Albertsons 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SU

PERVAL

U

IN

C

. and

S

ubsidiaries

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

F

ebruary 24

,

200

7

F

ebruary 25

,

2006

V

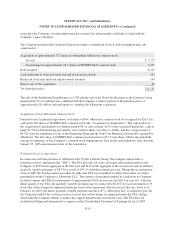

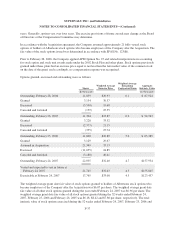

ariable Rate Note, currently 7.10%, due June 2012 (face amount $1,241) $1,241 $ —

V

ariable Rate Note, currentl

y

6.85%, due June 2011 (face amount

$

713) 713

—

7

.50% (7.49%) Notes due February 2011 (face amounts $700) 700

—

R

evolvin

g

Credit Facilit

y

, currentl

y

7.08%, due June 2011 (face amount

$

654) 654

—

Notes, average interest rate of 6.68% (7.89%), due June 2007 – June 2028 (face amounts $662) 592 —

7

.45% (8.73%) Debentures due Au

g

ust 2029 (face amounts

$

650) 569

—

7

.50% Note due November 2014 (face amount

$

500) 500

—

8

.00% (8.86%) Debentures due May 2031 (face amounts $400) 366

—

6

.95% (6.71%) Notes due Au

g

ust 2009 (face amounts

$

350) 352

—

7

.88% Notes due August 2009 (face amounts $350) 350 350

7

.50% Notes due Ma

y

2012 (face amounts

$

300) 300 300

8

.35% (7.15%) Notes due May 2010 (face amounts $275) 284

—

8

.00%

(

8.46%

)

Debentures due June 2026

(

face amounts

$

272

)

260

—

8

.70% (8.97%) Debentures due Ma

y

2030 (face amounts

$

225) 219

—

7

.50% (5.44%) Debentures due May 2037 (face amounts $200) 209

—

7

.25% (7.53%) Notes due Ma

y

2013 (face amounts

$

200) 197

—

7

.75%

(

8.76%

)

Debentures due June 2026

(

face amounts $200

)

181

—

A

ccounts Receivable Securitization Facilit

y

, currentl

y

5.35% (face amount

$

159) 159

—

7

.90% (7.98%) Debentures due May 2017 (face amounts $96) 95

—

4.50% Yield Zero-cou

p

on Convertible Debentures due November 2031 (face amounts

$

159 and

$

811, respectivel

y)

53 259

V

ar

i

a

bl

e Rate In

d

ustr

i

a

l

Revenue Bon

d

s, avera

g

e

i

nterest rate o

f

3.73%,

d

ue Ju

ly

2007 – Decem

b

er

2014 (face amounts

$

49 and

$

52, respectivel

y

)4952

Secured Mortgages and other Notes, average interest rate of 8.26% (7.24%), secured by real estat

e

w

ith a net book value of $50, due June 2007 – April 2019 (face amounts $38) 39

—

6

.64% Medium Term Notes due June 2006 (face amounts

$

65) — 65

8

.28% - 9.46% Notes due 2006 – 2010

(

face amounts $10

)

—1

0

8

.02% - 8.57% Notes due 2006

(

face amounts

$

2

)

—2

O

t

h

e

r

7

11

T

otal

8

,089 1,04

9

L

ess cu

rr

e

n

t

m

atu

r

ities

(

226

)(

75

)

Lon

g

-term debt

$

7,863

$

97

4

Aggregate contractua

l

matur

i

t

i

es o

fd

e

b

taso

f

Fe

b

ruary 24, 2007 were

:

F

isca

lY

ea

r

2008

$

30

2

2009

1

9

6

2010

914

2011 1,12

1

2012

948

Thereafter 4

,

608

F-

29