Albertsons 2007 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SU

PERVAL

U

IN

C

. and

S

ubsidiaries

N

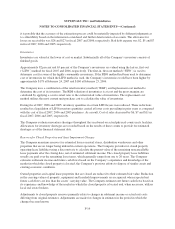

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

R

evenues and costs from third part

y

lo

g

istic operations are recorded in accordance with EITF Issue No. 99-19

,

“Reporting Revenue Gross as a Principal Versus Net as an Agent.” Generally, when the Company is the primary

obli

gor

i

n a transact

i

on,

i

ssu

bj

ect to

i

nventory an

d

/or cre

di

tr

i

s

k

,

h

as

l

at

i

tu

d

e

i

n esta

bli

s

hi

ng pr

i

ce an

d

se

l

ect

i

n

g

suppliers, or has several, but not all of these indicators, revenue is recorded

g

ross. If the Compan

y

is not th

e

primary obligor and amounts earned have little or no credit risk, the Company generally records the net amount

s

a

s management

f

ees earne

d.

C

ost o

f

Sales

C

ost o

f

sa

l

es

i

nc

l

u

d

es cost o

fi

nventory so

ld d

ur

i

ng t

h

e per

i

o

d

,

i

nc

l

u

di

ng purc

h

as

i

ng an

ddi

str

ib

ut

i

on costs an

d

s

hi

pp

i

n

g

an

dh

an

dli

n

gf

ees

.

A

d

vert

i

s

i

ng expenses are a component o

f

Cost o

f

sa

l

es

i

nt

h

e Conso

lid

ate

d

Statements o

f

Earn

i

ngs an

d

ar

e

expensed as incurred. Advertisin

g

expenses were $301, $79 and $81 for fiscal 2007, 2006 and 2005, respectivel

y.

Th

e Compan

y

rece

i

ves

f

un

d

s

f

rom man

y

o

f

t

h

e ven

d

ors w

h

ose pro

d

ucts t

h

e Compan

yb

u

y

s

f

or resa

l

e

i

n

i

ts

stores. These vendor funds are provided to increase the sell-throu

g

h of the related products. The Compan

y

rece

i

ves ven

d

or

f

un

d

s

f

or a var

i

ety o

f

merc

h

an

di

s

i

ng act

i

v

i

t

i

es,

i

nc

l

u

di

ng: p

l

acement o

f

t

h

e ven

d

ors’ pro

d

ucts

in

the Compan

y

’s advertisin

g

; displa

y

of the vendors’ products in prominent locations in the Compan

y

’s stores

;

introduction of new products into the Compan

y

’s distribution s

y

stem and retail stores; exclusivit

y

ri

g

hts in

certa

i

n categor

i

es t

h

at

h

ave s

l

ower-turn

i

ng pro

d

ucts; an

d

to compensate

f

or temporary pr

i

ce re

d

uct

i

ons o

ff

ere

d

t

o

customers on products held for sale at retail stores. The Compan

y

also receives vendor funds for bu

y

in

g

activities

such as volume commitment rebates, credits for purchasin

g

products in advance of their need and cash discount

s

f

or t

h

e ear

l

y payment o

f

merc

h

an

di

se purc

h

ases. As o

f

Fe

b

ruary 24, 2007, t

h

e terms o

f

t

h

e Company’s ven

d

or

f

unds arran

g

ements varied in len

g

th from primaril

y

short-term arran

g

ements that are to be completed within a

quarter to lon

g

-term arran

g

ements that are primaril

y

expected to be completed within three

y

ears.

T

he Compan

y

reco

g

nizes vendor funds for merchandisin

g

activities as a reduction of Cost of sales when th

e

related products are sold in accordance with EITF Issue 02-16, “Accounting by a Customer (Including a Reseller

)

f

or

C

erta

i

n

C

ons

id

erat

i

on Rece

iv

e

df

rom a Ven

d

or.

”

C

as

h

an

d

Cas

h

Equiva

l

ent

s

Th

e Company cons

id

ers a

ll hi

g

hl

y

li

qu

id i

nvestments w

i

t

h

a matur

i

ty o

f

t

h

ree mont

h

sor

l

ess at t

h

et

i

me o

f

purc

h

ase to

b

e cas

h

equ

i

va

l

ents. T

h

e Compan

y

’s

b

an

ki

n

g

arran

g

ements a

ll

ow t

h

e Compan

y

to

f

un

d

outstan

di

n

g

checks when presented to the financial institution for pa

y

ment. This cash mana

g

ement practice frequentl

y

results

i

n a net cas

hb

oo

k

over

d

ra

f

t pos

i

t

i

on, w

hi

c

h

occurs w

h

en tota

l

outstan

di

ng

i

ssue

d

c

h

ec

k

s excee

d

ava

il

a

bl

e cas

h

b

alances at a sin

g

le financial institution. The Compan

y

records its cash disbursement accounts with a net cash

b

ook overdraft position in Accounts pa

y

able in the Consolidated Balance Sheets, and the net chan

g

e in cash boo

k

o

ver

d

ra

f

ts

i

nt

h

e Accounts paya

bl

e

li

ne

i

tem w

i

t

hi

nt

h

e Cas

hfl

ows

f

rom operat

i

ng act

i

v

i

t

i

es sect

i

on o

f

t

he

C

onsolidated Statements of Cash Flows. At Februar

y

24, 2007 and Februar

y

25, 2006, the Compan

y

had net

b

ook overdrafts of $416 and $198, respectivel

y

.

A

llowances for Losses on Receivables

M

ana

g

ement makes estimates of the uncollectibilit

y

of its accounts and notes receivable portfolios. In

d

etermining the adequacy of the allowances, management analyzes the value of the collateral, customer financial

statements,

hi

stor

i

ca

l

co

ll

ect

i

on exper

i

ence, ag

i

ng o

f

rece

i

va

bl

es an

d

ot

h

er econom

i

can

di

n

d

ustry

f

actors.

Althou

g

h risk mana

g

ement practices and methodolo

g

ies are utilized to determine the adequac

y

of the allowance

,

F-

13