Albertsons 2007 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SU

PERVAL

U

IN

C

. and

S

ubsidiaries

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

T

he expectations on timin

g

of disposition or sublease and the estimated sales price or sublease income associated

w

ith closed properties are impacted by variable factors such as inflation, the general health of the economy

,

resu

l

tant

d

eman

df

or commerc

i

a

l

property, t

h

ea

bili

ty to secure su

bl

eases, t

h

e cre

di

twort

hi

ness o

f

su

bl

essees an

d

the Compan

y

’s success at ne

g

otiatin

g

earl

y

termination a

g

reements with lessors. While mana

g

ement believes th

e

current estimates on closed

p

ro

p

erties are ade

q

uate, it is

p

ossible that market conditions in the real estate marke

t

cou

ld

cause c

h

anges

i

nt

h

e Company’s assumpt

i

ons an

d

may requ

i

re a

ddi

t

i

ona

l

reserves an

d

asset

i

mpa

i

rment

char

g

es to be recorded

.

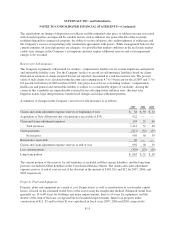

Reserves for Se

l

f-Insuranc

e

Th

e Compan

yi

spr

i

mar

ily

se

lf

-

i

nsure

df

or wor

k

ers’ compensat

i

on,

h

ea

l

t

h

care

f

or certa

i

n emp

l

o

y

ees an

dg

enera

l

a

nd automobile liabilit

y

costs. It is the Compan

y

’s polic

y

to record its self-insurance liabilities based on claim

s

fil

e

d

an

d

an est

i

mate o

f

c

l

a

i

ms

i

ncurre

db

ut not yet reporte

d

,

di

scounte

d

at a r

i

s

kf

ree

i

nterest rate. T

h

e present

v

alue of such claims was calculated usin

g

discount rates ran

g

in

g

from 4.7 to 5.0 percent for fiscal 2007 and 3.7 to

6.8 percent for both fiscal 2006 and fiscal 200

5

.An

y

pro

j

ection of losses concernin

g

workers’ compensation,

h

ea

l

t

h

care an

d

genera

l

an

d

automo

bil

e

li

a

bili

ty

i

ssu

bj

ect to a cons

id

era

bl

e

d

egree o

f

var

i

a

bili

ty. Among t

h

e

causes o

f

t

hi

s var

i

a

bili

t

y

are unpre

di

cta

bl

e externa

lf

actors a

ff

ect

i

n

gf

uture

i

n

fl

at

i

on rates,

di

scount rates

,

l

iti

g

ation trends, le

g

al interpretations, benefit level chan

g

es and claim settlement patterns.

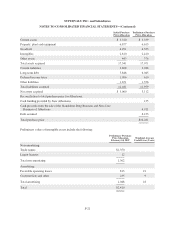

A summary o

f

c

h

anges

i

nt

h

e Company’s reserves

f

or se

lf

-

i

nsurance

i

sas

f

o

ll

ows

:

2

007

2

006

2

005

C

laims and claim adjustment expense reserves at beginning of year

$

58

$

59

$

5

4

Ac

q

uisition of New Albertsons (net of reinsurance receivable of

$

35) 922 —

—

C

laim and claim ad

j

ustment expenses 193

5

160

T

otal increases 1,115 51 60

)

C

laim payments (217) (52) (55

Net reserves 956 58 59

R

einsurance receivable 36 — —

C

laims and claim ad

j

ustment expense reserves at end of

y

ear 992

5

8

5

9

)Less current port

i

on (329) (27) (29

Long-term portion

$

663

$

31

$

30

T

he current portion of the reserves for self-insurance is included in Other current liabilities, and the long-ter

m

port

i

on

i

s

i

nc

l

u

d

e

di

nOt

h

er

li

a

bili

t

i

es

i

nt

h

e Conso

lid

ate

d

Ba

l

ance S

h

eets. T

h

ec

l

a

i

ms an

d

c

l

a

i

ma

dj

ustmen

t

expense reserves at end of

y

ear are net of the discount in the amount of $148, $11 and $12 for 2007, 2006, and

200

5

respectively.

P

roperty, Plant and E

q

uipment

Propert

y

, plant and equipment are carried at cost. Depreciation, as well as amortization of assets under capital

l

eases,

i

s

b

ase

d

on t

h

e est

i

mate

d

use

f

u

lli

ves o

f

t

h

e assets us

i

ng t

h

e stra

i

g

h

t-

li

ne met

h

o

d

. Est

i

mate

d

use

f

u

lli

ve

s

g

enerall

y

are 10 to 40

y

ears for buildin

g

s and ma

j

or improvements, three to 10

y

ears for equipment, and the

shorter of the term of the lease or expected life for leasehold improvements. Interest on propert

y

unde

r

construction of

$

11,

$

2 and less than

$

1 was capitalized in fiscal years 2007, 2006 and 2005, respectively

.

F-1

5