Albertsons 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SU

PERVAL

U

IN

C

. and

S

ubsidiaries

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

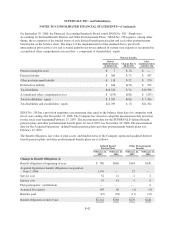

C

orporate Unit, includin

g

accrued interest. In Januar

y

2007, the Compan

y

purchased approximatel

y

4,000,00

0

C

orporate Units at a purchase price of

$

25.52 per Corporate Unit, including accrued interest. The Company pai

d

a

n aggregate amount of approximately

$

979, including accrued interest, and recognized a gain of approximatel

y

$

1 related to these

p

urchases

.

I

nFe

b

ruary 2007, pursuant to t

h

e terms o

f

t

h

e Corporate Un

i

ts, t

h

e sen

i

or notes

h

e

ld

as components o

f

Corporat

e

Units (the “Pled

g

ed Senior Notes”) were remarketed b

y

the remarketin

g

a

g

ent. Throu

g

h the remarketin

g

, the

C

ompany purchased all of the remarketed senior notes for approximately

$

180 and recognized a gain of less than

$

1. The proceeds of the remarketing of the Pledged Senior Notes (net of remarketing fee) were delivered to th

e

collateral a

g

ent and used to purchase U.S. treasur

y

securities, maturin

g

on or about the purchase contrac

t

settlement date of May 16, 2007 (the “Purchase Contract Settlement Date”). The treasury securities will serve a

s

co

ll

atera

lf

or t

h

e

h

o

ld

ers’ o

bli

gat

i

ons un

d

er t

h

e purc

h

ase contracts assoc

i

ate

d

w

i

t

h

t

h

e Corporate Un

i

ts

.

As of February 24, 2007, under the terms of the purchase contracts, the Company would be required to issue a

m

i

n

i

mum o

f

1.1 s

h

ares an

d

a max

i

mum o

f

1.4 s

h

ares o

fi

ts common stoc

kf

or t

h

e rema

i

n

i

ng purc

h

ase contracts

.

I

f the purchase contracts had been settled at Februar

y

24, 2007, the Compan

y

would have received approximatel

y

$

45 of net cash and would have issued approximately 1.2 shares of its common stock. Upon settlement of each

purc

h

ase contract, t

h

e Company w

ill

rece

i

ve t

h

e state

d

amount o

f

twenty-

fi

ve

d

o

ll

ars on t

h

e purc

h

ase contract

a

nd will issue the re

q

uisite amount of Ac

q

uisition Consideration ($20.35 in cash and 0.182 SUPERVALU shares

per share of Albertsons common stock subject to the settlement rate). The net amount of cash received will be

recor

d

e

d

as an

i

ncrease to stoc

kh

o

ld

ers’ equ

i

ty

.

Upon settlement of the purchase contracts on May 16, 2007, the Company will receive approximately

$

45 of net

cas

h

an

di

ssue 1.2 s

h

ares.

B

efore the issuance of common stock u

p

on settlement of the

p

urchase contracts, the Cor

p

orate Units will b

e

re

fl

ecte

di

nt

h

e

dil

ute

d

earn

i

ngs per s

h

are ca

l

cu

l

at

i

ons us

i

ng t

h

e treasury stoc

k

met

h

o

d

as

d

e

fi

ne

db

y SFA

S

N

o. 128, “Earnin

g

s Per Share.” Under this method, the number of shares of common stock used in calculatin

g

d

iluted earnings per share (based on the settlement formula applied at the end of the reporting period) is deeme

d

to

b

e

i

ncrease

db

yt

h

e excess,

if

any, o

f

t

h

e num

b

er o

f

s

h

ares t

h

at wou

ld b

e

i

ssue

d

upon sett

l

ement o

f

t

he

purchase contracts less the number of shares that could be purchased b

y

the Compan

y

in the market at th

e

a

verage market price during the period using the proceeds to be received upon settlement. Therefore, dilution

will

occur

f

or per

i

o

d

sw

h

en t

h

e average mar

k

et pr

i

ce o

f

t

h

e Company’s common stoc

kf

or t

h

e 20-

d

ay tra

di

ng

period precedin

g

the end of the reportin

g

period is above $46.54, and will potentiall

y

occur when the avera

g

e

market price of the Company’s common stock for the 20-day trading period preceding the end of the reporting

per

i

o

di

s

l

ower t

h

an t

h

e average pr

i

ce o

f

t

h

e Company’s common stoc

kf

or t

h

e

f

u

ll

report

i

ng per

i

o

d

. For t

h

e yea

r

ended Februar

y

24, 2007, the Corporate Units were dilutive b

y

approximatel

y

0.09 shares.

F-

32