Albertsons 2007 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

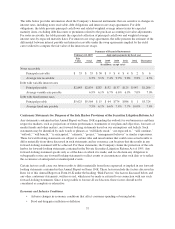

(4) The Company’s benefit obligations include obligations related to sponsored defined benefit pension an

d

postret

i

rement

b

ene

fi

tp

l

ans an

dd

e

f

erre

d

compensat

i

on p

l

ans. T

h

e

d

e

fi

ne

db

ene

fi

t pens

i

on p

l

an

h

as p

l

a

n

assets of approximatel

y

$1,735 at the end of fiscal 2007. The postretirement plan obli

g

ations exclude an

y

Medicare Part D subsidies that might be received from the federal government

.

(

5

) The Company’s purchase obligations include various obligations that have annual purchase commitments of

$

1 or greater. As of February 24, 2007, future purchase obligations existed that primarily related to suppl

y

c

ontracts. In the ordinar

y

course of business, the Compan

y

enters into suppl

y

contracts to purchase product

s

for resale. These supply contracts typically include either volume commitments or fixed expiration dates,

term

i

nat

i

on prov

i

s

i

ons an

d

ot

h

er stan

d

ar

d

contractua

l

cons

id

erat

i

ons. T

h

e supp

l

y contracts t

h

at are

c

ancelable have not been included above.

CO

MM

O

N

S

T

OC

K PRI

CE

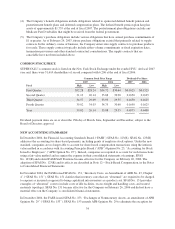

SUPERVALU’s common stock is listed on the New York Stock Exchange under the symbol SVU. At fiscal 2007

year end, there were 31,

6

14 shareholders of record compared with

6

,20

6

at the end of fiscal 200

6.

C

ommon

S

tock Price Rang

e

Dividends Per

S

hare

200

7

2006

2007

2006

Fiscal Hig

h

Low

Hig

h

Low

First

Q

uarter

$

32.28

$

28.24

$

34.72

$

30.64

$

0.1625

$

0.152

5

S

econd Quarter 31.13 26.14 3

5

.88 30.90 0.16

5

0 0.162

5

T

hird Quarter 34.

5

7 29.09 33.93 29.

55

0.16

5

0 0.162

5

Fourth Quarter 39.02 34.03 34.75 30.60 0.1650 0.162

5

Year 3

9

.02 26.14 3

5

.88 2

9

.

55

0.6

5

7

5

0.640

0

Dividend payment dates are on or about the 15th day of March, June, September and December, subject to the

B

oard of Directors a

pp

roval.

NEW A

CCOU

NTIN

GS

TANDARD

S

I

n December 2004, the Financial Accounting Standards Board (“FASB”) SFAS No. 123(R). SFAS No. 123(R)

add

resses t

h

e account

i

ng

f

or s

h

are-

b

ase

d

payments,

i

nc

l

u

di

ng grants o

f

emp

l

oyee stoc

k

opt

i

ons. Un

d

er t

h

ene

w

standard, companies are no lon

g

er able to account for share-based compensation transactions usin

g

the intrinsi

c

v

alue method in accordance with Accounting Principles Board (“APB”) Opinion No. 2

5

, “Accounting for Stock

I

ssued to Employees” (“APB Opinion No. 25”). Instead, companies are required to account for such transactions

u

sin

g

a fair-value method and reco

g

nize the expense in their consolidated statements of earnin

g

s. SFA

S

No. 123(R) and related FASB Staff Positions became effective for the Company on February 26, 2006. Th

e

ad

opt

i

on o

f

SFAS No. 123(R) an

di

ts e

ff

ects are

d

escr

ib

e

di

n Note 12—Stoc

k

-Base

d

Compensat

i

on,

i

nt

h

e Note

s

to Consolidated Financial Statements

.

I

n November 2004, the FASB issued SFAS No. 151, “Inventory Costs, an Amendment of ARB No. 43, Chapter

4” (“SFAS No. 1

5

1”). SFAS No. 1

5

1 clarifies that inventor

y

costs that are “abnormal” are required to be char

g

e

d

to expense as incurred as opposed to being capitalized into inventory as a product cost. SFAS No. 1

5

1 provide

s

examp

l

es o

f

“a

b

norma

l

” costs to

i

nc

l

u

d

e costs o

f idl

e

f

ac

ili

t

i

es, excess

f

re

i

g

h

tan

dh

an

dli

ng costs, an

d

waste

d

materials (spoila

g

e). SFAS No. 1

5

1 became effective for the Compan

y

on Februar

y

26, 2006 and did not have

a

material effect on the Company’s consolidated financial statements.

I

n December 2004, the FASB issued SFAS No. 1

5

3, “Exchan

g

es of Nonmonetar

y

Assets, an amendment of AP

B

O

p

inion No. 29” (“SFAS No. 1

5

3”). SFAS No. 1

5

3 amends APB O

p

inion No. 29 to eliminate the exce

p

tion fo

r

34