Albertsons 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SU

PERVAL

U

IN

C

. and

S

ubsidiaries

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

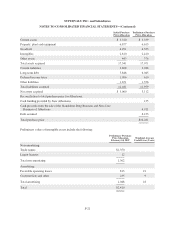

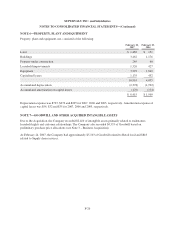

NOTE 6—PROPERTY, PLANT AND EQUIPMEN

T

Propert

y

, plant and equipment, net, consisted of the followin

g:

F

ebruar

y 24,

200

7

F

ebruar

y2

5

,

2006

L

a

n

d

$ 1,482 $ 131

B

u

ildi

n

gs

3

,

4

6

21

,

17

6

Property under construction 265 6

0

Leasehold im

p

rovements 1,326 42

7

E

q

ui

p

ment 3,293 1,84

9

C

apitalized leases 1,135 45

2

10

,

963 4

,

095

Accumu

l

ate

dd

eprec

i

at

i

on (2,378) (1,992

)

Accumulated amortization on ca

p

ital leases (170) (134

)

$ 8,415 $ 1,96

9

Depreciation expense was $793, $274 and $265 for 2007, 2006 and 2005, respectivel

y

. Amortization expense of

capital leases was

$

54,

$

32 and

$

35 for 2007, 2006 and 2005, respectively

.

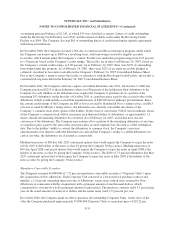

NOTE 7—GOODWILL AND OTHER AC

Q

UIRED INTANGIBLE A

SS

ET

S

Due to the Acquisition, the Compan

y

recorded $2,410 of intan

g

ible assets primaril

y

related to tradenames

,

l

easehold ri

g

hts and customer relationships. The Compan

y

also recorded $4,333 of Goodwill based on

pre

li

m

i

nary purc

h

ase pr

i

ce a

ll

ocat

i

ons (see Note 3 – Bus

i

ness Acqu

i

s

i

t

i

on)

.

At Februar

y

24, 2007, the Compan

y

had approximatel

y

$5,103 of Goodwill related to Retail food and $81

8

re

l

ate

d

to Supp

l

yc

h

a

i

n serv

i

ces.

F-2

6