Albertsons 2007 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Net Earn

i

n

gs

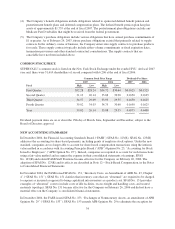

Net earnings were

$

206 for fiscal 2006 compared with Net earnings of

$

386 in fiscal 2005. Results for fiscal

2006 include charges of

$

61 after tax related to Chicago and

$

38 after tax related to Pittsburgh. Results for fiscal

2005 include a net after-tax

g

ain on the sale of the Compan

y

’s minorit

y

interest in WinCo of $68 after tax.

Wei

g

hted avera

g

e basic shares increased to 136 for fiscal 2006 compared with 13

5

in fiscal 200

5

and wei

g

hted

a

verage diluted shares increased to 146 for fiscal 2006 compared with 145 shares in fiscal 2005, reflecting the net

i

mpact o

f

stoc

k

act

i

v

i

t

yi

nc

l

u

di

n

g

stoc

k

opt

i

on act

i

v

i

t

y

,s

h

are repurc

h

ases un

d

er t

h

e treasur

y

p

l

an an

d dil

ut

i

o

n

im

p

acts

.

CRITICAL ACCOUNTING POLICIE

S

Th

e preparat

i

on o

f

conso

lid

ate

dfi

nanc

i

a

l

statements

i

n con

f

orm

i

ty w

i

t

h

account

i

ng pr

i

nc

i

p

l

es genera

ll

y accepte

d

in the United States of America requires mana

g

ement to make estimates and assumptions that affect the reporte

d

a

mounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financia

l

statements an

d

t

h

e reporte

d

amounts o

f

revenues an

d

expenses

d

ur

i

ng t

h

e report

i

ng per

i

o

d

. Actua

l

resu

l

ts cou

ld

d

iffer from those estimates

.

Si

g

nificant accountin

g

policies are discussed in the Summar

y

of Si

g

nificant Accountin

g

Policies in th

e

a

ccompany

i

ng Notes to Conso

lid

ate

d

F

i

nanc

i

a

l

Statements. Management

b

e

li

eves t

h

e

f

o

ll

ow

i

ng cr

i

t

i

ca

l

a

ccountin

g

policies reflect its more sub

j

ective or complex

j

ud

g

ments and estimates used in the preparation of the

C

ompan

y

’s consolidated financial statements

.

V

endor Fund

s

Th

e Company rece

i

ves

f

un

d

s

f

rom many o

f

t

h

e ven

d

ors w

h

ose pro

d

ucts t

h

e Company

b

uys

f

or resa

l

e

i

n

i

ts

stores. These vendor funds are provided to increase the sell-throu

g

h of the related products. The Compan

y

receives vendor funds for a variety of merchandising activities: placement of the vendors’ products in the

C

ompany’s a

d

vert

i

s

i

ng;

di

sp

l

ay o

f

t

h

e ven

d

ors’ pro

d

ucts

i

n prom

i

nent

l

ocat

i

ons

i

nt

h

e Company’s stores

;

introduction of new products into the Compan

y

’s distribution s

y

stem and retail stores; exclusivit

y

ri

g

hts in

certain categories that have slower-turning products; and to compensate for temporary price reductions offered t

o

customers on pro

d

ucts

h

e

ld f

or sa

l

e at reta

il

stores. T

h

e Company a

l

so rece

i

ves ven

d

or

f

un

d

s

f

or

b

uy

i

ng act

i

v

i

t

i

es

such as volume commitment rebates, credits for purchasin

g

products in advance of their need and cash discount

s

f

or the early payment of merchandise purchases. As of February 24, 2007, the terms of the Company’s vendor

f

un

d

s arrangements var

i

e

di

n

l

engt

hf

rom pr

i

mar

il

ys

h

ort-term arrangements t

h

at are to

b

e comp

l

ete

d

w

i

t

hi

na

quarter to lon

g

-term arran

g

ements that are primaril

y

expected to be completed within three

y

ears.

T

he Compan

y

reco

g

nizes vendor funds for merchandisin

g

activities as a reduction of Cost of sales when th

e

related products are sold in accordance with Emerging Issues Task Force (“EITF”) Issue 02-1

6

, “Accounting b

y

a

Customer (Includin

g

a Reseller) for Certain Consideration Received from a Vendor.

”

Inventorie

s

I

nventories are valued at the lower of cost or market. Substantially all of the Company’s inventory consists of

fi

n

i

s

h

e

d

goo

d

s.

Approximatel

y

82 percent and 65 percent of the Compan

y

’s inventories are valued usin

g

the last-in, first-ou

t

(“LIFO”) method for fiscal 2007 and 2006, respectivel

y

. The first-in, first-out method (“FIFO”) is used t

o

d

eterm

i

ne cost

f

or some o

f

t

h

e rema

i

n

i

ng

hi

g

hl

y per

i

s

h

a

bl

e

i

nventor

i

es. I

f

t

h

e FIFO met

h

o

dh

a

db

een use

d

t

o

d

etermine cost of inventories for which the LIFO method is used, the Compan

y

’s inventories would have been

h

i

g

her b

y

approximatel

y

$178 at Februar

y

24, 2007 and $160 at Februar

y

25, 2006.

Th

e Company uses a com

bi

nat

i

on o

f

t

h

e reta

il i

nventory met

h

o

d

(“RIM”) an

d

rep

l

acement cost met

h

o

d

t

o

d

eterm

i

ne t

h

e cost o

fi

ts

i

nventor

y

.T

h

e RIM va

l

uat

i

on o

fi

nventor

i

es

i

s at cost an

d

t

h

e

g

ross mar

gi

ns ar

e

25