eBay 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.indexed notes. Issuances under the shelf registration will require the filing of a prospectus supplement identifying

the amount and terms of the securities to be issued. The registration statement does not limit the amount of debt

securities that may be issued thereunder. Our ability to issue debt securities is subject to market conditions and other

factors impacting our borrowing capacity, including compliance with the covenants in our credit agreement.

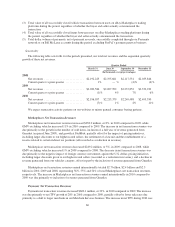

In October 2010, we issued $1.5 billion aggregate principal amount of our senior unsecured debt securities

under the shelf registration statement in an underwritten public offering. These debt securities consisted of $400

million aggregate principal amount of 0.875% notes due 2013, $600 million aggregate principal amount of

1.625% notes due 2015 and $500 million aggregate principal amount of 3.250% notes due 2020 (collectively, the

“notes”). Interest on the notes is payable semi-annually in arrears at the respective per annum rates, and the notes

mature on October 15 of the respective years indicated in the preceding sentence. The indenture pursuant to

which the notes were issued includes customary covenants that, among other things, limit our ability to incur,

assume or guarantee debt secured by liens on specified assets or enter into sale and lease-back transactions with

respect to specified properties, and also includes customary events of default.

Commercial Paper Program.

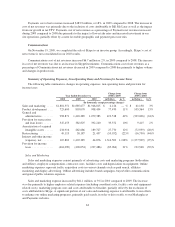

In November 2010, we implemented a commercial paper program pursuant to which we may issue

commercial paper notes with maturities of up to 397 days from the date of issue in an aggregate principal amount

of up to $1.0 billion at any time outstanding. As of December 31, 2010, $300.0 million aggregate principal

amount of commercial paper notes were outstanding and the weighted average interest rate on those notes was

0.20% per annum and the weighted average remaining term on our commercial paper notes was 15 days.

Liquidity and Capital Resource Requirements

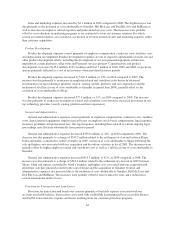

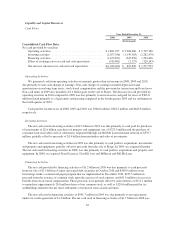

At December 31, 2010, we had assets classified as cash and cash equivalents, as well as time deposits and

fixed income securities classified as short-term investments, in an aggregate amount of $7.8 billion, compared to

$5.2 billion at December 31, 2009. At December 31, 2010, we held assets of these types outside the U.S. in

certain of our foreign operations totaling approximately $5.1 billion. If these assets were distributed to the

U.S., we may be subject to additional U.S. taxes in certain circumstances. We actively monitor these assets,

primarily focusing on the safety of principal and secondarily maximizing yield on these assets. We diversify our

cash and cash equivalents and investments among various financial institutions in order to reduce our exposure

should any one of these financial institutions or money market funds fail or encounter difficulties. To date, we

have not experienced any material loss or lack of access to our invested cash, cash equivalents or short-term

investments; however, we can provide no assurances that access to our invested cash, cash equivalents or short-

term investments will not be impacted by adverse conditions in the financial markets.

At any point in time we have funds in our operating accounts and customer accounts that are with third party

financial institutions. These balances in the U.S. may exceed the Federal Deposit Insurance Corporation (FDIC)

insurance limits. While we monitor the cash balances in our operating accounts, these cash balances could be

impacted if the underlying financial institutions fail and could be subject to other adverse conditions in the

financial markets.

We believe that our existing cash and cash equivalents and short-term investments, together with cash

expected to be generated from operations, borrowings available under our credit agreement and commercial

paper program, and our access to the capital markets, will be sufficient to fund our operating activities,

anticipated capital expenditures, Bill Me Later portfolio of receivables from loans and stock repurchases for at

least the next twelve months and for the foreseeable future.

From time to time, we engage in certain intercompany transactions and legal entity restructurings. For

example, in 2009, we completed a legal entity restructuring that resulted in a cash payment for taxes of

approximately $207.4 million in the first quarter of 2010. We consider many factors when evaluating these

69