Albertsons 2007 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SU

PERVAL

U

IN

C

. and

S

ubsidiaries

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

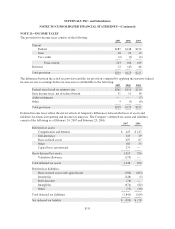

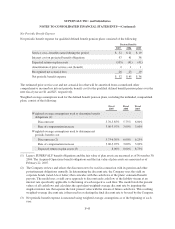

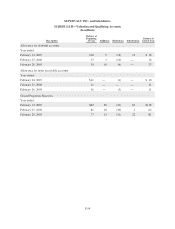

Net Periodic Benefit Expense

N

et periodic benefit expense for qualified defined benefit pension plans consisted of the followin

g

:

P

e

n

sio

nB

e

n

efi

t

s

200

7

2006

2005

S

ervice cost—benefits earned durin

g

the period $ 32 $ 21 $ 19

Interest cost on pro

j

ecte

db

ene

fi

to

blig

at

i

ons 97 41 3

8

Expected return on plan assets (105) (41) (41)

A

mortization of

p

rior service cost (benefit) 2 1 1

R

eco

g

nized net actuarial loss 26 23 1

9

Net periodic benefit expense $ 52 $ 45 $ 36

Th

e est

i

mate

d

pr

i

or serv

i

ce cost an

d

net actuar

i

a

ll

oss t

h

at w

ill b

e amort

i

ze

df

rom accumu

l

ate

d

ot

h

e

r

com

p

rehensive income/loss into net

p

eriodic benefit cost for the

q

ualified defined benefit

p

ension

p

lans over the

next fiscal year are

$

1 and

$

25, respectively

.

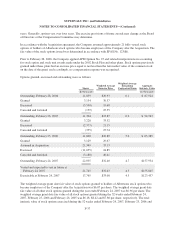

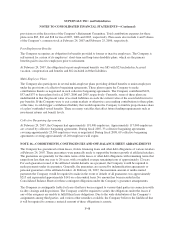

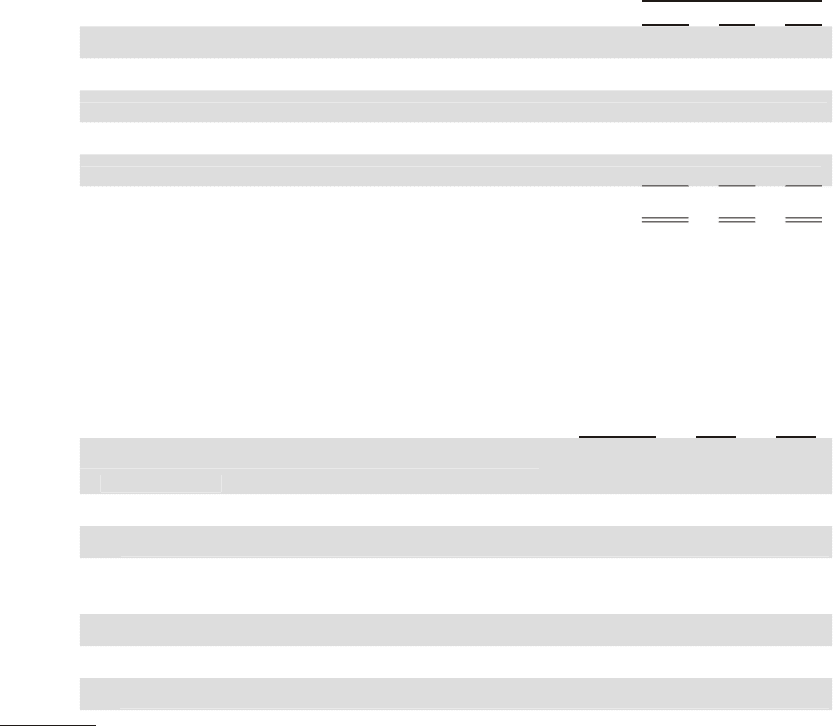

Weighted average assumptions used for the defined benefit pension plans, including the unfunded, nonqualified

p

l

ans, cons

i

st o

f

t

h

e

f

o

ll

ow

i

ng

:

F

isca

l

2007

F

isca

l

2006

F

isca

l

2005

W

ei

g

hted-avera

g

e assumptions used to determine benefit

o

bli

gat

i

ons (1):

Discount rate

5

.70-

5

.8

5

%

5

.7

5

% 6.00%

Rate of com

p

ensation increase 3.00-3.07% 3.00% 3.00%

W

ei

g

hted-avera

g

e assumptions used to determine ne

t

p

eriodic benefit cost

:

Discount rate (2)

5

.7

5

-6.30% 6.00% 6.2

5

%

Rate o

f

compensat

i

on

i

ncrease 3.00-3.07% 3.00% 3.00%

E

xpected return on plan assets (3) 8.00% 8.00% 8.75

%

(1) Le

g

ac

y

SUPERVALU benefit obli

g

ations and the fair value of plan assets are measured as of November 30,

2006. The Acquired Operations benefit obligations and the fair value of plan assets are measured as of

Fe

b

ruary 22, 2007

.

(2) T

h

e Company rev

i

ews an

d

se

l

ects t

h

e

di

scount rate to

b

e use

di

n connect

i

on w

i

t

hi

ts pens

i

on an

d

ot

h

er

postretirement obli

g

ations annuall

y

. In determinin

g

the discount rate, the Compan

y

uses the

y

ield o

n

c

orporate

b

on

d

s (rate

d

AA or

b

etter) t

h

at co

i

nc

id

es w

i

t

h

t

h

e cas

hfl

ows o

f

t

h

ep

l

ans’ est

i

mate

db

ene

fit

payouts. T

h

emo

d

e

l

uses a y

i

e

ld

curve approac

h

to

di

scount eac

h

cas

hfl

ow o

f

t

h

e

li

a

bili

ty stream at a

n

i

nterest rate specificall

y

applicable to the timin

g

of each respective cash flow. The model totals the present

va

l

ues o

f

a

ll

cas

hfl

ows an

d

ca

l

cu

l

ates t

h

e equ

i

va

l

ent we

i

g

h

te

d

-average

di

scount rate

b

y

i

mput

i

ng t

he

si

ngu

l

ar

i

nterest rate t

h

at equates t

h

e tota

l

present va

l

ue w

i

t

h

t

h

e stream o

ff

uture cas

hfl

ows. T

hi

s resu

l

t

i

ng

wei

g

hted-avera

g

e discount rate is then used in evaluatin

g

the final discount rate to be used b

y

the Compan

y.

(3) Net periodic benefit expense is measured usin

g

wei

g

hted avera

g

e assumptions as of the be

g

innin

g

of eac

h

year

.

F-4

5