Albertsons 2007 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SU

PERVAL

U

IN

C

. and

S

ubsidiaries

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

y

ears. Generall

y

, options vest over four

y

ears. The exercise provisions of future awards ma

y

chan

g

e as the Board

o

f Directors or the Compensation Committee may determine

.

I

n accordance with the Acquisition agreement, the Company assumed approximately 21 fully vested stock

o

pt

i

ons o

fh

o

ld

ers o

f

A

lb

ertsons stoc

k

opt

i

ons w

h

o

b

ecame emp

l

oyees o

f

t

h

e Company a

f

ter t

h

e Acqu

i

s

i

t

i

on. T

he

f

air value of the stock o

p

tions issued was determined in accordance with SFAS No. 123(R).

Prior to Februar

y

26, 2006, the Compan

y

applied APB Opinion No. 2

5

and related interpretations in accountin

g

f

or stock option and stock unit awards made under the 2002 Stock Plan and other plans. Stock options previously

g

rante

d

un

d

er t

h

ese p

l

ans

h

a

d

an exerc

i

se pr

i

ce equa

l

to not

l

ess t

h

an t

h

e

f

a

i

r mar

k

et va

l

ue o

f

t

h

e common stoc

k

o

n the date of the

g

rant, and accordin

g

l

y

, no compensation expense was reco

g

nized.

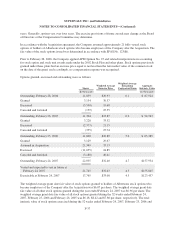

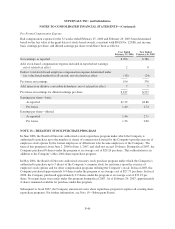

Options

g

ranted, exercised and outstandin

g

were as follows

:

S

hares

W

eighted Averag

e

E

xercise Price

Weighted Average

Remainin

g

C

ontractual Ter

m

Aggregate

I

ntrinsic

V

alu

e

(

In thousands

)(

In thousands

)

Outstanding, February 28, 2004 11,839

$

20.93 6.1

$

87,92

4

Granted 3,1

5

4 30.37

Exercised (3,550) 19.6

8

C

anceled and forfeited

(

139

)

25.55

Outstandin

g

, Februar

y

26, 2005 11,304 $23.87 6.2 $ 94,743

Grante

d

3

,

228 33.32

Exercised

(

2,377

)

21.1

5

C

anceled and forfeited (3

55

) 27.7

4

Outstanding, February 25, 2006 11,800

$

26.89 5.6

$

65,38

5

Granted 3,129 29.67

Assumed in Ac

q

uisition 21,349 33.13

Exercised

(

11,055

)

24.85

C

ance

l

e

d

an

df

or

f

e

i

te

d(

3,188

)

40.41

Outstanding, February 24, 2007 22,035

$

32.40 4.7

$

157,95

4

Vested and ex

p

ected to vest in future a

t

February 24, 2007 21,745

$

32.43 4.5

$

155,84

5

Exercisable at February 24, 2007 17,765

$

33.08 4.3

$

123,437

Th

ewe

i

g

h

te

d

average grant

d

ate

f

a

i

rva

l

ue o

f

stoc

k

opt

i

ons grante

d

to

h

o

ld

ers o

f

A

lb

ertsons stoc

k

opt

i

ons w

h

o

became emplo

y

ees of the Compan

y

after the Acquisition was $6.07 per share. The wei

g

hted avera

g

e

g

rant date

f

air value of all other stock options granted during the year ended February 24, 2007 was

$

6.96 per share. Th

e

weighted average grant date fair value of all stock options granted during the 52 weeks ended February 24,

2007, Februar

y

25, 2006 and Februar

y

26, 2005 was $6.18, $8.42 and $7.80 per share, respectivel

y

. The tota

l

intrinsic value of stock options exercised during the

5

2 weeks ended February 24, 2007, February 2

5

, 2006 and

F-

37