Albertsons 2007 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

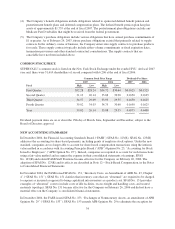

T

he table below provides information about the Company’s financial instruments that are sensitive to changes in

i

nterest rates,

i

nc

l

u

di

ng notes rece

i

va

bl

e,

d

e

b

to

bli

gat

i

ons an

di

nterest rate swap agreements. For

d

e

bt

o

bli

g

ations, the table presents principal cash flows and related wei

g

hted avera

g

e interest rates b

y

expected

maturity dates, excluding debt discounts or premiums related to the purchase accounting fair value adjustments

.

For notes rece

i

va

bl

e, t

h

eta

bl

e presents t

h

e expecte

d

co

ll

ect

i

on o

f

pr

i

nc

i

pa

l

cas

hfl

ows an

d

we

i

g

h

te

d

averag

e

interest rates b

y

expected maturit

y

dates. For interest rate swap a

g

reements, the table presents the estimate of th

e

d

ifferential between interest payable and interest receivable under the swap agreements implied by the yiel

d

curve ut

ili

ze

d

to compute t

h

e

f

a

i

rva

l

ue o

f

t

h

e

i

nterest rate swaps

.

S

ummary of Financial Instrument

s

February 24, 200

7

A

ggregate payments by fiscal year

F

ai

r

V

alue

To

t

a

l

2008

2

009

2

0

1

0

20

11

20

12 Th

e

r

eaf

t

e

r

(in millions, exce

p

t rates

)

Notes recei

v

abl

e

P

rincipal receivable

$

55

$

55

$3

0$

9

$

4

$

4

$

2

$

6

A

verage rate receivable 6.2%

5

.1% 7.4% 9.9% 9.8% 9.8% 4.3

%

Debt with variable interest rate

s

P

rincipal pa

y

able $2,843 $2,834 $287 $132 $137 $125 $ 947 $1,206

A

vera

g

e variable rate pa

y

able

6

.9%

6

.1%

6

.7%

6

.

6

%

6

.9% 7.0% 7.0

%

De

b

t

wi

t

hfi

xe

di

nterest rate

s

P

rincipal payable

$

5,625

$

5,564

$

15

$

64

$

774

$

986

$

1

$

3,72

4

A

vera

g

e fixed rate pa

y

able 7.

5

% 6.1% 6.6% 7.4% 7.7% 10.0% 7.4

%

Cautionary

S

tatements for Purposes of the

S

afe Harbor Provisions of the

S

ecurities Litigation Reform Ac

t

An

y

statements contained in this Annual Report on Form 10-K re

g

ardin

g

the outlook for our businesses and their

respect

i

ve mar

k

ets, suc

h

as pro

j

ect

i

ons o

ff

uture per

f

ormance, statements o

f

our p

l

ans an

d

o

bj

ect

i

ves,

f

orecasts o

f

mar

k

et tren

d

san

d

ot

h

er matters, are

f

orwar

d

-

l

oo

ki

n

g

statements

b

ase

d

on our assumpt

i

ons an

db

e

li

e

f

s. Suc

h

statements ma

y

be identified b

y

such words or phrases as “will likel

y

result,” “are expected to,” “will continue,

”

“out

l

oo

k

,” “w

ill b

ene

fi

t,” “

i

s ant

i

c

i

pate

d

,” “est

i

mate,” “pro

j

ect,” “management

b

e

li

eves” or s

i

m

il

ar express

i

ons.

Th

ese

f

orwar

d

-

l

oo

ki

n

g

statements are su

bj

ect to certa

i

nr

i

s

k

san

d

uncerta

i

nt

i

es t

h

at cou

ld

cause actua

l

resu

l

ts t

o

d

iffer materiall

y

from those discussed in such statements and no assurance can be

g

iven that the results in an

y

f

orwar

d

-

l

oo

ki

ng statement w

ill b

eac

hi

eve

d

. For t

h

ese statements, t

h

e Company c

l

a

i

ms t

h

e protect

i

on o

f

t

h

esa

f

e

h

arbor for forward-lookin

g

statements contained in the Private Securities Liti

g

ation Reform Act of 1995. An

y

f

orward-lookin

g

statement speaks onl

y

as of the date on which it is made, and we disclaim an

y

obli

g

ation to

su

b

sequent

l

y rev

i

se any

f

orwar

d

-

l

oo

ki

ng statement to re

fl

ect events or c

i

rcumstances a

f

ter suc

hd

ate or to re

fl

ect

t

h

e occurrence o

f

ant

i

c

i

pate

d

or unant

i

c

i

pate

d

events.

C

ertain factors could cause our future results to differ materiall

y

from those expressed or implied in an

y

forward

-

l

ookin

g

statements contained in this Annual Report on Form 10-K. These factors include the factors discussed i

n

I

tem 1A o

f

t

hi

s Annua

l

Report on Form 10-K un

d

er t

h

e

h

ea

di

ng “R

i

s

k

Factors,” t

h

e

f

actors

di

scusse

db

e

l

ow an

d

a

n

y

other cautionar

y

statements, written or oral, which ma

y

be made or referred to in connection with an

y

suc

h

f

orward-lookin

g

statements. Since it not possible to foresee all such factors, these factors should not be

cons

id

ere

d

as comp

l

ete or ex

h

aust

i

ve

.

E

conomic and Industry Conditions

• Adverse chan

g

es in economic conditions that affect consumer spendin

g

or bu

y

in

g

habits

• Foo

d

an

dd

rug pr

i

ce

i

n

fl

at

i

on or

d

e

fl

at

i

on

3

7