Albertsons 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company records a valuation allowance to reduce the deferred tax assets to the amount that it is more-likely-

than-not to realize. Forecasted earnings, future taxable income and future prudent and feasible tax planning

strategies are considered in determining the need for a valuation allowance. In the event the Company was not

able to realize all or part of its net deferred tax assets in the future, the valuation allowance would be increased.

Likewise, if it was determined that the Company was more-likely-than-not to realize the net deferred tax assets,

the applicable portion of the valuation allowance would reverse. The Company had a valuation allowance of

$1,358 and $12 as of February 23, 2013 and February 25, 2012, respectively.

Included in discontinued operations is the recognition of the additional tax basis in the shares of NAI offset by a

valuation allowance on the estimated capital loss, as there is no current evidence that the capital loss will be used

prior to its expiration.

Self-Insurance Liabilities

The Company is primarily self-insured for workers’ compensation, healthcare for certain employees and general

and automobile liability costs. It is the Company’s policy to record its self-insurance liabilities based on

management’s estimate of the ultimate cost of reported claims and claims incurred but not yet reported and

related expenses, discounted at a risk-free interest rate.

In determining its self-insurance liabilities, the Company performs a continuing review of its overall position and

reserving techniques. Since recorded amounts are based on estimates, the ultimate cost of all incurred claims and

related expenses may be more or less than the recorded liabilities. Any projection of losses concerning workers’

compensation, healthcare and general and automobile liability is subject to a degree of variability. Among the

causes of this variability are unpredictable external factors affecting future inflation rates, discount rates,

litigation trends, legal interpretations, regulatory changes, benefit level changes and actual claim settlement

patterns. If, in the future, the Company were to experience significant volatility in the amount and timing of cash

payments compared to its earlier estimates, the Company would assess whether to continue to discount these

liabilities. The Company had self-insurance liabilities of approximately $83, net of the discount of $7, and $81,

net of the discount of $8, as of February 23, 2013 and February 25, 2012, respectively. As of February 23, 2013,

each 25 basis point change in the discount rate would impact the self-insurance liabilities by less than $1. Prior to

the NAI Banner Sale, the majority of the self-insurance liability for workers’ compensation was related to claims

occurring in California. As a result of the NAI Banner Sale and the retention of liability for California self-

insurance liabilities related to workers compensation by NAI, the Company has significantly reduced the extent

of self-insurance obligations.

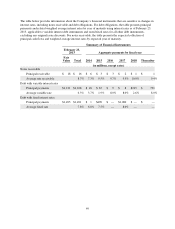

LIQUIDITY AND CAPITAL RESOURCES

Management expects that the Company will continue to replenish operating assets and pay down debt obligations

with internally generated funds. There can be no assurance, however, that the Company’s business will continue

to generate cash flow at current levels. A significant reduction in operating earnings or the incurrence of

operating losses in one or more quarterly periods could have a negative impact on the Company’s operating cash

flow, which would limit the Company’s ability to pay down its outstanding indebtedness as planned. The

Company’s primary source of liquidity is from internally generated funds and borrowings under its credit

facilities. To the extent that the Company’s inventory levels decline as a result of reduced cash flow from

operations, the Company’s borrowing capacity under its credit facilities would also decline. Reduced liquidity

could also result in less favorable trade terms with vendors and other third parties.

Long-term financing will be maintained through existing and new debt issuances and credit facilities. The

Company’s short-term and long-term financing abilities are believed to be adequate as a supplement to internally

generated cash flows to fund capital expenditures as opportunities arise. Maturities of debt issued will depend on

management’s views with respect to the relative attractiveness of interest rates at the time of issuance and other

debt maturities.

40