Albertsons 2007 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SU

PERVAL

U

IN

C

. and

S

ubsidiaries

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

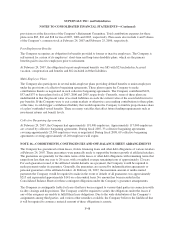

Albertson’s failed to timel

y

pa

y

wa

g

es of terminated or resi

g

ned emplo

y

ees as required b

y

California law. The

l

awsuit further alleges a violation of the California Unfair Competition Law, Business and Professions Code

Sect

i

on 17200 et seq. T

h

e

l

awsu

i

t see

k

s recovery o

f

a

ll

wages, compensat

i

on an

d

/or pena

l

t

i

es owe

d

t

h

e mem

b

er

s

o

f the class certified, includin

g

compensation of one hour of pa

y

for rest or meal period violations and wa

g

es for

a

ll time worked while employees were clocked out for meal periods or required to remain on the premises durin

g

mea

l

per

i

o

d

s. T

h

e

l

awsu

i

t

f

urt

h

er see

k

s to recover a

ll

past

d

ue compensat

i

on an

d

pena

l

t

i

es

f

or

f

a

il

ure to prov

ide

a

ccurate itemized wa

g

e statements and to pa

y

all wa

g

es due at time of termination for members of the class

certified with interest from August 6, 2000 to time of trial. The Company is vigorously defending this lawsuit.

A

l

t

h

oug

h

t

hi

s

l

awsu

i

t

i

ssu

bj

ect to t

h

e uncerta

i

nt

i

es

i

n

h

erent

i

nt

h

e

li

t

i

gat

i

on process,

b

ase

d

on t

h

e

i

n

f

ormat

i

o

n

presentl

y

available to the Compan

y

, mana

g

ement does not expect that the ultimate resolution of this lawsuit will

h

ave a material adverse effect on the Company’s financial condition, results of operations or cash flows

.

On January 24, 2006, a class action complaint was filed in the Fourth Judicial District of the State of Idaho in an

d

f

or t

h

e County o

f

A

d

a, nam

i

ng A

lb

ertsons an

di

ts

di

rectors as

d

e

f

en

d

ants. T

h

e act

i

on (C

h

r

i

stop

h

er Carmona v.

H

enr

y

Br

y

ant et al., No. CV-OC 06012

5

1) challen

g

ed the a

g

reements entered into in connection with the serie

s

o

f transactions facilitating the sale of Albertsons to SUPERVALU, CVS and Cerberus Group. On May 18, 2006

,

t

h

e

d

e

f

en

d

ants entere

di

nto a memoran

d

um o

f

un

d

erstan

di

ng

f

or a

f

u

ll

sett

l

ement w

i

t

h

t

h

ep

l

a

i

nt

iff

.O

n

December 13, 2006, the Court held a hearin

g

for final approval of the settlement, and on Januar

y

23, 2007, issued

a

Memorandum Decision and Order granting approval. On March 9, 2007, the Court issued a Final Judgment and

Or

d

er o

f

D

i

sm

i

ssa

l

w

i

t

h

Pre

j

u

di

ce

.

Th

e Company

i

sa

l

so

i

nvo

l

ve

di

n rout

i

ne

l

ega

l

procee

di

ngs

i

nc

id

enta

l

to

i

ts operat

i

ons. Some o

f

t

h

ese rout

i

n

e

proceedin

g

s involve class alle

g

ations, man

y

of which are ultimatel

y

dismissed. Mana

g

ement does not expect that

the ultimate resolution of these legal proceedings will have a material adverse effect on the Company’s financia

l

con

di

t

i

on, resu

l

ts o

f

operat

i

ons or cas

hfl

ows

.

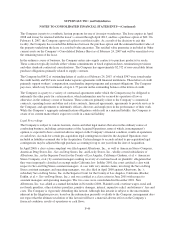

Th

e statements a

b

ove re

fl

ect management’s current expectat

i

ons

b

ase

d

on t

h

e

i

n

f

ormat

i

on present

l

y ava

il

a

bl

et

o

the Compan

y

. However, predictin

g

the outcomes of claims and liti

g

ation and estimatin

g

related costs an

d

exposures involves substantial uncertainties that could cause actual outcomes, costs and exposures to vary

mater

i

a

ll

y

f

rom current expectat

i

ons. In a

ddi

t

i

on, t

h

e Company regu

l

ar

l

y mon

i

tors

i

ts exposure to t

h

e

l

os

s

contin

g

encies associated with these matters and ma

y

from time to time chan

g

e its predictions with respect to

o

utcomes and its estimates with res

p

ect to related costs and ex

p

osures. It is

p

ossible that material differences i

n

a

ctua

l

outcomes, costs an

d

exposures re

l

at

i

ve to current pre

di

ct

i

ons an

d

est

i

mates, or mater

i

a

l

c

h

anges

i

n suc

h

predictions or estimates, could have a material adverse effect on the Compan

y

’s financial condition, results o

f

op

erations or cash flows.

I

nsurance

C

ontingencies

T

he Company has outstanding workers’ compensation and general liability claims with a former insurance

carr

i

er t

h

at

i

s exper

i

enc

i

ng

fi

nanc

i

a

l diffi

cu

l

t

i

es. I

f

t

h

e

i

nsurer

f

a

il

s to pay any covere

d

c

l

a

i

ms t

h

at excee

d

d

eductible limits, creatin

g

“excess claims,” the Compan

y

ma

y

have the abilit

y

to present these excess claims to

g

uarantee funds in certain states in which the claims originated. In the state where the Company faces the larges

t

potent

i

a

l

exposure,

l

eg

i

s

l

at

i

on was enacte

d

t

h

at t

h

e Company

b

e

li

eves

i

ncreases t

h

e

lik

e

lih

oo

d

o

f

state guarante

e

f

und protection. The Compan

y

currentl

y

cannot estimate the amount of the covered claims in excess of

d

eductible limits which will not be paid by the insurance carrier or otherwise. As of February 24, 2007, the

i

nsurance carr

i

er cont

i

nues to pay t

h

e Company’s c

l

a

i

ms. Base

d

on

i

n

f

ormat

i

on present

l

y ava

il

a

bl

etot

he

C

ompan

y

, mana

g

ement does not expect that the ultimate resolution of this matter will have a material adverse

effect on the Company’s financial condition, results of operations or cash flows

.

F-

51