Albertsons 2007 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SU

PERVAL

U

IN

C

. and

S

ubsidiaries

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

T

he preliminar

y

purchase price allocation to intan

g

ible assets is based on estimated fair values determined b

y

internal analyses and third-party valuation specialists. Amortizing intangible assets are amortized on a straight

-

li

ne

b

as

i

s over t

h

e

i

r rema

i

n

i

ng expecte

d

use

f

u

lli

ves o

fl

ess t

h

an one to 30 years

.

T

he estimated values of operating leases with unfavorable terms compared with current market conditions totale

d

$

143. These leases have an estimated weighted average life of 15 years and are included in other liabilities.

T

he excess of the

p

urchase

p

rice over the fair value of assets ac

q

uired and liabilities assumed was recorded a

s

Goo

d

w

ill

. Goo

d

w

ill i

s non-amort

i

z

i

ng

f

or

fi

nanc

i

a

l

statement purposes an

di

s not tax

d

e

d

uct

ibl

e

.

U

naudited Pro Forma Financial Informatio

n

T

he followin

g

unaudited pro forma financial information presents the combined historical results of the

o

perations of SUPERVALU and the Acquired Operations as if the Acquisition had occurred at the beginning o

f

f

iscal 2007 and 200

6

, respectively. Certain adjustments have been made to reflect changes in depreciation,

income taxes and interest expense that would have resulted from the chan

g

e in the accountin

g

base of certain

a

ssets and liabilities due to the Acquisition, based on the Company’s preliminary estimates of fair value and

i

ncrease

dd

e

b

tto

f

un

d

t

h

e Acqu

i

s

i

t

i

on. T

h

ese a

dj

ustments are su

bj

ect to c

h

ange as t

h

e

i

n

i

t

i

a

l

est

i

mates are re

fi

ne

d

o

ver time. Because of differences in the accountin

g

calendars of SUPERVALU and the Acquired Operations, the

pro forma results below for the

5

2 weeks ended February 24, 2007 include SUPERVALU results for the

5

2

w

eeks and results of the Acquired Operations for 51 weeks. This pro forma financial information is not intende

d

to re

p

resent or be indicative of what would have occurred if the transactions had taken

p

lace on the dates

presented and should not be taken as representative of the Company’s future consolidated results of operations or

f

inancial position. The pro forma financial information for fiscal 200

6

does not reflect any potential synergies.

(

Unaudited

)

Yea

r

e

n

ded

F

ebruar

y 24,

2007

F

ebruar

y2

5

,

2006

N

et sa

l

e

s

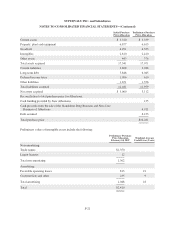

$43,356 $44,286

Net earnings (1) 536 38

5

We

i

g

h

te

d

average common s

h

ares

:

Bas

i

c

2

02 20

2

Dil

uted

208 208

Earn

i

ngs per s

h

are:

B

as

ic

$

2.64

$

1.90

Dil

uted

2.

5

8 1.8

8

(1) Certain items impactin

g

the comparabilit

y

of this pro forma financial information include: (a) $40 after-tax

e

xpense reco

g

nized in fiscal 2007 due to transaction costs related to the Acquisition; (b) $29 after-ta

x

c

urta

il

ment ga

i

n recogn

i

ze

di

n

fi

sca

l

2007 t

h

at resu

l

te

df

rom amen

d

ments to certa

i

no

f

A

lb

ertsons’

d

e

fi

ne

d

benefit pension plans, (c) $23 after-tax char

g

e for the planned disposition of 18 Scott’s stores in fiscal 2007;

(d) $19 after-tax incremental stock option expense related to the Compan

y

’s adoption of SFAS No. 123(R)

i

n fiscal 2007; (e)

$

61 after-tax charge for the sale of Cub Foods stores in Chicago in fiscal 2006; and

(f) $38 after-tax char

g

e for the disposition of Shop ’n Save stores in Pittsbur

g

h in fiscal 2006.

F-

22