Albertsons 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SU

PERVAL

U

IN

C

. and

S

ubsidiaries

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

T

he maturities above reflect contractual maturities of debt (includin

g

an

y

remainin

g

debt discounts or premiums

)

a

nd do not include the potential accelerations due to the debt holders’ ability to cause the Company to repurchas

e

t

h

e

d

e

b

t.

Th

e

d

e

b

t agreements conta

i

n var

i

ous

fi

nanc

i

a

l

covenants

i

nc

l

u

di

ng rat

i

os

f

or

i

nterest coverage an

dd

e

b

t

l

everage

a

s defined in the Compan

y

’s debt a

g

reements. The Compan

y

was in compliance with the financial covenant

s

u

nder the debt agreements as of February 24, 2007.

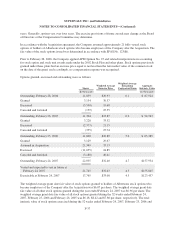

On October 31, 2006, the Company issued

$

500 in senior notes. The notes bear interest at a rate of 7.50 percen

t

a

n

d

are

d

ue

i

n 2014. T

h

e notes are sen

i

or o

bli

gat

i

ons an

d

ran

k

equa

ll

yw

i

t

h

a

ll

o

f

t

h

e Company’s ot

h

er sen

i

or

u

nsecured indebtedness

.

On June 1, 2006, the Compan

y

executed senior secured credit facilities in the amount of $4,000. These facilities

w

ere provided by a group of lenders and consist of a

$

2,000 five-year revolving credit facility (the “Revolvin

g

C

redit Facility”), a

$

750 five-year term loan (“Term Loan A”), and a

$

1,250 six-year term loan (“Term Loan

B

”). As of Februar

y

24, 2007, rates on the facilities were tied to LIBOR plus 0.

5

0 percent to 2.00 percent or the

Prime Rate plus 0.00 percent to 1.00 percent, depending on the type of borrowing and the Company’s credit

ratings, with facility fees ranging from 0.10 percent to 0.50 percent, also depending on the Company’s credi

t

ratin

g

s. The rates in effect on outstandin

g

borrowin

g

s under the facilities as of Februar

y

24, 2007, based on th

e

C

ompany’s current credit ratings, were 0.40 percent for the facility fees, LIBOR plus 1.

5

0 percent for LIBO

R

revolving advances, Prime Rate plus 0.50 percent for base rate revolving advances, LIBOR plus 1.50 for Term

L

oan A and LIBOR

p

lus 1.7

5p

ercent for Term Loan B. See Note 19—Subse

q

uent Events

.

All obli

g

ations under the senior secured credit facilities are

g

uaranteed b

y

each material subsidiar

y

of the

C

ompany. The obligations are also secured by a pledge of the equity interests in those same material subsidiaries

,

li

m

i

te

d

as requ

i

re

db

yt

h

eex

i

st

i

ng pu

bli

c

i

n

d

entures o

f

t

h

e Company an

d

su

b

s

idi

ar

i

es suc

h

t

h

at t

h

e respect

i

ve

d

ebt issued need not be equall

y

and ratabl

y

secured

.

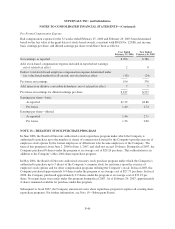

T

he senior secured credit facilities also contain various financial covenants includin

g

a minimum interest

expense coverage ratio and a maximum debt leverage ratio. The interest expense coverage ratio shall not be less

than 2.10 to 1 for each of the fiscal quarters ending up through December 30, 2006, 2.15 to 1 for each of th

e

f

iscal quarters endin

g

up throu

g

h December 30, 2007, and moves pro

g

ressivel

y

to a ratio of not less than 2.30 t

o

1

for the fiscal quarters ending after December 30, 2009. The debt leverage ratio shall not exceed 4.

5

0to1fo

r

eac

h

o

f

t

h

e

fi

sca

l

quarters en

di

ng up t

h

roug

h

Decem

b

er 30, 2007 an

d

moves progress

i

ve

l

y to a rat

i

o not t

o

exceed 3.7

5

to 1 for each of the fiscal quarters endin

g

after December 30, 2009. As of Februar

y

24, 2007, the

C

ompany is in compliance with the covenants of the senior secured credit facilities.

I

n conjunction with the

$

4,000 senior secured credit facilities, the Company terminated its previous five-yea

r

u

nsecured

$

750 revolving credit agreement dated February 2005. Also terminated were the previous Albertsons

credit facilities: $400 dated June 2005, $900 dated June 2004 and $100 dated Jul

y

2004. All letters of credit that

h

ad been issued and outstanding under the previous credit facilities were transferred under the new credit facility

.

B

orrowings under Term Loan A and Term Loan B may be repaid, in full or in part, at any time without penalty

.

T

erm Loan A has required repayments, payable quarterly, equal to 2.50 percent of the initial drawn balance fo

r

the first four quarterl

y

pa

y

ments (

y

ear one) and 3.7

5

percent of the initial drawn balance for each quarterl

y

payment in years two through five, with the entire remaining balance due at the five year anniversary of th

e

inception date. Term Loan B has required repayments, payable quarterly, equal to 0.25 percent of the initial

d

rawn balance, with the entire remainin

g

balance due at the six

y

ear anniversar

y

of the inception date

.

As of Februar

y

24, 2007, there were $654 of outstandin

g

borrowin

g

s under the Revolvin

g

Credit Facilit

y

, Term

L

oan A had a remaining principal balance of

$

713, of which

$

94 was classified as current, and Term Loan B had

F-

30