Albertsons 2007 Annual Report Download - page 37

Download and view the complete annual report

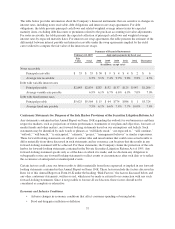

Please find page 37 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Upon settlement of the purchase contracts on May 16, 2007, the Company will receive approximately

$

45 of net

cas

h

an

di

ssue 1.2 s

h

ares, w

hi

c

h

t

h

e Company

i

nten

d

s to repurc

h

ase t

h

roug

hi

ts s

h

are repurc

h

ase program.

T

he Company is party to a synthetic leasing program for one of its major warehouses. The lease expires in April

2008 and it may be renewed with the lessor’s consent through April 2013, and has a purchase option of

$

60. On

Februar

y

8, 2007, the Compan

y

approved a plan to exit this facilit

y

. As a result of the decision to exit this

f

acility, the Company has recorded the difference between the purchase option and the estimated market value o

f

t

h

e property un

d

er

l

y

i

ng t

h

e

l

ease as a res

id

ua

l

va

l

ue guarantee. T

h

e res

id

ua

l

va

l

ue guarantee

i

s

i

nc

l

u

d

e

di

nOt

h

e

r

current assets on the Compan

y

’s Consolidated Balance Sheet as of Februar

y

24, 2007 and will be amortized ove

r

the remaining term of the lease.

Medium-term notes of $30 due Jul

y

2027 contain put options that would require the Compan

y

to repa

y

the note

s

in July 2007 if the holders of the notes so elect by giving the Company 30-days notice. Medium-term notes of

$

49 due April 2028 contain put options that would require the Company to repay the notes in April 2008 if th

e

h

olders of the notes so elect b

yg

ivin

g

the Compan

y

30-da

y

s notice. The $209 of 7.5 percent debentures due Ma

y

2037 contain put options that would require the Company to repay the notes in May 2009 if the holders of the

notes so e

l

ect

b

yg

i

v

i

ng t

h

e Company 30-

d

ays not

i

ce

.

Annual cash dividends declared for fiscal 2007, 2006 and 2005, were

$

0.6575,

$

0.6400 and

$

0.6025

p

er common

s

h

are, respect

i

ve

l

y. T

h

e Company’s

di

v

id

en

d

po

li

cy w

ill

cont

i

nue to emp

h

as

i

ze a

hi

g

hl

eve

l

o

f

earn

i

ngs retent

i

o

n

f

or

g

rowth

.

C

apital spending for fiscal 2007 was

$

927, including

$

73 of capital leases. Capital spending primarily included

retail store expansion and store remodelin

g

. The Compan

y

’s capital spendin

g

for fiscal 2008 is pro

j

ected to be

a

pproximately

$

1,200, including capital leases.

S

UB

S

E

Q

UENT EVENT

S

On Marc

h

8, 2007, t

h

e Company execute

d

an amen

d

ment to t

h

eex

i

st

i

ng cre

di

t

f

ac

ili

ty, resu

l

t

i

ng

i

nne

w

a

pplicable interest rates for two of its term loans. Rates on Term Loan A and Term Loan B were chan

g

ed to

LIBOR plus 0.37

5

percent to 1.

5

0 percent and LIBOR plus 1.2

5

percent to 1.7

5

percent, respectively, depending

o

nt

h

e Company’s cre

di

t rat

i

ngs. T

hi

s amen

d

ment resu

l

te

di

nt

h

e rates on t

h

e outstan

di

ng Term Loan A an

d

Ter

m

Loan B balances chan

g

in

g

to LIBOR plus 1.37

5

percent and LIBOR plus 1.

5

0 percent, respectivel

y

.

On Apr

il

18, 2007, t

h

e Company’s Boar

d

o

f

D

i

rectors a

d

opte

d

a new s

h

are repurc

h

ase program aut

h

or

i

z

i

ng t

h

e

C

ompan

y

to purchase up to $235 of the Compan

y

’s common stock. Share repurchases will be made with the cash

g

enerated from the exercise of stock options and mandatory convertible securities equity issuance. This progra

m

rep

l

aces a

ll

prev

i

ous

l

yex

i

st

i

ng programs

.

On April 18, 2007, the Company cancelled its interest rate swap agreements.

COMMITMENT

S

, CONTINGENCIE

S

AND OFF-BALANCE

S

HEET ARRANGEMENT

S

Th

e Company

h

as guarantee

d

certa

i

n

l

eases,

fi

xture

fi

nanc

i

ng

l

oans an

d

ot

h

er

d

e

b

to

bli

gat

i

ons o

f

var

i

ous reta

il

er

s

a

t Februar

y

24, 2007. These

g

uarantees were

g

enerall

y

made to support the business

g

rowth of affiliated retailers

.

T

he guarantees are generally for the entire terms of the leases or other debt obligations with remaining terms that

range

f

rom

l

ess t

h

an one year to 20 years, w

i

t

h

awe

i

g

h

te

d

average rema

i

n

i

ng term o

f

approx

i

mate

l

y 12 years.

For each

g

uarantee issued, if the affiliated retailer defaults on a pa

y

ment, the Compan

y

would be required t

o

make payments under its guarantee. Generally, the guarantees are secured by indemnification agreements o

r

persona

l

guarantees o

f

t

h

ea

ffili

ate

d

reta

il

er. At Fe

b

ruary 24, 2007, t

h

e max

i

mum amount o

f

un

di

scounte

d

pa

y

ments the Compan

y

would be required to make in the event of default of all

g

uarantees was approximatel

y

$

215 and represented approximately

$

141 on a discounted basis. No amount has been recorded in th

e

31