eBay 2010 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2010 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7: MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A

of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including statements that

involve expectations, plans or intentions (such as those relating to future business or financial results, new

features or services, or management strategies). You can identify these forward-looking statements by words

such as “may,” “will,” “would,” “should,” “could,” “expect,” “anticipate,” “believe,” “estimate,” “intend,”

“plan” and other similar expressions. These forward-looking statements involve risks and uncertainties that

could cause our actual results to differ materially from those expressed or implied in our forward-looking

statements. Such risks and uncertainties include, among others, those discussed in “Item 1A: Risk Factors” of

this Annual Report on Form 10-K, as well as in our consolidated financial statements, related notes, and the

other financial information appearing elsewhere in this report and our other filings with the SEC. We do not

intend, and undertake no obligation, to update any of our forward-looking statements after the date of this report

to reflect actual results or future events or circumstances. Given these risks and uncertainties, readers are

cautioned not to place undue reliance on such forward-looking statements.

You should read the following Management’s Discussion and Analysis of Financial Condition and Results

of Operations in conjunction with the consolidated financial statements and the related notes included in this

report.

Overview

We have two business segments: Marketplaces and Payments. Our Marketplaces segment provides the

infrastructure to enable global online commerce on a variety of platforms, including the eBay.com platform and

its localized counterparts and our other online platforms, such as our online classifieds businesses, our secondary

tickets marketplace (StubHub), our online shopping comparison website (Shopping.com), our apartment listing

service platform (Rent.com), and our fixed price media marketplace (Half.com). Our Payments segment is

comprised of our online payment solutions PayPal and Bill Me Later. Historically, we also had a

Communications segment that consisted of Skype Technologies S.A. (“Skype”). On November 19, 2009, we sold

Skype to an investor group for cash, a subordinated note and an equity stake in the outstanding capital stock of

the Skype successor entity (now approximately 30%). Accordingly, Skype’s operating results are not

consolidated in our 2010 results. However, Skype’s results of operations are consolidated in our 2008 and 2009

results through the date of sale. Our non-controlling interest in Skype is accounted for under the equity method of

accounting. Our proportionate share of the net income (loss) of Skype is recognized on a one quarter lag as a

component of interest and other income (expense), net in our consolidated statement of income.

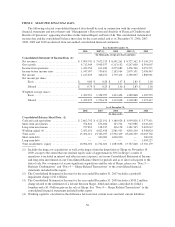

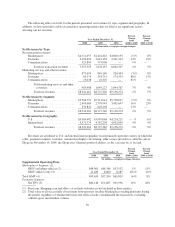

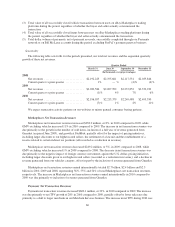

Overall, net revenues increased 5% to $9.2 billion in 2010 compared to $8.7 billion in 2009. Excluding 2009

revenue from Skype (sold in November 2009) of $620.4 million, net revenues would have increased 13%, from

$8.1 billion in 2009 to $9.2 billion in 2010. These increases were driven by net revenue growth of 23% and 8%

in our Payments and Marketplaces businesses, respectively. We achieved an operating margin of 22% in 2010

compared to 17% in 2009, driven primarily by the impact of a Skype-related legal settlement charge in 2009 and

lower amortization costs associated with our acquired intangible assets. Diluted earnings per share decreased to

$1.36 in 2010 compared to $1.83 in 2009 driven primarily by the gain on sale of Skype, partially offset by the

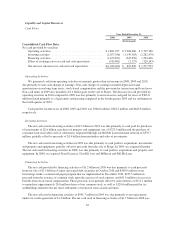

impact of a Skype-related legal settlement charge in 2009. Operating cash flow decreased to $2.7 billion in 2010

from $2.9 billion in 2009.

Overall, net revenues increased 2% to $8.7 billion in 2009 compared to 2008. The increase was driven

primarily by PayPal offset by a decline in revenues generated from our Marketplaces business. We achieved an

operating margin of 17% in 2009 compared to 24% in 2008 driven by the impact of a Skype-related legal

settlement charge, acquisitions and foreign currency movements against the U.S. dollar. Diluted earnings per

share increased to $1.83 in 2009 compared to $1.36 in 2008 driven primarily by the gain on the sale of Skype.

Operating cash flow increased to $2.91 billion in 2009 from $2.88 billion in 2008.

57