Albertsons 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SU

PERVAL

U

IN

C

. and

S

ubsidiaries

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

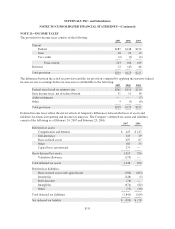

Durin

g

fiscal 200

5

, the Compan

y

sold its minorit

y

ownership interest in WinCo. As a result of the sale, th

e

C

ompany recognized an after-tax gain of

$

68 (

$

109 pre-tax).

Reserves for C

l

ose

d

Propertie

s

Th

e Company ma

i

nta

i

ns reserves

f

or est

i

mate

dl

osses on reta

il

stores,

di

str

ib

ut

i

on ware

h

ouses an

d

ot

h

e

r

properties that are no lon

g

er bein

g

utilized in current operations. The reserves for closed properties includ

e

management’s estimates for lease subsidies, lease terminations and future payments on exited real estate.

Additions include approximately

$

19 of reserves for closed properties acquired from Albertsons, which were

recorded in purchase accountin

g

.Ad

j

ustments in the table below include approximatel

y

$62 related to the fair

v

alue of liabilities recognized in purchase accounting at the Acquisition Date for lease liabilities of former

A

lb

ertsons stores.

At February 24, 2007, the remaining 2001 restructuring reserve of

$

15 included

$

14 representing the estimate

d

f

air value of future lease payments less estimated sublease income related to properties exited and

$

1 related to

a

multi-emplo

y

er pension plan withdrawal liabilit

y

. Future lease pa

y

ments related to facilities primaril

y

under

o

perating leases that were exited as part of the 2001 restructuring plan will continue through fiscal 2027 and th

e

C

ompany expects t

h

emu

l

t

i

-emp

l

oyer pens

i

on p

l

an w

i

t

hd

rawa

lli

a

bili

ty w

ill b

epa

id i

n

f

u

ll b

yt

h

een

d

o

ffi

sca

l

2008

.

Deta

il

so

f

t

h

ese reser

v

es

w

ere as

f

o

ll

o

w

s

:

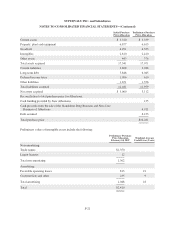

2007

2006

200

5

B

eginning balance

$

62

$

81

$

7

7

A

ddi

t

i

on

s

36

1

0

1

3

U

sag

e

(

42) (30) (31

)

Ad

j

ustments 62 1 22

Ending balance

$

118

$

62

$

81

Asset Im

p

airment

T

he Company recognized asset impairment charges of

$

7 (excluding the

$

19 goodwill and

$

1 other charge

s

related to Scott’s discussed above) for the

5

2 weeks ended Februar

y

24, 2007, primaril

y

for the write-down o

f

property, plant and equipment related to the plan to dispose of the 18 Scott’s retail stores. The Compan

y

recognized asset impairment charges of

$

66 during fiscal 2006 on the write-down of property, plant an

d

equipment for closed properties, primaril

y

related to the plan to dispose of corporate operated Shop ’n Save retail

stores in Pittsburgh and the impairment of certain assets following the planned disposition of Deals stores. Th

e

C

ompany recognized asset impairment charges of

$

5 in fiscal 2005 on the write-down of property, plant an

d

equipment for closed properties. The asset impairment char

g

es for fiscal 2007, 2006 and 200

5

related to the

R

etail food segment. Impairment charges, a component of Selling and administrative expenses in th

e

C

onso

lid

ate

d

Statements o

f

Earn

i

ngs, re

fl

ect t

h

e

diff

erence

b

etween t

h

e carry

i

ng va

l

ue o

f

t

h

e assets an

d

t

h

e

estimated fair values, which were based on the estimated market values for similar assets

.

F-2

5