Albertsons 2007 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SU

PERVAL

U

IN

C

. and

S

ubsidiaries

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(

4) Expected lon

g

-term return on plan assets is estimated b

y

asset class and is

g

enerall

y

based on widel

y-

a

ccepted capital market principles, long-term return analysis for global fixed income and equity markets, the

a

ct

i

ve tota

l

return-or

i

ente

d

port

f

o

li

o management sty

l

easwe

ll

as t

h

e

di

vers

ifi

cat

i

on nee

d

san

d

re

b

a

l

anc

i

ng

c

haracteristics of the plan. Lon

g

-term trends are evaluated relative to market factors such as inflation,

i

nterest rates and fiscal and monetary polices in order to assess the capital market assumptions

.

C

ontributions

T

he Compan

y

expects to contribute $32 to its pension plans and $13 to its postretirement benefit plans in fisca

l

2

008. T

h

e Company’s

f

un

di

ng po

li

cy

f

or t

h

e

d

e

fi

ne

db

ene

fi

t pens

i

on p

l

ans

i

s to contr

ib

ute t

h

em

i

n

i

mum

contr

ib

ut

i

on a

ll

owe

d

un

d

er t

h

e Emp

l

o

y

ee Ret

i

rement Income Secur

i

t

y

Act (“ERISA”), w

i

t

h

cons

id

erat

i

on

gi

ven

to contributin

g

lar

g

er amounts in order to be exempt from Pension Benefit Guarant

y

Corporation (“PBGC”

)

v

ar

i

a

bl

e rate prem

i

ums or part

i

c

i

pant not

i

ces o

f

un

d

er-

f

un

di

ng. T

h

e Company w

ill

recogn

i

ze contr

ib

ut

i

ons

i

n

a

ccor

d

ance w

i

t

h

app

li

ca

bl

ere

g

u

l

at

i

ons, w

i

t

h

cons

id

erat

i

on

gi

ven to reco

g

n

i

t

i

on

f

or t

h

e ear

li

est p

l

an

y

ear

p

ermitted.

Pl

an A

ss

et

s

Plan assets are held in trust and invested in separatel

y

mana

g

ed accounts and publicl

y

traded mutual funds

h

oldin

g

equit

y

, fixed income securities and alternative investment classes.

T

he Compan

y

emplo

y

s a total return approach whereb

y

a mix of equities and fixed income investments are use

d

to max

i

m

i

ze t

h

e

l

ong-term return o

f

p

l

an assets

f

or a pru

d

ent

l

eve

l

o

f

r

i

s

k

.A

l

ternat

i

ve

i

nvestments,

i

nc

l

u

di

n

g

h

e

dg

e

f

un

d

s, pr

i

vate equ

i

t

y

an

d

rea

l

estate are a

l

so use

dj

u

di

c

i

ous

ly

to en

h

ance r

i

s

k

a

dj

uste

dl

on

g

-term returns

w

hile improvin

g

portfolio diversification. The overall investment strate

gy

and polic

y

have been developed based

o

nt

h

e nee

d

to sat

i

s

f

yt

h

e

l

ong-term

li

a

bili

t

i

es o

f

t

h

e Company’s pens

i

on p

l

ans. R

i

s

k

management

i

s

a

ccomp

li

s

h

e

d

t

h

rou

gh di

vers

ifi

cat

i

on across asset c

l

asses, mu

l

t

i

p

l

e

i

nvestment mana

g

er port

f

o

li

os an

db

ot

h

g

eneral and portfolio-specific investment

g

uidelines. Risk tolerance is established throu

g

h careful consideration

of

t

h

ep

l

an

li

a

bili

t

i

es, p

l

an

f

un

d

e

d

status an

d

t

h

e Company’s

fi

nanc

i

a

l

con

di

t

i

on. T

hi

s asset a

ll

ocat

i

on po

li

cy m

i

x

i

s rev

i

ewe

d

annua

lly

an

d

actua

l

a

ll

ocat

i

ons are re

b

a

l

ance

d

on a re

g

u

l

ar

b

as

i

s

.

P

l

an assets are

i

nveste

d

us

i

ng a com

bi

nat

i

on o

f

act

i

ve an

d

pass

i

ve

i

nvestment strateg

i

es. Pass

i

ve strateg

i

es

i

nvest

in broad sectors of the market primaril

y

throu

g

h the use of indexin

g

. Indexin

g

is an investment mana

g

ement

a

pproach based on investing in exactly the same securities, in the same proportions, as an index, such as the S&

P

500. Active strategies employ multiple investment management firms. Managers within each asset class cover a

ran

g

e of investment st

y

les and approaches and are combined in a wa

y

that controls for capitalization, and st

y

le

b

iases (equities) and interest rate bets (fixed income) versus benchmark indices while focusing primarily o

n

secur

i

ty se

l

ect

i

on as a means to a

dd

va

l

ue. Mon

i

tor

i

ng act

i

v

i

t

i

es to eva

l

uate per

f

ormance aga

i

nst targets an

d

measure investment risk take place on an on

g

oin

g

basis throu

g

h annual liabilit

y

measurements, periodic asset/

l

iability studies and quarterly investment portfolio reviews

.

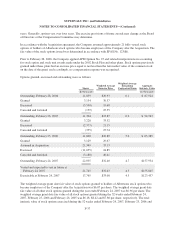

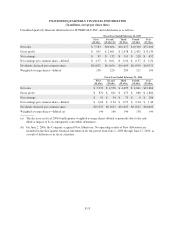

T

he asset allocation

g

uidelines and the actual allocation of pension plan assets are as follows:

Asset Category

Target Allocation

R

anges

Pl

a

nA

sse

t

s

Fiscal 200

7

Pl

a

nA

sse

t

s

Fiscal 2006

D

omestic Equit

y

45.0% - 70.0% 52.5% 60.1

%

International Equit

y

7.0% - 20.0% 17.7% 9.9

%

D

omestic Fixed Income 2

5

.0%-3

5

.0% 29.

5

% 24.

5%

C

ash and

O

ther

0

.

0

%-1

5

.

0

%

0

.

3

%

5

.

5%

T

otal 100.0% 100.0

%

F-4

6