Albertsons 2007 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SU

PERVAL

U

IN

C

. and

S

ubsidiaries

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Other Postretirement Benefits

T

he Compan

y

offers health and life insurance to retirees under multiple pro

g

rams. The terms of these plans var

y

b

ase

d

on emp

l

oyment

hi

story, age, an

dd

ate o

f

ret

i

rement. For most ret

i

rees, t

h

e Company prov

id

es a

fi

xe

dd

o

ll

a

r

contr

ib

ut

i

on an

d

ret

i

rees pa

y

contr

ib

ut

i

ons to

f

un

d

t

h

e rema

i

n

i

n

g

cost

.

Th

e net per

i

o

di

c postret

i

rement

b

ene

fi

t cost was as

f

o

ll

ows:

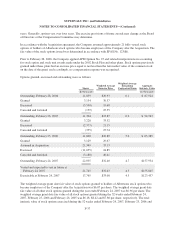

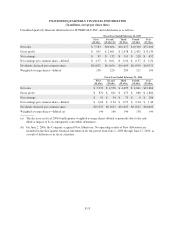

Fiscal

2

00

7

F

isca

l

2006

F

isca

l

2

005

S

ervice cost

$

2

$

2

$

1

Interest cost 9 9

7

)

A

mortization of

p

rior service cost (benefit) (2) (2) (2

)

R

eco

g

nized net actuarial loss 5 6 4

Net

p

eriodic benefit ex

p

ense $14 $15 $10

Th

e est

i

mate

d

net amount o

f

pr

i

or serv

i

ce

b

ene

fi

tan

d

net actuar

i

a

ll

oss t

h

at w

ill b

e amort

i

ze

df

rom accumu

l

ate

d

o

ther comprehensive income/loss into net periodic benefit cost over the next fiscal

y

ear is $3.

We

igh

te

d

avera

g

e assumpt

i

ons use

df

or t

h

e postret

i

rement

b

ene

fi

tp

l

ans cons

i

st o

f

t

h

e

f

o

ll

ow

i

n

g

:

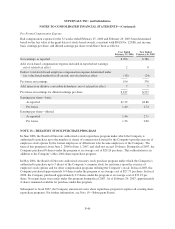

Fiscal

2

007

F

isca

l

2006

F

isca

l

2

005

W

e

i

g

h

te

d

-average assumpt

i

ons use

d

to

d

eterm

i

ne

b

ene

fi

t

obli

g

ations (1):

Discount rate

5

.7

0

-

5

.

85

%

5

.7

5

%

6

.

00%

W

e

i

g

h

te

d

-average assumpt

i

ons use

d

to

d

eterm

i

ne net per

i

o

di

c

b

enefit cost (2):

Discount rate

5

.

38

-

5

.7

5

%

6

.

00

%

6

.2

5%

(1) SUPERVALU benefit obligations are measured as of November 30, 2006. The Acquired Operations benefi

t

o

bli

gat

i

ons are measure

d

as o

f

Fe

b

ruary 22, 2007.

(2) Net periodic benefit expense is measured usin

g

wei

g

hted avera

g

e assumptions as of the be

g

innin

g

of eac

h

y

ear

.

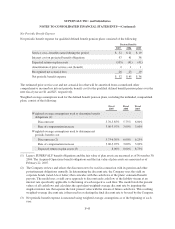

For those retirees whose health plans provide for variable emplo

y

er contributions, the assumed health care cost

trend rate used in measurin

g

the accumulated postretirement benefit obli

g

ation ran

g

ed from 6% to 13% in fiscal

2007. T

h

e assume

dh

ea

l

t

h

care cost tren

d

rate w

ill d

ecrease

b

y0%to2%eac

h

year

f

or t

h

e next

fi

ve years unt

il it

reaches the ultimate trend rate of 5% to 6%. For those retirees whose health plans provide for a fixed emplo

y

e

r

contribution rate, a health care cost trend is not a

pp

licable. The health care cost trend rate assum

p

tion has a

s

i

gn

ifi

cant

i

mpact on t

h

e amounts reporte

d

. For examp

l

e, a 1% c

h

ange

i

nt

h

e tren

d

rate wou

ld i

mpact t

he

C

ompan

y

’s accumulated postretirement benefit obli

g

ation b

y

approximatel

y

$11 and the service and interest cost

b

y

approximatel

y

$1 in fiscal 2008.

D

e

f

ined Contribution Plan

s

Th

e Company sponsors severa

ld

e

fi

ne

d

contr

ib

ut

i

on an

d

pro

fi

ts

h

ar

i

ng p

l

ans pursuant to Sect

i

on 401(

k

)o

f

t

h

e

I

nternal Revenue Code. The total amount contributed b

y

the Compan

y

to the plans is determined b

y

pla

n

F-

47