fiscal 2012, was approximately 17.6 million, an increase of

1.2 percent from the end of fiscal 2011. Total retail square footage, excluding actual and planned store

dispositions, increased 1.1 percent from the end of fiscal 2011.

Net Sales

Net sales for fiscal 2012 were $17,336, compared with $17,357 for fiscal 2011, a decrease of $21 or 0.1 percent.

Retail Food net sales were 28.4 percent of Net sales, Save-A-Lot net sales were 24.3 percent of Net sales and

Independent Business net sales were 47.3 percent of Net sales for fiscal 2012, compared with 29.1 percent,

22.4 percent and 48.5 percent, respectively, in fiscal 2011.

Retail Food net sales for fiscal 2012 were $4,921, compared with $5,054 for fiscal 2011, a decrease of $133 or

2.6 percent. The decrease primarily reflects closed stores and market exits net of new stores of $102 and negative

identical store retail sales of 0.7 percent, or $31 (defined as stores operating for four full quarters, including store

expansions and excluding fuel). Identical store retail sales performance was primarily a result of heightened

value-focused competitive activity and the impact of the challenging economic environment on consumers.

Customer count declined approximately 1.5 percent and average basket size increased approximately 0.8 percent

during fiscal 2012 driven by higher inflation and fewer items per customer.

Save-A-Lot net sales for fiscal 2012 were $4,221, compared with $3,890 for fiscal 2011, an increase of $331 or

8.5 percent. The increase is primarily due to new store and licensee sales of $326, positive network identical

store retail sales of 3.1 percent over fiscal 2011 or $104 (defined as net sales from Company-owned and sales to

licensee stores operating for four full quarters, including store expansions and excluding planned store

dispositions), partially offset by a decrease from closed stores of $99.

Independent Business net sales for fiscal 2012 were $8,194, compared with $8,413 for fiscal 2011, a decrease of

$219 or 2.6 percent. The decrease is primarily due to reduced volume from a national retail customer’s transition

of volume to self-distribution offset in part by increased sales to existing independent retail customers of $107.

30