Albertsons 2007 Annual Report Download - page 33

Download and view the complete annual report

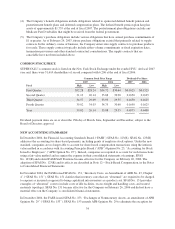

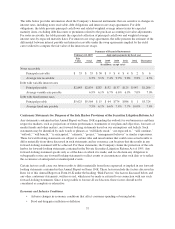

Please find page 33 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the Acquired Operations. The impact to the Company’s liability of each 2

5

basis point reduction in the discount

rate would be to increase the Company’s liability by approximately

$

6

.

Benefit Plan

s

T

he Compan

y

sponsors pension and other postretirement plans in various forms coverin

g

substantiall

y

al

l

employees who meet eligibility requirements. The determination of the Company’s obligation and related

expense

f

or Company-sponsore

d

pens

i

on an

d

ot

h

er postret

i

rement

b

ene

fi

ts

i

s

d

epen

d

ent,

i

n part, o

n

mana

g

ement’s selection of certain assumptions used b

y

its actuaries in calculatin

g

these amounts. These

a

ssumptions include, among other things, the discount rate, the expected long-term rate of return on plan asset

s

a

n

d

t

h

e rates o

fi

ncrease

i

n compensat

i

on an

dh

ea

l

t

h

care costs. In accor

d

ance w

i

t

h

genera

ll

y accepte

d

account

i

n

g

principles, actual results that differ from the Compan

y

’s assumptions are accumulated and amortized over future

periods and, therefore, affect expense and obligation in future periods. While the Company believes that its

a

ssumpt

i

ons are appropr

i

ate, s

i

gn

ifi

cant

diff

erences

i

n actua

l

exper

i

ence or s

i

gn

ifi

cant c

h

anges

i

n assumpt

i

on

s

ma

y

materiall

y

impact non-union pension and other postretirement obli

g

ations and future expenses

.

For fiscal 2008, the impact to pension expense of each 25 basis point reduction in the discount rate would be t

o

increase pension expense b

y

approximatel

y

$6 and the impact of each 25 basis point reduction in expected return

o

n plan assets would be to increase pension expense by approximately

$

4. Similarly, for postretirement benefits,

a

one percent c

h

ange

i

nt

h

e

h

ea

l

t

h

care cost tren

d

rate wou

ld i

mpact t

h

e accumu

l

ate

d

postret

i

rement

b

ene

fi

t

o

bli

g

ation b

y

approximatel

y

$11 and the service and interest cost b

y

$1 in fiscal 2008. The actuarial assumptions

u

sed by the Company may differ materially from actual results due to changing market and economic conditions,

hi

g

h

er or

l

ower w

i

t

hd

rawa

l

rates, an

dl

onger or s

h

orter

lif

e spans o

f

part

i

c

i

pants

.

Goodwill and Intan

g

ible Assets

Goodwill was $5,921 as of Februar

y

24, 2007, reflectin

g

an increase of approximatel

y

$4,307 in fiscal 2007 from

$

1,614 as of February 25, 2006. This increase was primarily due to

$

4,333 of goodwill recognized as a result of

t

h

e Acqu

i

s

i

t

i

on. Goo

d

w

ill

an

di

ntang

ibl

e asset

b

a

l

ances re

l

ate

d

to t

h

e Acqu

i

s

i

t

i

on w

ill b

ea

dj

uste

d

t

h

roug

h

t

h

e

f

irst

q

uarter of fiscal 2008 in accordance with SFAS No. 141, “Business Combinations.” For further information

,

see Note 3 – Business Ac

q

uisition, in the Notes to Consolidated Financial Statements. In fiscal 2007, th

e

C

ompany recorded a pre-tax goodwill impairment charge of

$

19 related to the plan to dispose of Scott’s. Th

e

d

ecrease in

g

oodwill from $1,628 as of Februar

y

25, 2005 to $1,614 as of Februar

y

26, 2006 resulted primaril

y

f

rom purchase accounting adjustments of

$

29 between deferred income taxes and goodwill related to forme

r

a

cquisitions and reductions of goodwill of

$

11 primarily related to the disposition of Pittsburgh and Chicag

o

stores, which were partiall

y

offset b

y

purchase accountin

g

ad

j

ustments to increase

g

oodwill b

y

$20 for the

f

inalization of the valuation in fiscal 2006 related to the acquisition of Total Logistics in fiscal 200

5

. For

addi

t

i

ona

li

n

f

ormat

i

on, see Note 7 – Goo

d

w

ill

an

d

Ot

h

er Acqu

i

re

d

Intang

ibl

e Assets,

i

nt

h

e Notes to

C

onsolidated Financial Statements.

I

ncome

T

axes

We calculate our current and deferred tax

p

rovisions based on estimates and assum

p

tions that could differ from

t

h

e actua

l

resu

l

ts re

fl

ecte

di

n our

i

ncome tax returns

fil

e

dd

ur

i

ng t

h

esu

b

sequent year. We recor

d

a

dj

ustment

s

based on filed returns when we have identified and finalized them, which is

g

enerall

y

in a subsequent period. In

conjunction with the Acquisition, the Company has and will continue to record the deferred tax impacts o

f

purc

h

ase account

i

ng a

dj

ustments

i

nc

l

u

di

ng t

h

eu

l

t

i

mate reso

l

ut

i

on o

f

acqu

i

s

i

t

i

on tax cont

i

ngenc

i

es an

d

any

chan

g

es to the respective valuation allowance

.

We recogn

i

ze

d

e

f

erre

d

tax assets an

dli

a

bili

t

i

es

f

or t

h

e expecte

d

tax consequences o

f

temporary

diff

erences

between the tax bases of assets and liabilities and their reported amounts usin

g

enacted tax rates in effect for the

year in which we expect the differences to reverse.

I

n addition, the calculation of our tax liabilities involves dealin

g

with uncertainties in the application of complex

tax regulations that can often take many years to resolve. We recognize liabilities for anticipated tax issues based

2

7