Albertsons 2007 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SU

PERVAL

U

IN

C

. and

S

ubsidiaries

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

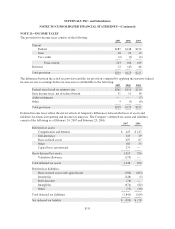

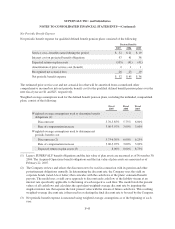

T

he estimated future benefit pa

y

ments to be paid from the Compan

y

’s defined benefit pension plans and othe

r

p

ostretirement benefit

p

lans, which reflect ex

p

ected future service, are as follows:

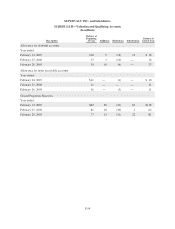

Pension Benefits

(

1

)

P

os

tr

e

tir

e

m

e

nt

Benefit

s

Fi

scal Year

2008 $ 62 $1

3

200

96

814

2010

7

414

2011 80 14

2012 87 14

Y

ears 2013-2017

5

76 7

7

(1) Pens

i

on

b

ene

fi

ts

i

nc

l

u

d

et

h

e est

i

mate

df

uture

b

ene

fi

t payments

f

or t

h

eun

f

un

d

e

d

, nonqua

lifi

e

d

pens

i

on p

l

an

s

s

ponsore

dby

t

h

e Compan

y

.

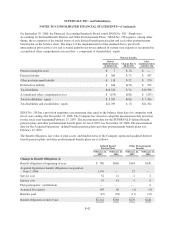

D

e

f

ined Bene

f

it Pension Plans

B

enefit calculations for the le

g

ac

y

SUPERVALU’s sponsored defined benefit pension plans for primaril

y

non-un

i

on e

li

g

ibl

e part

i

c

i

pants are genera

ll

y

b

ase

d

on years o

f

e

li

g

ibl

e serv

i

ce an

d

t

h

e part

i

c

i

pants’

hi

g

h

est

compensat

i

on

d

ur

i

n

gfi

ve consecut

i

ve

y

ears o

f

emp

l

o

y

ment. Bene

fi

ts pa

id

to Acqu

i

re

d

Operat

i

on ret

i

rees ar

e

based upon a

g

e at retirement,

y

ears of eli

g

ible service and avera

g

e compensation. The Compan

y

’s accumulate

d

benefit obligation for the qualified defined benefit pension plans was

$

2,072 and

$

719 at February 24, 2007 and

Februar

y

25, 2006, respectivel

y

.

Th

e Company a

l

so sponsors certa

i

n supp

l

ementa

l

execut

i

ve ret

i

rement

b

ene

fi

tp

l

ans w

hi

c

h

are un

f

un

d

e

d

,

nonqua

lifi

e

d

p

l

ans w

hi

c

h

prov

id

e certa

i

n

k

e

y

emp

l

o

y

ees ret

i

rement

b

ene

fi

ts t

h

at supp

l

ement t

h

ose prov

id

e

dby

the Compan

y

’s other retirement plans. The pro

j

ected benefit obli

g

ation for the unfunded, nonqualified plans wa

s

$

30 and

$

22 at February 24, 2007 and February 25, 2006, respectively. The accumulated benefit obligation fo

r

these plans totaled $26 and $18 at Februar

y

24, 2007 and Februar

y

25, 2006, respectivel

y

. Net periodic pensio

n

cost was $5, $3 and $4 for fiscal 2007, 2006 and 2005, respectivel

y

. The amount reco

g

nized in accumulated

o

ther comprehensive income/loss for prior service cost and net actuarial loss, before tax, are

$

2 and

$

16

,

respectivel

y

, at Februar

y

24, 2007 and $0 and $7, respectivel

y

, at Februar

y

25, 2006. The estimated prior servic

e

cost and net actuarial loss that will be amortized from accumulated other com

p

rehensive income/loss into net

periodic benefit cost for over the next fiscal year are

$

1 and

$

2, respectively

.

At Februar

y

24, 2007 and Februar

y

2

5

, 2006, the accumulated benefit obli

g

ation for all defined benefit pensio

n

p

l

ans excee

d

e

d

t

h

e

f

a

i

rva

l

ue o

f

t

h

e respect

i

ve p

l

an assets

.

F-

44