Albertsons 2007 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SU

PERVAL

U

IN

C

. and

S

ubsidiaries

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

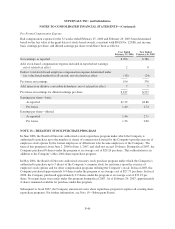

provisions or at the discretion of the Compan

y

’s Retirement Committee. Total contribution expenses for these

plans were

$

83,

$

16 and

$

18 for fiscal 2007, 2006 and 2005, respectively. Plan assets also include 4 and 3 share

s

o

f the Company’s common stock at February 24, 2007 and February 25, 2006, respectively.

P

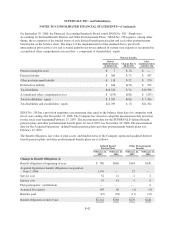

ost-Employment Benefits

T

he Compan

y

reco

g

nizes an obli

g

ation for benefits provided to former or inactive emplo

y

ees. The Compan

y

is

self-insured for certain of its employees’ short-term and long-term disability plans, which are the primar

y

b

ene

fi

ts pa

id

to

i

nact

i

ve emp

l

oyees pr

i

or to ret

i

rement

.

At February 24, 2007, the obligation for post-employment benefits was

$

85 with

$

23 included in Accrue

d

v

acation, compensation and benefits and

$

62 included in Other liabilities.

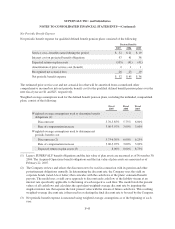

M

ulti-Employer Plan

s

T

he Compan

y

also participates in several multi-emplo

y

er plans providin

g

defined benefits to union emplo

y

ee

s

u

nder the provisions of collective bargaining agreements. These plans require the Company to mak

e

contributions thereto as negotiated in such collective bargaining agreements. The Company contributed

$

122,

$

37 and $37 to these plans for fiscal 2007, 2006 and 2005, respectivel

y

. Currentl

y

, some of these plans ar

e

u

nderfunded in that the

p

resent value of accrued liabilities exceeds the current value of the assets held in trust to

pay

b

ene

fi

ts. I

f

t

h

e Company were to ex

i

t certa

i

n mar

k

ets or ot

h

erw

i

se cease ma

ki

ng contr

ib

ut

i

ons to t

h

ese p

l

an

s

a

t this time, it could tri

gg

er a withdrawal liabilit

y

that would require the Compan

y

to fund its proportionate share

o

f a plan’s unfunded vested benefits. There are many variables that affect future funding requirements such as

i

n

v

estment returns an

db

ene

fi

t

l

e

v

e

l

s.

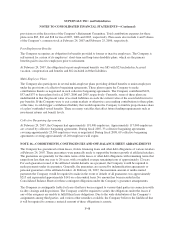

C

ollective Bargaining Agreements

At Februar

y

24, 2007, the Compan

y

had approximatel

y

191,400 emplo

y

ees. Approximatel

y

117,000 emplo

y

ees

a

re covered by collective bargaining agreements. During fiscal 2007, 33 collective bargaining agreement

s

covering approximately 25,500 employees were re-negotiated. During fiscal 2008, 69 collective bargaining

ag

reements coverin

g

approximatel

y

43,200 emplo

y

ees will expire

.

NOTE 16—COMMITMENTS

,

CONTINGENCIES AND OFF-BALANCE SHEET ARRANGEMENT

S

T

he Company has guaranteed certain leases, fixture financing loans and other debt obligations of various retailer

s

a

tFe

b

ruary 24, 2007. T

h

ese guarantees were genera

ll

yma

d

e to support t

h

e

b

us

i

ness growt

h

o

f

a

ffili

ate

d

reta

il

ers

.

T

he

g

uarantees are

g

enerall

y

for the entire terms of the leases or other debt obli

g

ations with remainin

g

terms that

range from less than one year to 20 years, with a weighted average remaining term of approximately 12 years.

F

or eac

h

guarantee

i

ssue

d

,

if

t

h

ea

ffili

ate

d

reta

il

er

d

e

f

au

l

ts on a payment, t

h

e Company wou

ld b

e requ

i

re

d

t

o

make pa

y

ments under its

g

uarantee. Generall

y

, the

g

uarantees are secured b

y

indemnification a

g

reements o

r

personal guarantees of the affiliated retailer. At February 24, 2007, the maximum amount of undiscounte

d

payments t

h

e Company wou

ld b

e requ

i

re

d

to ma

k

e

i

nt

h

e event o

fd

e

f

au

l

to

f

a

ll

guarantees was approx

i

mate

ly

$

215 and represented approximatel

y

$141 on a discounted basis. No amount has been recorded in th

e

C

onsolidated Balance Sheets for these contingent obligations under the Company’s guarantee arrangements

.

T

he Compan

y

is contin

g

entl

y

liable for leases that have been assi

g

ned to various third parties in connection wit

h

f

acility closings and dispositions. The Company could be required to satisfy the obligations under the leases i

f

a

ny o

f

t

h

e ass

i

gnees are una

bl

eto

f

u

lfill

t

h

e

i

r

l

ease o

bli

gat

i

ons. Due to t

h

ew

id

e

di

str

ib

ut

i

on o

f

t

h

e Company’

s

a

ssi

g

nments amon

g

third parties, and various other remedies available, the Compan

y

believes the likelihood tha

t

it will be required to assume a material amount of these obligations is remote.

F-

48