Albertsons 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SU

PERVAL

U

IN

C

. and

S

ubsidiaries

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

D

ebt A

ss

ume

d

T

he Compan

y

assumed $6,123 of the Acquired Operations’ outstandin

g

debt. This debt consisted primaril

y

o

f

publicly issued notes and debentures (including mandatory convertible securities), medium term notes and capita

l

l

ease obligations (see Note 9—Debt). The estimated fair value of the debt assumed by the Company was

$

6,088

.

T

he fair value of the

p

ublic notes and debentures were estimated based on market

q

uotes. The fair value of th

e

mandatory convertible securities was estimated based on the closing market price of the security. The fair value

f

or t

h

e rema

i

n

i

ng

d

e

b

t was est

i

mate

db

ase

d

on t

h

e mar

k

et y

i

e

ld

so

f

pu

bli

c

l

y tra

d

e

dd

e

b

tw

i

t

h

s

i

m

il

ar cre

dit

ratin

g

s, interest rates, and maturit

y

dates

.

C

ash Settlement o

f

Stock Options and Restricted Stock Unit

s

As of the Acquisition Date, Albertsons had approximately 31 stock options and 7 restricted stock units

o

utstan

di

ng. As a resu

l

to

f

t

h

e Acqu

i

s

i

t

i

on, a

ll

outstan

di

ng awar

d

s

f

u

ll

y veste

d

ot

h

er t

h

an approx

i

mate

l

y0.

4

restricted stock unit awards. In accordance with the Acquisition a

g

reement, the Compan

y

settled in cash an

d

stock all of the Albertsons stock options held by Albertsons employees who did not become employees of th

e

C

ompany. T

h

e Company a

l

so sett

l

e

d

a

ll

o

f

t

h

eA

lb

ertsons

f

u

ll

y veste

d

restr

i

cte

d

stoc

k

un

i

ts

i

n cas

h

or a

combination of cash and SUPERVALU common stock

.

S

tock O

p

tions and Restricted Stock Units Assume

d

I

n accordance with the Acquisition agreement, the Company assumed the obligation of stock options and

a

pprox

i

mate

l

y 0.4 unveste

d

restr

i

cte

d

stoc

k

un

i

ts o

fi

n

di

v

id

ua

l

sw

h

o

b

ecame emp

l

oyees o

f

t

h

e Company. T

h

e

stock options became full

y

vested and were converted into the ri

g

ht to acquire a total of 21 shares of

SUPERVALU stock, using an exchange ratio based on the Acquisition Consideration

.

D

irect Costs of t

h

e Acquisition

D

i

rect costs o

f

t

h

e Acqu

i

s

i

t

i

on

i

nc

l

u

d

e

i

nvestment

b

an

ki

ng

f

ees,

l

ega

l

an

d

account

i

ng

f

ees an

d

ot

h

er externa

l

costs directl

y

related to the Acquisition.

P

reliminar

y

Purchase Price Allocatio

n

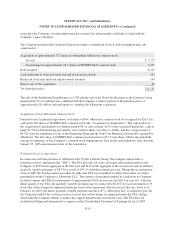

T

he Acquisition was accounted for under the purchase method of accounting with the Company as the acquirer i

n

a

ccor

d

ance w

i

t

h

Statement o

f

F

i

nanc

i

a

l

Account

i

ng Stan

d

ar

d

s No. 141, Bus

i

ness Com

bi

nat

i

ons (“SFA

S

N

o. 141”). As a result, the Compan

y

applied the purchase method of accountin

g

to the separable assets, includin

g

g

oodwill, and liabilities of New Albertsons. The following summarizes the preliminary estimated fair values of

t

h

e assets acqu

i

re

d

an

dli

a

bili

t

i

es assume

d

at t

h

e Acqu

i

s

i

t

i

on Date. T

h

ese pre

li

m

i

nary purc

h

ase pr

i

ce a

ll

ocat

i

on

s

a

re estimates as of Februar

y

24, 2007 based on a combination of third-part

y

valuations and internal anal

y

ses an

d

w

ill be further adjusted during the allocation period as defined in SFAS No. 141. The primary areas of the

purc

h

ase pr

i

ce a

ll

ocat

i

on t

h

at are not yet

fi

na

li

ze

d

re

l

ate to t

h

eva

l

uat

i

on o

fl

ong-

li

ve

d

assets,

i

nventor

i

es,

intan

g

ible assets, capital and operatin

g

lease obli

g

ations, income taxes and deferred income taxes, and residual

g

oodwill. Additionally, the Company is in the process of gathering data and making assessments in other areas

t

h

at cou

ld h

ave an

i

mpact on t

h

e

fi

na

l

purc

h

ase pr

i

ce a

ll

ocat

i

on. T

h

eva

l

uat

i

ons are pre

li

m

i

nary

d

ue pr

i

mar

il

yto

the size and complexit

y

of the Acquisition

.

F-

20