Albertsons 2007 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.o

n our estimate of whether, and the extent to which, additional tax payments will be required. If we ultimatel

y

d

eterm

i

ne t

h

at payment o

f

t

h

ese amounts

i

s unnecessary, we reverse t

h

e

li

a

bili

ty an

d

recogn

i

ze a tax

b

ene

fi

t

d

urin

g

the period in which we determine that the liabilit

y

is no lon

g

er necessar

y

. We record an additional char

g

e

in our provision for taxes in the period in which we determine that the recorded tax liability is less than w

e

expect t

h

eu

l

t

i

mate assessment to

b

e.

We record a valuation allowance to reduce the deferred tax assets to the amount that we are more likely than not

to rea

li

ze. We

h

ave cons

id

ere

df

orecaste

d

earn

i

ngs,

f

uture taxa

bl

e

i

ncome an

df

uture pru

d

ent an

df

eas

ibl

e tax

plannin

g

strate

g

ies in determinin

g

the need for a valuation allowance. In the event we were to determine that we

would not be able to realize all or

p

art of our net deferred tax assets in the future, we would increase th

e

v

a

l

uat

i

on a

ll

owance. L

ik

ew

i

se,

if

we

l

ater

d

eterm

i

ne t

h

at we are more

lik

e

l

yt

h

an not to rea

li

ze t

h

e net

d

e

f

erre

d

tax assets, we would reverse the a

pp

licable

p

ortion of the valuation allowance.

L

IQUIDITY AND CAPITAL RESOURCES

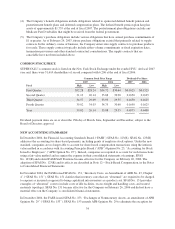

Net cash provided by operating activities was

$

801,

$

695 and

$

801 in fiscal 2007, 2006 and 2005, respectively

.

T

he increase in cash from operating activities in fiscal 2007 from fiscal 200

6

is primarily attributable t

o

increased Net earnin

g

s and Depreciation and amortization as a result of the Acquisition, which is partiall

y

offse

t

by changes in working capital and deferred income taxes.

Net cash used in investin

g

activities was $2,760, $258 and $162 in fiscal 2007, 2006 and 2005, respectivel

y.

Fiscal 2007 investing activities primarily relate to the net assets acquired in the Acquisition and capital spending

to fund retail store expansion and remodeling. Fiscal 200

6

investing activities primarily reflect capital spending

to fund retail store expansion, store remodelin

g

, technolo

gy

enhancements and suppl

y

chain

g

rowth initiatives

.

Fiscal 200

5

activities primarily reflect capital spending to fund retail store expansion, store remodeling and

tec

h

no

l

ogy en

h

ancements as we

ll

as t

h

e acqu

i

s

i

t

i

on o

f

Tota

l

Log

i

st

i

cs an

d

t

h

e procee

d

s

f

rom t

h

esa

l

eo

f

W

i

nCo.

Net cash provided (used) by financing activities was

$

1,443, (

$

193) and (

$

458) in fiscal 2007, 2006 and 2005,

respect

i

ve

l

y. F

i

sca

l

2007

fi

nanc

i

ng act

i

v

i

t

i

es re

l

ate pr

i

mar

il

ytot

h

e

d

e

b

t

i

ncurre

di

n connect

i

on w

i

t

h

t

he

Acquisition, and senior notes issued in October 200

6

partiall

y

offset b

y

repa

y

ment of lon

g

-term debt of

Albertsons standalone drug business payables related to the sale of Albertsons. Fiscal 2006 financing activities

pr

i

mar

il

yre

fl

ect t

h

e repayments o

fl

ong-term

d

e

b

t, t

h

e payment o

fdi

v

id

en

d

san

d

t

h

e purc

h

ase o

f

treasury s

h

ares

net of proceeds from the exercise of outstandin

g

options. Fiscal 200

5

financin

g

activities primaril

y

reflect the

payment of debt, the payment of dividends and the purchase of treasury shares net of proceeds from the exercise

of

outstan

di

ng opt

i

ons.

Management expects that the Company will continue to invest in capital expenditures with internally generated

f

un

d

s. T

h

ere can

b

e no assurance,

h

owever, t

h

at t

h

e Company’s

b

us

i

ness w

ill

cont

i

nue to generate cas

hfl

ow a

t

current levels. The Compan

y

will continue to obtain short-term financin

g

from its credit facilities. Lon

g

-term

f

inancing will be maintained through existing and new debt issuances. The Company’s short-term and long-term

fi

nanc

i

ng a

bili

t

i

es are

b

e

li

eve

d

to

b

ea

d

equate as a supp

l

ement to

i

nterna

ll

y generate

d

cas

hfl

ows to

f

un

di

ts

ca

p

ital ex

p

enditures and ac

q

uisitions as o

pp

ortunities arise. Maturities of debt issued will de

p

end o

n

management’s views with respect to the relative attractiveness of interest rates at the time of issuance and othe

r

d

e

b

t matur

i

t

i

es.

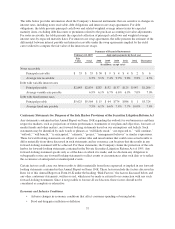

On October 31, 2006, the Company issued

$

500 in senior notes. The notes bear interest at a rate of 7.50 percen

t

a

n

d

are

d

ue

i

n 2014. T

h

e notes are sen

i

or o

bli

gat

i

ons an

d

ran

k

equa

ll

yw

i

t

h

a

ll

o

f

t

h

e Company’s ot

h

er sen

i

or

u

nsecured indebtedness

.

On June 1, 2006, the Company executed senior secured credit facilities in the amount of

$

4,000. These facilities

were provided b

y

a

g

roup of lenders and consist of a $2,000 five-

y

ear revolvin

g

credit facilit

y

(the “Revolvin

g

C

redit Facility”), a

$

750 five-year term loan (“Term Loan A”), and a

$

1,250 six-year term loan (“Term Loan

28