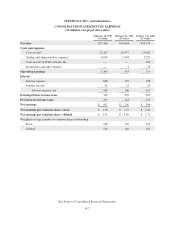

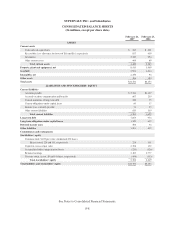

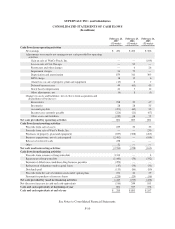

Albertsons 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

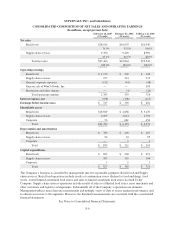

SU

PERVAL

U

IN

C

. and

S

ubsidiaries

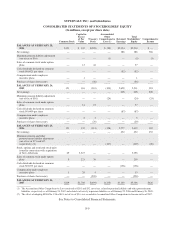

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUIT

Y

(

In millions, exce

p

t

p

er share data

)

C

ommon

S

toc

k

C

a

pi

tal

i

n

E

xces

s

of

P

a

r

V

a

l

u

e

T

reasur

y

S

tock

A

ccumulated

O

the

r

C

om

p

rehens

i

ve

L

oss

(

1

)

R

e

t

ai

n

ed

Earn

i

ngs

T

otal

S

tockholders’

E

q

u

i

t

y

C

om

p

rehens

i

ve

I

n

co

m

e

BALANCE

S

AT FEBRUARY 28

,

2004

$

151

$

102

$

(298)

$

(99)

$

2,354

$

2,210

$

—

N

et earnings — — — — 38

6

38

6

38

6

M

inimum pension liabilit

y

ad

j

ustmen

t

(

net of tax of

$

16

)

———

(

5

)

—

(

5

)(

5

)

Sa

l

es o

f

common stoc

k

un

d

er opt

i

o

n

plans — 13 44 — —

5

7

—

C

ash di

v

idends declared on commo

n

s

tock $0.6025

p

er share — — — — (82) (82) —

C

ompensation under emplo

y

ee

i

ncentive

p

lans — 1 — — — 1 —

Purchase of shares for treasury — — (56) — — (56) —

BALANCES AT FEBRUARY 26

,

2005

15

1 116 (310) (104) 2,6

5

82,

5

11 381

N

et earnings — — — — 20

6

20

6

20

6

M

inimum pension liabilit

y

ad

j

ustmen

t

(net of tax of

$

16) — — — (24) — (24) (24)

Sa

l

es o

f

common stoc

k

un

d

er opt

i

o

n

p

l

ans — 14 23 — — 37

—

C

ash di

v

idends declared on commo

n

s

tock

$

0.6400

p

er share — — — — (87) (87) —

C

ompensat

i

on un

d

er emp

l

oyee

i

ncentive plans — 2 3 — —

5

—

Purc

h

ase o

f

s

h

ares

f

or treasury — — (29) — — (29) —

BALANCES AT FEBRUARY 25

,

2006

15

1 132 (313) (128) 2,777 2,619 18

2

N

et earnings — — — — 452 452 45

2

M

inimum

p

ension and othe

r

postretirement liabilit

y

ad

j

ustment

(net of tax of

$

71 and

$

17,

respectivel

y

) (2) — — — (107) — (107) (26)

Stoc

k

, opt

i

ons an

d

restr

i

cte

d

stoc

k

un

i

t

s

i

ssue

di

n connect

i

on w

i

t

h

acqu

i

s

i

t

i

o

n

of New Albertsons

6

9 2,327 — — — 2,39

6

—

Sales of common stock under o

p

tio

n

p

lans 8 221 30 — — 259 —

C

as

hdi

v

id

en

d

s

d

ec

l

are

d

on commo

n

s

tock $0.6575 per share — — — — (126) (126) —

C

ompensation under employee

i

ncentive

p

lans 1 28 4 — — 33 —

Purchase of shares for treasur

y

— — (220) — — (220) —

BALANCE

S

AT FEBRUARY 24

,

200

7

$

229

$

2,708

$(

499

)$(

235

)$

3,103

$

5,306

$

42

6

(1) The Accumulated Other Com

p

rehensive Loss consisted of $203 and $32, net of tax, related to

p

ension liabilities and other

p

ostretirement

liabilities, respectivel

y

as of Februar

y

24, 2007 and related exclusivel

y

to pension liabilities as of Februar

y

2

5

, 2006 and Februar

y

26, 200

5.

(2) The effect of adoptin

g

SFAS No. 158 of $81, net of tax of $54, was recorded in Accumulated Other Comprehensive Income in fiscal 2007.

S

ee Notes to

C

onso

lid

ate

d

F

i

nanc

i

a

lS

tatements

.

F-

9