Albertsons 2007 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SU

PERVAL

U

IN

C

. and

S

ubsidiaries

N

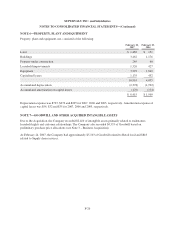

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

stores

g

ive the Compan

y

a stron

g

market presence in man

y

ke

y

urban markets with little overlap with th

e

C

ompany’s legacy business

.

T

he Compan

y

purchased the Acquired Operations usin

g

a combination of stock, debt assumption and cash

compr

i

se

d

o

f:

Acqu

i

s

i

t

i

on o

f

approx

i

mate

l

y 372 s

h

ares o

f

outstan

di

ng A

lb

ertsons common stoc

k:

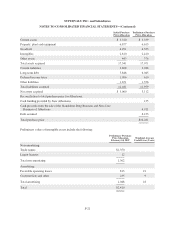

I

n

cash

$

7,572

I

n exchan

g

e for approximatel

y

68.

5

shares of SUPERVALU common stock 2,2

5

1

D

ebt assu

m

ed

6

,123

C

as

h

sett

l

ement o

f

restr

i

cte

d

stoc

k

un

i

tan

d

stoc

k

opt

i

on awar

d

s 143

R

estr

i

cte

d

stoc

k

un

i

tan

d

stoc

k

opt

i

on awar

d

s assume

d

143

Direct costs of the ac

q

uisition

4

9

T

otal

p

urchase

p

rice $16,281

Th

esa

l

eo

f

t

h

e Stan

d

a

l

one Drug Bus

i

ness to CVS an

d

t

h

esa

l

eo

f

t

h

e Non-Core Bus

i

ness to t

h

e Cer

b

erus Grou

p

g

enerated

$

4,911 in cash that was combined with the Company’s relative portion of the purchase price o

f

a

pproximatel

y

$11,400 in cash and equit

y

to complete the Albertsons acquisition.

Acquisition of New Albertsons Common Stoc

k

Pursuant to the Acquisition agreement, each share of New Albertsons common stock was acquired for

$

20.35 in

cas

h

an

d

0.182 s

h

ares o

f

SUPERVALU common stoc

k

(t

h

e “Acqu

i

s

i

t

i

on Cons

id

erat

i

on”). T

h

e cas

h

port

i

on o

f

the Acquisition Consideration was funded usin

g

$556 of cash on hand, $135 of the Acquired Operations’ cash on

h

and,

$

1,970 of debt financing provided by new credit facilities (see Note 9—Debt), and the cash proceeds o

f

$

4,911 from the simultaneous sale of the Standalone Drug and the Non-Core Businesses historically operated by

Albertsons. The fair value of SUPERVALU common stock issued was $32.73

p

er share, which re

p

resented the

a

verage c

l

os

i

ng pr

i

ce o

f

t

h

e Company’s common stoc

kb

eg

i

nn

i

ng two

d

ays

b

e

f

ore an

d

en

di

ng two

d

ays a

f

ter t

h

e

J

anuary 23, 200

6

announcement date of the Acquisition

.

Transition Services

A

greement

I

n connection with the purchase of Albertsons LLC b

y

the Cerberus Group, the Compan

y

entered into

a

trans

i

t

i

on serv

i

ces agreement (t

h

e “TSA”). T

h

e TSA prov

id

es

f

or a two-year term an

dfi

xe

d

payments to t

he

C

ompany of

$

155 in the aggregate in the first year and

$

135 in the aggregate in the second year and, in addition,

quarterl

y

variable pa

y

ments of $8.75 for a total of $35 of variable pa

y

ments per

y

ear. Durin

g

the second quarte

r

of fi

sca

l

2007 t

h

e

fi

xe

d

payments prov

id

e

df

or un

d

er t

h

e TSA were mo

difi

e

d

to re

fl

ect t

h

e trans

f

er o

f

certa

i

n

personne

lf

rom t

h

e Company to A

lb

ertsons LLC. T

h

e trans

f

er o

f

personne

l

resu

l

te

di

nare

d

uct

i

on

i

n Company

-

incurred expense and TSA fixed pa

y

ments of approximatel

y

$10.6 in

y

ear one and $10.6 in

y

ear two. After the

initial quarter of the TSA, the quarterly variable payments may be reduced by

$

0.4375 for each increment of 3

5

stores t

h

at w

ill

no

l

on

g

er

b

e supporte

d

un

d

er t

h

e terms o

f

t

h

ea

g

reement. Base

d

on stores t

h

at are c

l

ose

d

as o

f

Februar

y

24, 2007, the future quarterl

y

variable pa

y

ment amount is $7.4. Albertsons LLC is required to provid

e

the Company with 60 days advance notice of stores that will no longer be supported under the TSA, during

w

hi

c

h

t

i

me t

h

e Compan

yi

nten

d

store

d

uce t

h

e support

i

n

f

rastructure an

d

re

l

ate

d

costs. T

h

e TSA

f

ees are

included in Sellin

g

and administrative expenses in the Consolidated Statement of Earnin

g

s for fiscal 2007

.

F-

19