Albertsons 2007 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SU

PERVAL

U

IN

C

. and

S

ubsidiaries

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

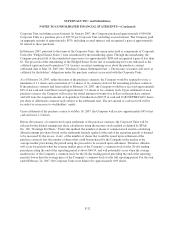

On September 29, 2006, the Financial Accountin

g

Standards Board issued SFAS No. 1

5

8, “Emplo

y

ers’

Accounting for Defined Benefit Pension and Other Postretirement Plans.” SFAS No. 1

5

8 requires, among othe

r

t

hi

ngs, t

h

e recogn

i

t

i

on o

f

t

h

e

f

un

d

e

d

status o

f

eac

hd

e

fi

ne

db

ene

fi

t pens

i

on p

l

an an

d

eac

h

ot

h

er postret

i

remen

t

b

enefit plan on the balance sheet. The impact of the implementation of the standard due to previousl

y

u

nrecognized prior service cost and actuarial gains/losses not recognized in current year expense is recognized in

a

ccumu

l

ate

d

ot

h

er compre

h

ens

i

ve

i

ncome/

l

oss, a component o

f

s

h

are

h

o

ld

ers’ equ

i

ty.

P

e

n

s

i

o

nB

e

n

e

fit

s

B

efo

r

e

i

mplementat

i

on

of

S

FA

S

15

8

C

hange due t

o

S

FA

S

15

8

Af

t

er

i

mplementat

i

o

n

o

f

S

FA

S

15

8

Pension intangible asset

$

7

$

(7)

$

—

Pension liability

$

364

$

73

$

43

7

Other postretirement liabilit

y

$ 118 $ 52 $ 170

Deferred tax liabilit

y

$ 644 $(51) $ 59

3

T

otal liabilities

$

16

,

322

$

74

$

16

,

396

Accumulated other comprehensive loss

$

(154)

$

(81)

$

(235)

T

otal stockholders’ equit

y

$ 5,387 $(81) $ 5,306

T

otal liabilities and stockholders’ equit

y

$21,709 $ (7) $21,70

2

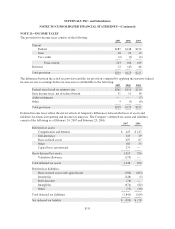

SFAS No. 158 has a provision requiring a measurement date equal to the balance sheet date for companies with

f

iscal

y

ears endin

g

after December 1

5

, 2008. The Compan

y

has chosen to adopt the measurement date provisio

n

f

or the fiscal year beginning February 2

5

, 2007. The measurement date for the SUPERVALU defined benefi

t

pension plans and other postretirement benefit plans for fiscal 2007 was November 30, 200

6

. The measurement

d

ate for the Ac

q

uired O

p

erations’ defined benefit

p

ension

p

lans and other

p

ostretirement benefit

p

lans wa

s

February 22, 2007

.

T

he benefit obli

g

ation, fair value of plan assets, and funded status of the Compan

y

-sponsored qualified defined

benefit

p

ension

p

lans and other

p

ostretirement benefit

p

lans are as follows

:

De

fi

ned Bene

fi

t

P

e

n

sio

nPl

a

n

s

O

ther Postret

i

remen

t

B

e

n

efi

t

s

F

ebruary

24,

200

7

F

ebruary

2

5

,

2006

F

ebruary

24,

200

7

F

ebruary

2

5

,

2006

Chan

g

e in Benefit Obli

g

ation (1

)

B

enefit obligation at beginning of year

$

780

$

686

$

144

$

14

9

Acquired Operations benefit obli

g

ation at acquisition

J

une 2

,

200

6

1

,

13

6

—27

—

Service cost 32 21 2 2

I

nterest cost 97 41 9 8

Plan participants’ contributions — — —

6

Actuarial loss (gain) 143

6

0 (1) (9

)

B

enefits paid (47) (28) (11) (12

)

B

enefit obligation at end of year

$

2,141

$

780

$

170

$

144

F-

42