Albertsons 2007 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

P

ension Plan / Health and Wel

f

are Plan Contingencies

Th

e Compan

y

contr

ib

utes to var

i

ous mu

l

t

i

-emp

l

o

y

er pens

i

on p

l

ans un

d

er co

ll

ect

i

ve

b

ar

g

a

i

n

i

n

g

a

g

reements

,

primaril

y

defined benefit pension plans. These plans

g

enerall

y

provide retirement benefits to participants based

o

nt

h

e

i

r serv

i

ce to contr

ib

ut

i

ng emp

l

oyers. Base

d

on ava

il

a

bl

e

i

n

f

ormat

i

on, t

h

e Company

b

e

li

eves t

h

at some o

f

t

h

emu

l

t

i

-emp

l

o

y

er p

l

ans to w

hi

c

hi

t contr

ib

utes are un

d

er-

f

un

d

e

d

. Compan

y

contr

ib

ut

i

ons to t

h

ese p

l

ans ar

e

l

ikel

y

to continue to increase in the near term. However, the amount of an

y

increase or decrease in contributions

w

ill d

epen

d

on a var

i

ety o

ff

actors,

i

nc

l

u

di

ng t

h

e resu

l

ts o

f

t

h

e Company’s co

ll

ect

i

ve

b

arga

i

n

i

ng e

ff

orts,

i

nvestment return on t

h

e assets

h

e

ld i

nt

h

ep

l

ans, act

i

ons ta

k

en

b

yt

h

e trustees w

h

o manage t

h

ep

l

ans, an

d

re

q

uirements under the Pension Protection Act and /or Section 412 (e) of the Internal Revenue Code

.

Furt

h

ermore,

if

t

h

e Company were to ex

i

t certa

i

n mar

k

ets or ot

h

erw

i

se cease ma

ki

ng contr

ib

ut

i

ons to t

h

ese p

l

ans

a

tt

hi

st

i

me,

i

t cou

ld

tr

i

gger a w

i

t

hd

rawa

lli

a

bili

ty t

h

at wou

ld

requ

i

re t

h

e Company to

f

un

di

ts proport

i

onate s

h

are

o

fa

p

lan’s unfunded vested benefits

.

T

he Compan

y

also makes contributions to multi-emplo

y

er health and welfare plans in amounts set forth in th

e

re

l

ate

d

co

ll

ect

i

ve

b

arga

i

n

i

ng agreements. Some o

f

t

h

eco

ll

ect

i

ve

b

arga

i

n

i

ng agreements conta

i

n reserve

requ

i

rements t

h

at ma

y

tr

igg

er unant

i

c

i

pate

d

contr

ib

ut

i

ons resu

l

t

i

n

gi

n

i

ncrease

dh

ea

l

t

h

care expenses. I

f

t

h

ese

h

ealth care provisions cannot be rene

g

otiated in a manner that reduces the prospective health care cost as th

e

C

ompany

i

nten

d

s, t

h

e Company’s Se

lli

ng an

d

a

d

m

i

n

i

strat

i

ve expenses cou

ld i

ncrease

i

nt

h

e

f

uture.

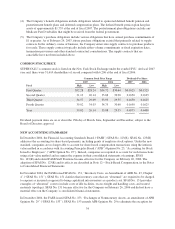

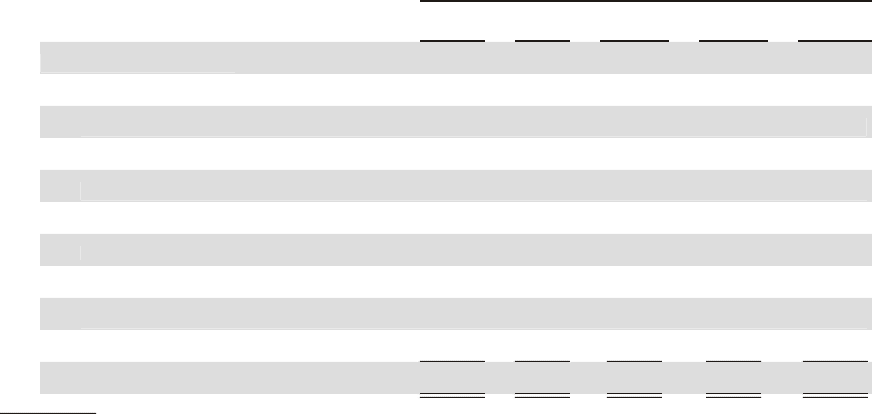

Th

e

f

o

ll

ow

i

ng ta

bl

e represents t

h

e Company’s s

i

gn

ifi

cant contractua

l

o

bli

gat

i

ons at Fe

b

ruary 24, 2007

.

Payments Due Per Perio

d

T

ota

l

Fi

sca

l

2

008

Fi

sca

l

2

009

-2

0

1

0

F

i

scal

2

0

11-2

0

12 Thereafter

Contractua

l

O

bli

gat

i

ons

:

D

ebt (1) $ 8,398 $ 302 $1,107 $2,059 $ 4,930

Interest on lon

g

-term debt 6,172

5

99 1,117 871 3,

5

8

5

O

perating leases (2) 3,824 359 717 567 2,181

Capital and direct financing leases (3) 2,304 153 306 291 1,55

4

B

enefit obligations (4) 7,824 116 222 233 7,2

5

3

Construction commitments 200 17

5

2

5

—

—

D

eferred income taxes 5

9

3

9

2 152 184 16

5

P

urchase obligations (5) 2,372 1,197 1,148 27

—

S

elf-insurance obligations 1,104 346 360 1

5

6 242

Total $32,791 $3,339 $5,154 $4,388 $19,910

(1) The Compan

y

has medium-term notes and debentures that contain put options that would require the

Company to repay borrowed amounts prior to maturity. Medium-term notes of

$

30 and

$

49 mature in Jul

y

2027 an

d

Apr

il

2028, respect

i

ve

l

y, an

dh

ave put opt

i

ons exerc

i

sa

bl

e

i

nJu

l

y 2007 an

d

Apr

il

2008

,

respectivel

y

. Debentures in the amount of $209 mature in Ma

y

2037 and have put options exercisable in

May 2009. Convertible debentures in the amount of

$

53 mature in 2031 and the holders have the ability to

c

onvert t

h

e

d

e

b

entures

i

nto s

h

ares o

f

t

h

e Company’s common stoc

k

an

d

t

h

e Company

h

as announce

di

t

s

i

ntent to use cash to settle the debentures. For the purpose of the table above, pa

y

ments of these obli

g

ation

s

are assumed to occur at scheduled maturity

.

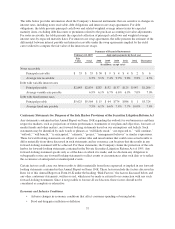

(2) Represents the minimum rents payable under operating leases, offset by expected sublease income of $242,

$

58, $79, $48 and $57, respectivel

y.

(3) Rent payments are net of expected sublease income of

$

101,

$

16,

$

26,

$

21 and

$

38, respectively

.

33