eBay 2010 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.component of accumulated other comprehensive income (loss), net of estimated tax. As of December 31, 2010,

approximately 62% of our total cash and investment portfolio was held in bank deposits and money market

funds. As such, changes in interest rates will impact interest income. Additionally, changes in interest rates will

impact our interest rate sensitive credit agreement and accordingly, impact interest expense or cost of net

revenues. As of December 31, 2010, we held no direct investments in auction rate securities, collateralized debt

obligations, structured investment vehicles or mortgaged-backed securities.

Investments in both fixed-rate and floating-rate interest-earning instruments carry varying degrees of

interest rate risk. The fair market value of our fixed-rate securities may be adversely impacted due to a rise in

interest rates. In general, securities with longer maturities are subject to greater interest-rate risk than those with

shorter maturities. While floating rate securities generally are subject to less interest-rate risk than fixed-rate

securities, floating-rate securities may produce less income than expected if interest rates decrease. Due in part to

these factors, our investment income may fall short of expectations or we may suffer losses in principal if

securities are sold that have declined in market value due to changes in interest rates. As of December 31, 2010,

the balance of our fixed income investments was $2.2 billion, which represented approximately 24% of our total

cash and investment portfolio. As of December 31, 2010, our fixed income investments earned an average pretax

yield of approximately 1.8%, with a weighted average maturity of 26 months. If interest rates were to

instantaneously increase (decrease) by 100 basis points, the fair market value of our total fixed-income

investment portfolio as of December 31, 2010 could decrease (increase) by approximately $23.5 million.

Investment Risk

As of December 31, 2010, our cost and equity method investments totaled $729.4 million, which

represented approximately 8% of our total cash and investment portfolio and was primarily related to our

retained equity interest in Skype. These investments relate primarily to equity-method investments in private

companies. We review our investments for impairment when events and circumstances indicate a decline in fair

value of such assets below carrying value is other-than-temporary. Our analysis includes review of recent

operating results and trends, recent sales/acquisitions of the investee securities, and other publicly available data.

Equity Price Risk

We are exposed to equity price risk on marketable equity instruments due to market volatility. At

December 31, 2010, the total fair value of our marketable equity instruments was $541.5 million, which

represented approximately 6% of our total cash and investment portfolio and was primarily related to our equity

holdings in MercadoLibre.

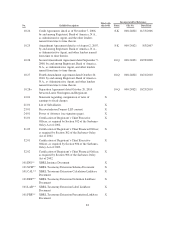

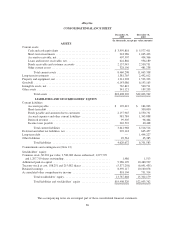

ITEM 8: FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The consolidated financial statements and accompanying notes listed in Part IV, Item 15(a)(1) of this

Annual Report on Form 10-K are included elsewhere in this Annual Report on Form 10-K.

ITEM 9: CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE

None.

ITEM 9A: CONTROLS AND PROCEDURES

Evaluation of disclosure controls and procedures. Based on the evaluation of our disclosure controls and

procedures (as defined in the Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, or the

Exchange Act) required by Exchange Act Rules 13a-15(b) or 15d-15(b), our principal executive officer and our

principal financial officer have concluded that as of the end of the period covered by this report, our disclosure

controls and procedures were effective.

77