Albertsons 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SU

PERVAL

U

IN

C

. and

S

ubsidiaries

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Goodwill and Other Intangible Asset

s

Goodwill re

p

resents the excess of costs over the fair value of net assets in a business combination. Ac

q

uire

d

g

oodwill and intangible assets that are determined to have indefinite useful lives are not amortized, but instead

a

re teste

df

or

i

mpa

i

rment at

l

east annua

ll

y

i

nt

h

e Company’s

f

ourt

h

quarter. Intang

ibl

e assets w

i

t

h

est

i

ma

ble

u

seful lives are amortized over their res

p

ective estimated useful lives and are reviewed for im

p

airment.

I

mpairment o

f

Long-Lived Assets

I

n accordance with the provisions of Statement of Financial Accounting Standards (“SFAS”) No. 144,

“Account

i

ng

f

or t

h

e Impa

i

rment or D

i

sposa

l

o

f

Long-L

i

ve

d

Assets,” t

h

e Company mon

i

tors t

h

e carry

i

ng va

l

ue o

f

l

on

g

-lived assets for potential impairment each quarter based on whether certain tri

gg

erin

g

events have occurred.

T

hese events include current period losses combined with a history of losses or a projection of continuing losses

,

a

s

i

gn

ifi

cant

d

ecrease

i

nt

h

e mar

k

et va

l

ue o

f

an asset or t

h

e Company’s p

l

ans

f

or store c

l

osures. W

h

en a

tri

gg

erin

g

event occurs, a recoverabilit

y

test is performed b

y

comparin

g

pro

j

ected undiscounted future cash flows

to the carrying value of the asset or group of assets as defined in SFAS No. 144. If impairment is identified for

l

ong-

li

ve

d

assets to

b

e

h

e

ld

an

d

use

d

,t

h

eun

di

scounte

df

uture cas

hfl

ows are compare

d

to t

h

e asset’s current

carr

y

in

g

value. Impairment is recorded when the carr

y

in

g

value exceeds the undiscounted future cash flows. Fo

r

l

ong-lived assets that are classified as Assets held for sale, the Company recognizes impairment charges for the

excess o

f

t

h

e carry

i

ng va

l

ue p

l

us est

i

mate

d

costs o

fdi

sposa

l

over t

h

e est

i

mate

df

a

i

rva

l

ue. T

h

ese est

i

mates can

b

e

si

g

nificantl

y

impacted b

y

factors such as chan

g

es in real estate market conditions, the economic environment and

inflation. Impairment charges are a component of Selling and administrative expenses in the Consolidate

d

Statement o

f

Earn

i

ngs.

F

or properties that have closed and are under long-term lease agreements, the present value of any remaining

li

a

bili

ty un

d

er t

h

e

l

ease,

di

scounte

d

us

i

ng cre

di

tr

i

s

k

-

f

ree rates an

d

net o

f

est

i

mate

d

su

bl

ease recovery,

i

s

reco

g

nized as a liabilit

y

and char

g

ed to operations. The value of an

y

equipment and leasehold improvement

s

related to a closed store is reduced to reflect net recoverable values. Internal real estate s

p

ecialists estimate th

e

su

b

tenant

i

ncome,

f

uture cas

hfl

ows an

d

asset recovery va

l

ues

b

ase

d

on t

h

e

i

r

hi

stor

i

ca

l

exper

i

ence an

d

knowled

g

e of (1) the market in which the store to be closed is located, (2) the results of the Compan

y

’s previous

efforts to dis

p

ose of similar assets and (3) the current economic conditions. The actual cost of dis

p

osition fo

r

t

h

ese

l

eases an

d

re

l

ate

d

assets

i

sa

ff

ecte

db

y spec

ifi

c

f

actors suc

h

as rea

l

estate mar

k

ets, t

h

e econom

ic

environment and inflation

.

D

e

f

erred Rent

T

he Company recognizes rent holidays, including the time period during which the Company has access to th

e

property pr

i

or to t

h

e open

i

ng o

f

t

h

es

i

te, as we

ll

as construct

i

on a

ll

owances an

d

esca

l

at

i

ng rent prov

i

s

i

ons, on

a

strai

g

ht-line basis over the term of the lease. The deferred rents are included in Other current liabilities and Othe

r

l

ong-term liabilities on the Consolidated Balance Sheets

.

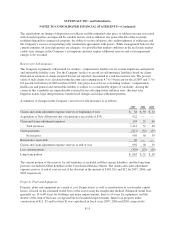

B

enefit P

l

ans

Th

e Company sponsors pens

i

on an

d

ot

h

er postret

i

rement p

l

ans

i

n var

i

ous

f

orms cover

i

ng su

b

stant

i

a

ll

ya

ll

emplo

y

ees who meet eli

g

ibilit

y

requirements. The determination of the Compan

y

’s obli

g

ation and related

expense for Company-sponsored pension and other postretirement benefits is dependent, in part, o

n

management’s se

l

ect

i

on o

f

certa

i

n assumpt

i

ons use

db

y

i

ts actuar

i

es

i

nca

l

cu

l

at

i

ng t

h

ese amounts. T

h

ese

a

ssumptions include, amon

g

other thin

g

s, the discount rate, the expected lon

g

-term rate of return on plan asset

s

a

nd the rates of increase in com

p

ensation and health care costs

.

F-1

6