Albertsons 2007 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SU

PERVAL

U

IN

C

. and

S

ubsidiaries

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

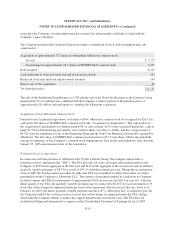

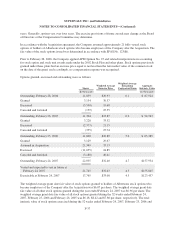

A summar

y

of chan

g

es in the Compan

y

’s Goodwill and other acquired intan

g

ible assets durin

g

fiscal 2007 and

f

iscal 2006 follows:

Februar

y

26,

200

5

A

m

o

rt

i-

za

t

io

n A

ddi

t

io

n

s

O

ther net

ad

j

ustments

Februar

y

25

,

2

006

A

m

o

rt

i-

z

a

t

ion

A

ddi

t

io

n

s

O

ther net

ad

j

ustment

s

F

ebruar

y

24

,

2

00

7

Goodwill

$

1,628

$

6

$

(20)

$

1,614

$

4,333

$

(26)

$

5,921

O

ther acquired intan

g

ible

asse

t

s

:

T

ra

d

emar

k

san

d

t

radenames $ 22 $— $ — $ 22 $1

,

362 $ — $1

,

38

4

Lease

h

o

ld

R

i

g

h

ts,

C

ustomer

li

sts an

d

ot

h

er

(

accumu

l

ate

d

amortization of

$

63

and $24, a

t

Februar

y

24, 2007

and Februar

y

2

5

,

2006, respectivel

y

)49 1 —

5

0 1,043 (11) 1,082

C

ustome

r

r

elationshi

p

s

(accumulated

amortization of $8

and

$

5at

Fe

b

ruary 24, 2007

and February 25,

200

6

, respectively) 47 1 — 48 — — 4

8

N

on-com

p

ete

agreements

(

accumu

l

ate

d

amortization of

$6

and $5 at

Februar

y

24, 2007

and Februar

y

2

5

,

2006, respectivel

y

) 8 — — 8 6 (1) 13

T

ota

l

ot

h

er ac

q

u

i

re

d

i

ntangible assets 126 2 — 128 2,411 (12) 2,52

7

Accumulated amortization (27) $(7) — — (34) $(48) — 5 (77

)

T

ota

l

ot

h

er acqu

i

re

d

i

ntan

g

ible assets, net $ 99 $(7) $ 2 $ — $ 94 $(48) $2,411 $ (7) $2,45

0

T

he increase in Goodwill from $1,614 as of Februar

y

25, 2006 to $5,921 at Februar

y

24, 2007 resulted primaril

y

f

rom the

$

4,333 Goodwill related to the Acquisition. Other net adjustments consist primarily of a Goodwil

l

impairment charge of

$

19 related to the Company’s plan to dispose of 18 Scott’s banner stores

.

T

he decrease in Goodwill from

$

1,628 as of February 26, 2005 to

$

1,614 as of February 25, 2006 resulte

d

primaril

y

from purchase accountin

g

ad

j

ustments of $29 between Deferred income taxes and Goodwill related to

f

ormer acquisitions and reductions of Goodwill of

$

11 primarily related to the disposition of the Shop ’n Sav

e

P

i

tts

b

urg

h

an

d

Cu

b

Foo

d

sC

hi

cago stores, w

hi

c

h

were part

i

a

ll

yo

ff

set

b

y purc

h

ase account

i

ng a

dj

ustments to

increase Goodwill b

y

$20 for the finalization of the valuation related to the acquisition of Total Lo

g

istics in fisca

l

200

5

.

I

ntang

ibl

e assets w

i

t

h

a

d

e

fi

n

i

te

lif

e are amort

i

ze

d

on a stra

i

g

h

t-

li

ne

b

as

i

sw

i

t

h

est

i

mate

d

use

f

u

lli

ves rang

i

ng

f

rom less than one to 37 years. Amortization expense of

$

48,

$

7 and

$

6 was recorded in fiscal 2007, 2006 an

d

2005, respectivel

y

. Future amortization expense will approximate $69 per

y

ear for each of the next five

y

ears. Al

l

i

ntang

ibl

e assets are amort

i

za

bl

ew

i

t

h

t

h

e except

i

on o

f

t

h

e tra

d

emar

k

san

d

tra

d

enames. Goo

d

w

ill

an

di

ntang

ibl

e

a

ssets

d

eterm

i

ne

d

to

h

ave

i

n

d

e

fi

n

i

te use

f

u

lli

ves are not amort

i

ze

d

,

b

ut are teste

df

or

i

mpa

i

rment at

l

east annua

ll

y

in the Compan

y

’s fourth quarter

.

F-

27