eBay 2010 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

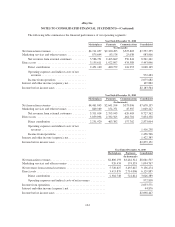

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Income taxes

We account for income taxes using an asset and liability approach, which requires the recognition of taxes

payable or refundable for the current year and deferred tax liabilities and assets for the future tax consequences of

events that have been recognized in our financial statements or tax returns. The measurement of current and

deferred tax assets and liabilities is based on provisions of enacted tax laws; the effects of future changes in tax

laws or rates are not anticipated. If necessary, the measurement of deferred tax assets is reduced by the amount of

any tax benefits that are not expected to be realized based on available evidence.

We report a liability for unrecognized tax benefits resulting from uncertain tax positions taken or expected

to be taken in a tax return. We recognize interest and penalties, if any, related to unrecognized tax benefits in

income tax expense.

Cash and cash equivalents

Cash and cash equivalents are short-term, highly liquid investments with original maturities of three months

or less when purchased and are mainly comprised of bank deposits and money market funds.

Allowance for doubtful accounts and authorized credits

We record our allowance for doubtful accounts based upon our assessment of various factors. We consider

historical experience, the age of the accounts receivable balances, credit quality of our customers, current

economic conditions and other factors that may affect our customers’ ability to pay. The allowance for doubtful

accounts and authorized credits was $102.8 million and $86.5 million at December 31, 2009 and 2010,

respectively.

Loans and interest receivable, net

Loans and interest receivable represent purchased consumer receivables arising from loans made by a

partner chartered financial institution to individual consumers in the U.S. to purchase goods and services through

our Bill Me Later merchant network. The terms of the consumer relationship require us to submit monthly bills

to the consumer detailing loan repayment requirements. The terms also allow us to charge the consumer, in

certain circumstances, interest and fees. Loans receivable are reported at their outstanding principal balances,

including unamortized deferred origination costs and net of allowance, and include the estimated collectible

interest and fees. Due to the relatively small dollar amount of individual loans and interest receivable, we do not

require collateral on these balances. We use a consumer’s FICO score, among other measures, in evaluating the

credit quality of our consumer receivables. A FICO score is a type of credit score that lenders use to assess an

applicant’s credit risk and whether to extend credit. Individual FICO scores are obtained each quarter the

consumer has a loan receivable owned by Bill Me Later outstanding. The weighted average consumer FICO

score related to our loans and interest receivables balance outstanding at December 31, 2010 was 699. As of

December 31, 2010, 63.6% of our loans and interest receivable balance was due from consumers with FICO

scores greater than 680, which is generally considered “prime” by the consumer credit industry.

We charge off loans and interest receivable in the month in which the customer becomes 180 days past due.

Bankrupt accounts are charged off within 60 days of receiving notification from the bankruptcy courts. Past due

loans receivable continue to accrue interest until such time as they are charged off. During the year ended

December 31, 2010, we charged off $79.0 million in loans and interest receivable, net of recoveries. As of

December 31, 2010, approximately 92% of our loans and interest receivable portfolio were current.

94