Albertsons 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 Albertsons annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SU

PERVAL

U

IN

C

. and

S

ubsidiaries

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

N

O

TE 11—IN

CO

ME TAXE

S

T

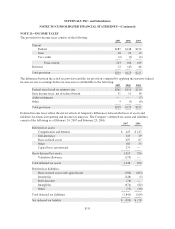

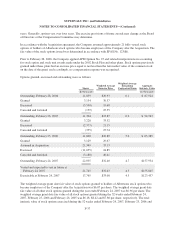

he provision for income taxes consists of the followin

g:

200

7

2006

2

005

C

urrent

F

ederal $187 $148 $152

S

tate

38 22 19

Tax credits (2) (2) (2)

Total current 223 1

6

81

69

D

eferred 72

(

45

)

46

p

Total provision $295 $123 $215

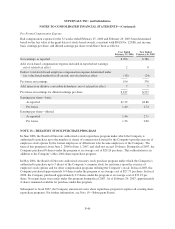

Th

e

diff

erence

b

etween t

h

e actua

l

tax prov

i

s

i

on an

d

t

h

e tax prov

i

s

i

on compute

db

y app

l

y

i

ng t

h

e statutory

f

e

d

era

l

income tax rate to earnin

g

s before income taxes is attributable to the followin

g

:

200

7

2006

2

005

y

Federal taxes based on statutor

y

rate $261 $115 $210

S

tate income taxes, net of federal benefit 31 11 1

6

A

u

di

t sett

l

ements — — (7)

O

t

h

er 3 (3) (4)

p

Total provision $295 $123 $215

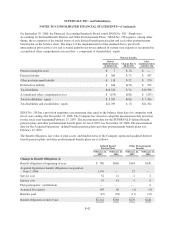

De

f

erre

di

ncome taxes re

fl

ect t

h

e net tax e

ff

ects o

f

temporar

y diff

erences

b

etween t

h

e

b

ases o

f

assets an

d

l

iabilities for financial reportin

g

and income tax purposes. The Compan

y

’s deferred tax assets and liabilitie

s

consist of the following as of February 24, 2007 and February 25, 2006

:

2007

2006

D

e

f

erre

d

tax assets:

Com

p

ensation and benefits

$

425

$

147

p

Se

lf

-

i

nsurance 143 2

9

Basis in fixed assets 497 67

Other 183

5

3

Capital loss carryforward 17

5

—

G

ross deferred tax assets 1,423 296

Valuation allowance (17

5

)—

T

otal deferred tax assets 1

,

248 29

6

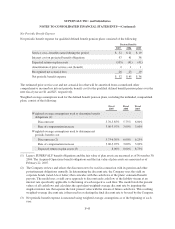

D

e

f

erre

d

tax

li

a

bili

t

i

es

:

p

Basis in fixed assets and ca

p

ital leases (766) (203)

Inventor

i

es

(

248

)(

3

)

De

b

t

di

scount

(

78

)

—

Intan

g

ibles (674) (82)

g

Other

(

75

)(

36

)

T

otal deferred tax liabilities (1,841) (324)

y

Net deferred tax liability $ (593) $ (28)

() (

F-3

5