Albertsons 2007 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SU

PERVAL

U

IN

C

. and

S

ubsidiaries

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

N

O

TE 8—FINAN

C

IAL IN

S

TR

U

MENT

S

I

nterest Rate Swap

A

greement

s

I

n fiscal 2003, the Compan

y

entered into swap a

g

reements in the a

gg

re

g

ate notional amount of $225 relatin

g

to

the Company’s 7.87

5

percent fixed interest rate promissory notes due fiscal 2010. The Company receives a fixed

interest rate of 7.875 percent on the notional amount of the swaps and pays interest based on the three-mont

h

U.S. dollar LIBOR rate (

5

.36 percent and 4.68 percent as of Februar

y

24, 2007 and Februar

y

2

5

, 2006,

respectively) plus 2.

55

percent to 2.60 percent. The swaps have been designated as a fair value hedge on long-

term

fi

xe

d

rate

d

e

b

to

f

t

h

e Company an

d

are a component o

f

Ot

h

er assets

i

nt

h

e Conso

lid

ate

d

Ba

l

ance S

h

eets. On

a

quarterl

y

basis, the Compan

y

performs an assessment of effectiveness and a measurement of ineffectiveness

.

T

hrough February 24, 2007, the net earnings impact was zero. See Note 19 – Subsequent Events

.

F

air Va

l

ue Disc

l

osures of Financia

l

Instrument

s

F

or certa

i

no

f

t

h

e Company’s

fi

nanc

i

a

li

nstruments,

i

nc

l

u

di

ng cas

h

an

d

cas

h

equ

i

va

l

ents, rece

i

va

bl

es, account

s

pa

y

able and notes pa

y

able, the fair values approximate book values due to their short maturities

.

Th

e est

i

mate

df

a

i

rva

l

ue o

f

notes rece

i

va

bl

e approx

i

mates t

h

e

b

oo

k

va

l

ue at Fe

b

ruary 24, 2007. Notes rece

i

va

bl

e

a

re valued based on a discounted cash flow approach appl

y

in

g

a rate that is comparable to publicl

y

traded debt

instruments of similar credit quality

.

T

he estimated fair value of the Compan

y

’s lon

g

-term debt (includin

g

current maturities) was in excess of th

e

b

ook value by approximately

$

380 at February 24, 2007. The estimated fair value was based on market quotes,

wh

ere ava

il

a

bl

e

,

or mar

k

et va

l

ues

f

or s

i

m

il

ar

i

nstruments

.

T

he estimated fair value of the Company’s interest rate swaps was equal to the book value at February 24, 2007

.

Th

e

f

a

i

rva

l

ue o

fi

nterest rate swaps

i

st

h

e amount at w

hi

c

h

t

h

ey cou

ld b

e sett

l

e

d

an

di

s est

i

mate

db

yo

b

ta

i

n

i

ng

q

uotes from brokers. See Note 19 – Subse

q

uent Events.

N

O

TE 9—DEBT

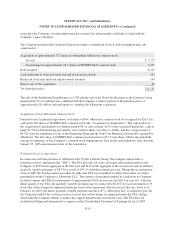

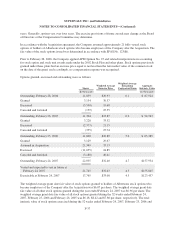

As a result of the Acquisition, the Company assumed

$

5,183 of the Acquired Operations’ outstanding long-ter

m

d

e

b

t, exc

l

u

di

ng cap

i

ta

ll

eases (see Note 3 – Bus

i

ness Acqu

i

s

i

t

i

on). In accor

d

ance w

i

t

h

t

h

e app

li

cat

i

on o

f

t

he

purchase method of accountin

g

, the Compan

y

estimated the fair value of the debt assumed from New Albertson

s

a

s a result of the Acquisition. This resulted in an aggregate net discount related to the New Albertsons long-ter

m

d

ebt of

$

231 as of the Acquisition Date, which will be amortized to Interest expense using the effective interes

t

method over the remainin

g

terms of the respective debt instruments. In the table below, the stated interest rate

s

f

or the debt assumed from New Albertsons are followed by the effective rates in parentheses resulting from th

e

di

scounts an

d

prem

i

ums

d

ue to purc

h

ase account

i

ng

f

a

i

rva

l

ue a

dj

ustments. Borrow

i

ngs are unsecure

d

un

l

ess

indicated otherwise.

F-

28