Albertsons 2007 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SU

PERVAL

U

IN

C

. and

S

ubsidiaries

N

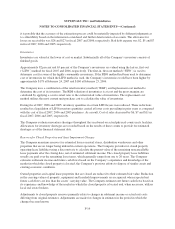

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

C

omprehensive Income

T

he Company reports comprehensive income in accordance with SFAS No. 130, “Reporting Comprehensive

I

ncome.” Compre

h

ens

i

ve

i

ncome re

f

ers to revenues, expenses, ga

i

ns an

dl

osses t

h

at are not

i

nc

l

u

d

e

di

nne

t

earnin

g

s but rather are recorded directl

y

in stockholders’ equit

y

in the Consolidated Statements of Stockholders’

E

quity

.

U

se of Estimate

s

T

he preparation of the Compan

y

’s consolidated financial statements in conformit

y

with accountin

g

principle

s

g

enerally accepted in the United States of America requires management to make estimates and assumptions that

aff

ect t

h

e reporte

d

amounts o

f

assets an

dli

a

bili

t

i

es an

ddi

sc

l

osure o

f

cont

i

ngent assets an

dli

a

bili

t

i

es at t

h

e

d

at

e

o

f the financial statements and the reported amounts of revenues and expenses durin

g

the reportin

g

period. Som

e

o

f those estimates require difficult, subjective or complex judgments about matters that are inherently uncertain

.

Actua

l

resu

l

ts cou

ld diff

er

f

rom t

h

ose est

i

mates

.

Reclassification

s

C

ertain reclassifications have been made to conform prior years’ data to the current presentation including

reclassifications between Cash and Accounts payable in the fiscal 200

6

Consolidated Balance Sheet and fisca

l

2

006 and 200

5

Consolidated Statements of Cash Flows to properl

y

classif

y

cash book overdrafts. The reclass

resulted in an increase in Cash and Accounts payable of

$

115 in the fiscal 2006 Consolidated Balance Sheet. Th

e

reclass resulted in an increase in cash inflow related to Accounts payable of

$

22 and

$

9 on the Consolidate

d

Statements of Cash Flow in fiscal 2006 and 200

5

, respectivel

y

. These reclassifications had no effect on reported

earnings

.

NOTE 3—BU

S

INE

SS

AC

Q

UI

S

ITION

On the Acquisition Date, the Compan

y

, CVS Corporation (“CVS”), an investment

g

roup led b

y

Cerberus Capital

M

anagement, L.P. (the “Cerberus Group”) and Albertsons entered into a series of agreements providing for th

e

sa

l

eo

f

A

lb

ertsons to t

h

e Company, CVS an

d

t

h

e Cer

b

erus Group. T

h

ose agreements prov

id

e

df

or t

h

e

f

o

ll

ow

i

ng

:

• First, Albertsons became a subsidiar

y

of New Albertsons.

• Next, Albertsons was converted to a limited liability company (“Albertsons LLC”) and a series of

reorgan

i

zat

i

ons occurre

d

. As a resu

l

to

f

t

h

ose reorgan

i

zat

i

ons, New A

lb

ertsons

h

e

ld

su

b

stant

i

a

ll

ya

ll

o

f

the assets and liabilities of the Ac

q

uired O

p

erations. Albertsons LLC and its subsidiaries held

substantially all of the assets of Albertsons’ standalone drug store business (the “Standalone Dru

g

B

us

i

ness”) an

d

t

h

e non-core supermar

k

et

b

us

i

ness (t

h

e “Non-Core Bus

i

ness”) an

d

certa

i

n

li

a

bili

t

i

es o

f

Albertsons’ historical business

.

• Next, CVS purchased substantially all of the assets and assumed specified liabilities of the Standalone

Drug Bus

i

ness

.

• The Cerberus Group then acquired the equit

y

interests of Albertsons LLC

.

• Then, the Company acquired New Albertsons (the “Acquisition”)

.

Th

e Acqu

i

s

i

t

i

on a

ll

owe

d

t

h

e Company to acqu

i

re t

h

e prem

i

er reta

il

operat

i

ons o

f

A

lb

ertsons a

ddi

ng

a

pproximatel

y

1,12

5

stores to the Compan

y

’s retail footprint. The Acquisition was a unique strate

g

ic opportunit

y

to acquire those assets of Albertsons that the Company viewed as the most attractive and profitable. The acquire

d

F-

18