eBay 2010 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the taxpayer and respective government taxing authorities. Significant judgment is required in determining our

tax expense and in evaluating our tax positions, including evaluating uncertainties. We review our tax positions

quarterly and adjust the balances as new information becomes available. Our income tax rate is significantly

affected by the tax rates that apply to our foreign earnings. In addition to local country tax laws and regulations,

our income tax rate depends on the extent that our earnings are indefinitely reinvested outside the U.S. Indefinite

reinvestment is determined by management’s judgment about and intentions concerning our future operations. At

December 31, 2010, $8.3 billion of earnings have been indefinitely reinvested outside the U.S, primarily in active

non-U.S. business operations. We do not intend to repatriate these earnings to fund U.S. operations.

Deferred tax assets represent amounts available to reduce income taxes payable on taxable income in future

years. Such assets arise because of temporary differences between the financial reporting and tax bases of assets

and liabilities, as well as from net operating loss and tax credit carryforwards. We evaluate the recoverability of

these future tax deductions and credits by assessing the adequacy of future expected taxable income from all

sources, including reversal of taxable temporary differences, forecasted operating earnings and available tax

planning strategies. These sources of income rely heavily on estimates that are based on a number of factors,

including our historical experience and short and long-range business forecasts. At December 31, 2010, we had a

valuation allowance on certain loss carryforwards based on our assessment that it is more likely than not that the

deferred tax asset will not be realized.

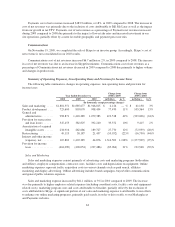

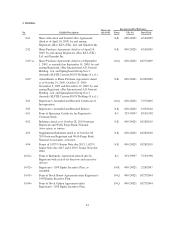

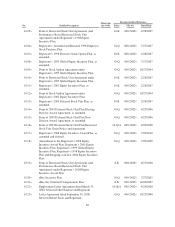

The following table illustrates our effective tax rates for 2008, 2009 and 2010 (in thousands, except

percentages):

Year Ended December 31,

2008 2009 2010

Provision for income taxes ...................................... $404,090 $490,054 $297,486

As a % of income before income taxes ............................ 19% 17% 14%

Our future effective tax rates could be adversely affected by earnings being lower than anticipated in

countries where we have lower statutory rates and higher than anticipated in countries where we have higher

statutory rates, by changes in the valuations of our deferred tax assets or liabilities, or by changes or

interpretations in tax laws, regulations or accounting principles. In addition, we are subject to the continuous

examination of our income tax returns by the Internal Revenue Service, various state tax authorities and other

various foreign tax authorities. We regularly assess the likelihood of adverse outcomes resulting from these

examinations to determine the adequacy of our provision for income taxes.

Based on our results for the year ended December 31, 2010, a one-percentage point change in our provision

for income taxes as a percentage of income before taxes would have resulted in an increase or decrease in the

provision of approximately $21.0 million, resulting in an approximate $0.02 change in diluted earnings per share.

We recognize and measure uncertain tax positions in accordance with generally accepted accounting

principles, or GAAP, pursuant to which we only recognize the tax benefit from an uncertain tax position if it is more

likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical

merits of the position. The tax benefits recognized in the financial statements from such positions are then measured

based on the largest benefit that has a greater than 50 percent likelihood of being realized upon ultimate settlement.

We report a liability for unrecognized tax benefits resulting from uncertain tax positions taken or expected to be

taken in a tax return. GAAP further requires that a change in judgment related to the expected ultimate resolution of

uncertain tax positions be recognized in earnings in the quarter in which such change occurs. We recognize interest

and penalties, if any, related to unrecognized tax benefits in income tax expense.

We file annual income tax returns in multiple taxing jurisdictions around the world. A number of years may

elapse before an uncertain tax position is audited and finally resolved. While it is often difficult to predict the final

outcome or the timing of resolution of any particular uncertain tax position, we believe that our reserves for income

73